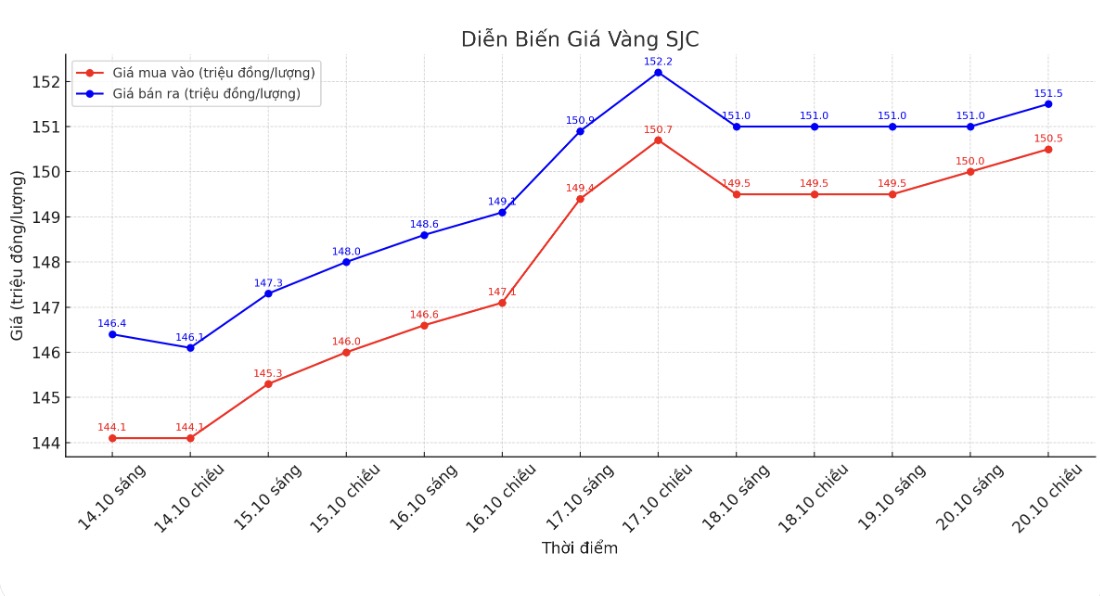

SJC gold bar price

As of 6:00 a.m. on October 21, the price of SJC gold bars was listed by DOJI Group at VND150.5-151.5 million/tael (buy - sell), an increase of VND1 million/tael for buying and VND500,000/tael for selling. The difference between buying and selling prices is at 1 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 151-151.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 500,000 VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 150-151.5 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

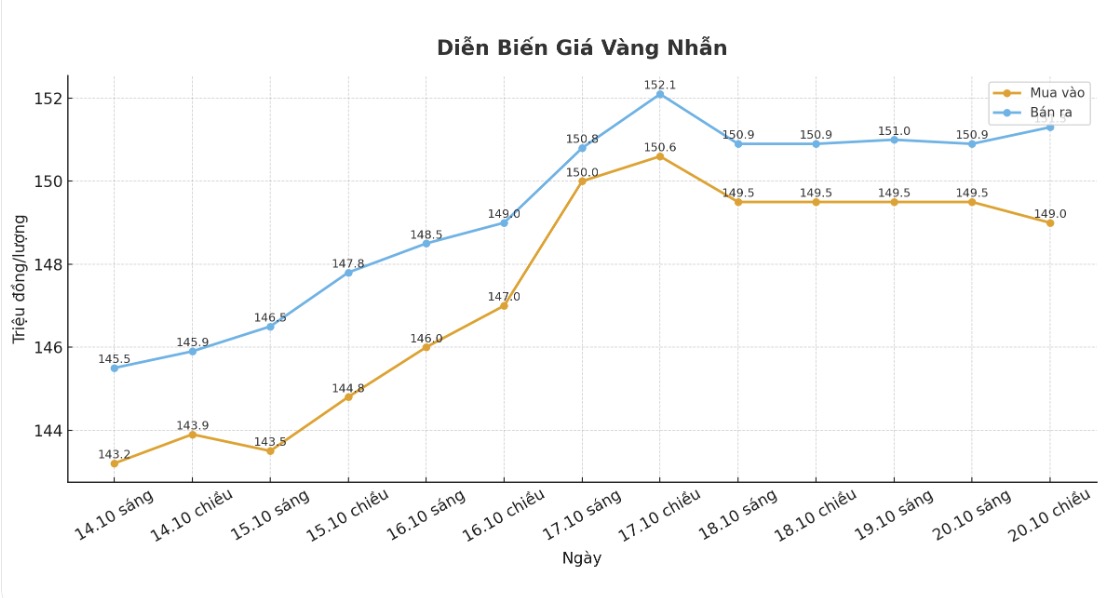

9999 gold ring price

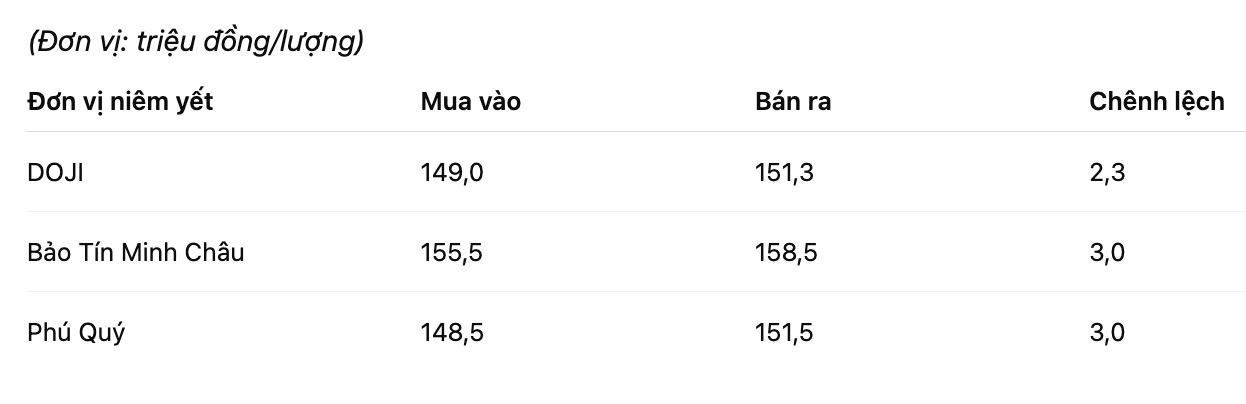

As of 6:00 a.m. on October 21, DOJI Group listed the price of gold rings at 149-151.3 million VND/tael (buy - sell), down 500,000 VND/tael for buying and up 400,000 VND/tael for selling. The difference between buying and selling is 2.3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 155.5-158.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 148.5-151.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

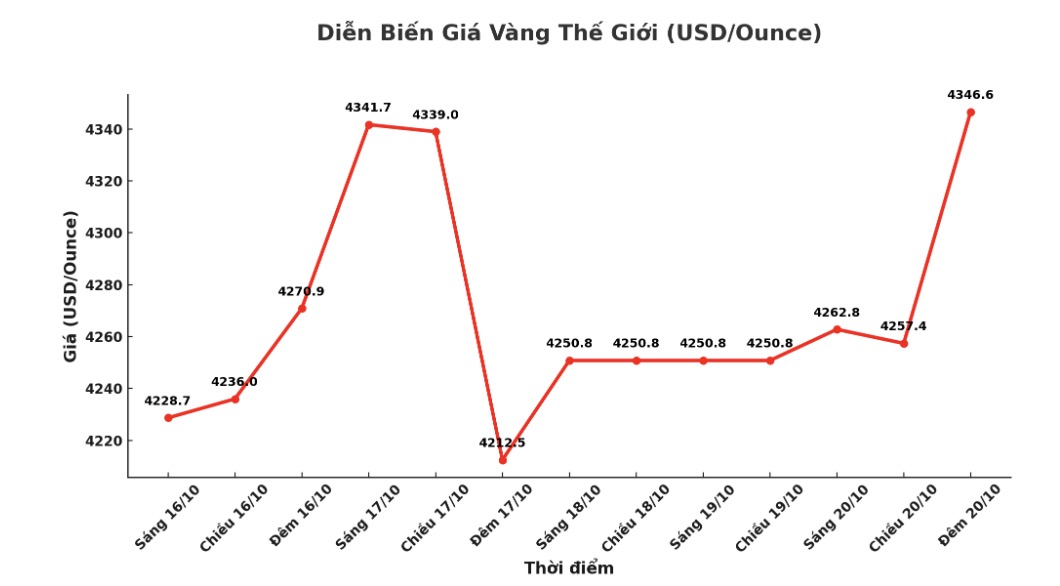

World gold price

Recorded at 23:15 (October 20, Vietnam time), the world spot gold price was listed at 4,346.6 USD/ounce, up 95.8 USD.

Gold price forecast

Gold prices rose more than 2% in the trading session on Monday, supported by expectations that the US Federal Reserve (FED) will continue to cut interest rates and safe-haven demand will remain high, as investors await US-China trade talks and US inflation data this week.

Bloomberg reported that the new US-China trade talks will take place this week in Malaysia between US Treasury Secretary Scott Bessent and Chinese Deputy Prime Minister He Lap Phong.

Mr. Mohit Kumar - chief economist of Jefferies International Ltd - commented: "US-China trade tensions seem to be cooling down as both sides have made reconciliatory statements".

When asked by Fox News about the possibility of a 100% tariff increase on Chinese goods, Mr. Trump said that tax rate was unsustainable, even though it could be implemented, and affirmed that the US will be stable in relations with China.

He also stressed China's desire to resume purchasing American soybeans - a commodity that Beijing has not imported since the beginning of this year's export season, which is considered a lever in trade negotiations.

Mr. Jeffrey Christian - CEO of CPM Group - commented: "political and economic instability is pushing gold prices up again after a strong sell-off on Friday.

We expect prices to continue to rise in the coming weeks and months, and we would not be surprised if gold soon hit $4,500/ounce, he added.

Technically, December gold futures buyers still have the advantage in the short term. However, the esecutive reversal model that emerged on Friday was a signal that a temporary peak could form.

The next upside target for buyers is to close above the strong resistance zone at a historical peak of $4,392/ounce.

Meanwhile, the sellers aim to pull the price below the solid support zone of 4,000 USD/ounce. The first resistance level was at $4,300, followed by $4,350/ounce; the most recent support was at the low last night at $4,229.7, then $4,200/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...