On the morning of October 21, both world and domestic gold prices increased. In particular, domestic gold prices increased sharply to a new record.

At 0:46 on October 21, Vietnam time, spot gold prices increased by 2.3% to 4,346.39 USD/ounce. December gold price closed the session up 3.5% to 4,359.40 USD/ounce.

Previously, the world gold price recorded a record high of 4,378.69 USD/ounce in the session on October 17.

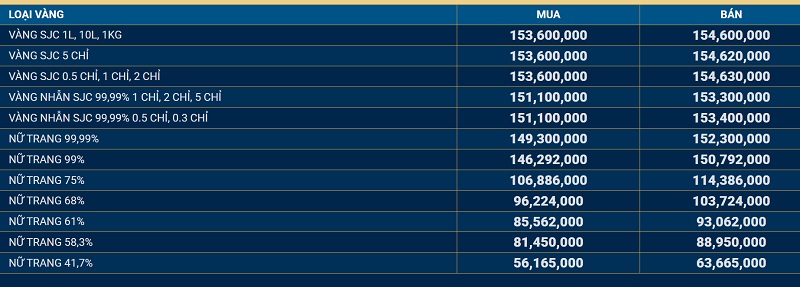

In the domestic market, Saigon Jewelry Company - SJC sharply increased the price of SJC gold bars by 3.1 million VND per tael, buying to 153.6 million VND, selling to 154.6 million VND.

Phu Nhuan Jewelry Joint Stock Company (PNJ) increased its purchase price to 153.6 million VND, selling 154.6 million VND.

Bao Tin Minh Chau listed SJC gold at 151 and 151.5 million VND/tael for both buying and selling.

Phu Quy Company listed the purchase price at 153 million VND, selling price at 154.6 million VND...

This is the highest price ever for SJC gold bars.

Gold rings also increased compared to yesterday's trading session.

The price of plain round gold rings at SJC Company early this morning was listed at 151.1 - 153.3 million VND/tael.

DOJI in the Hanoi and Ho Chi Minh City markets this morning was also listed at 151.5 - 154.5 million VND/tael.

At Bao Tin Minh Chau alone, the price of gold rings is listed at 157.5 million VND/tael for buying and 160.5 million VND/tael for selling.

This is a new record for domestic gold ring prices.

Previously, at the opening session of the 10th Session of the 15th National Assembly held on the morning of October 20, many opinions mentioned the need to strengthen the stability of the financial and monetary markets, including the issue of gold market management, which has long been a sensitive field, posing many potential risks to macro stability.

The State Bank has also continued to consult experts on the model of Vietnam's gold exchange, to manage the domestic gold market.

According to experts, setting up a gold exchange is the final step in reforming gold market management, but piloting the gold market requires a specific roadmap.

According to economist Ngo Tri Long, the short-term goal of the exchange is to be a transparent source of raw gold distribution channel for licensed enterprises; the medium term is to develop account and derivative gold trading products; the long term is to convert physical gold in the people to capital for production - business, reduce the psychology of holding physical gold

The core principle is "ustate supervision - operating enterprises - controlled competition". The State does not directly trade gold, but sets data standards, safety standards, monitoring mechanisms andcircuit breaker tools. Operating enterprises must meet the requirements of minimum capital, technical infrastructure, information security, storage, and separation of customer accounts. All transaction orders, volumes, and inventories must be recorded and reported online to the SBV.

Agribank representative proposed that the State Bank soon issue detailed instructions for gold derivatives transactions, to help banks have full risk-off tools in gold production, import-export and trading activities.

BIDV proposed that the State Bank issue additional documents guiding the implementation of foreign account gold transactions to balance the gold status. This is a necessary profession to control the risk of gold price fluctuations, helping credit institutions have appropriate derivatives instead of only holding physical gold.