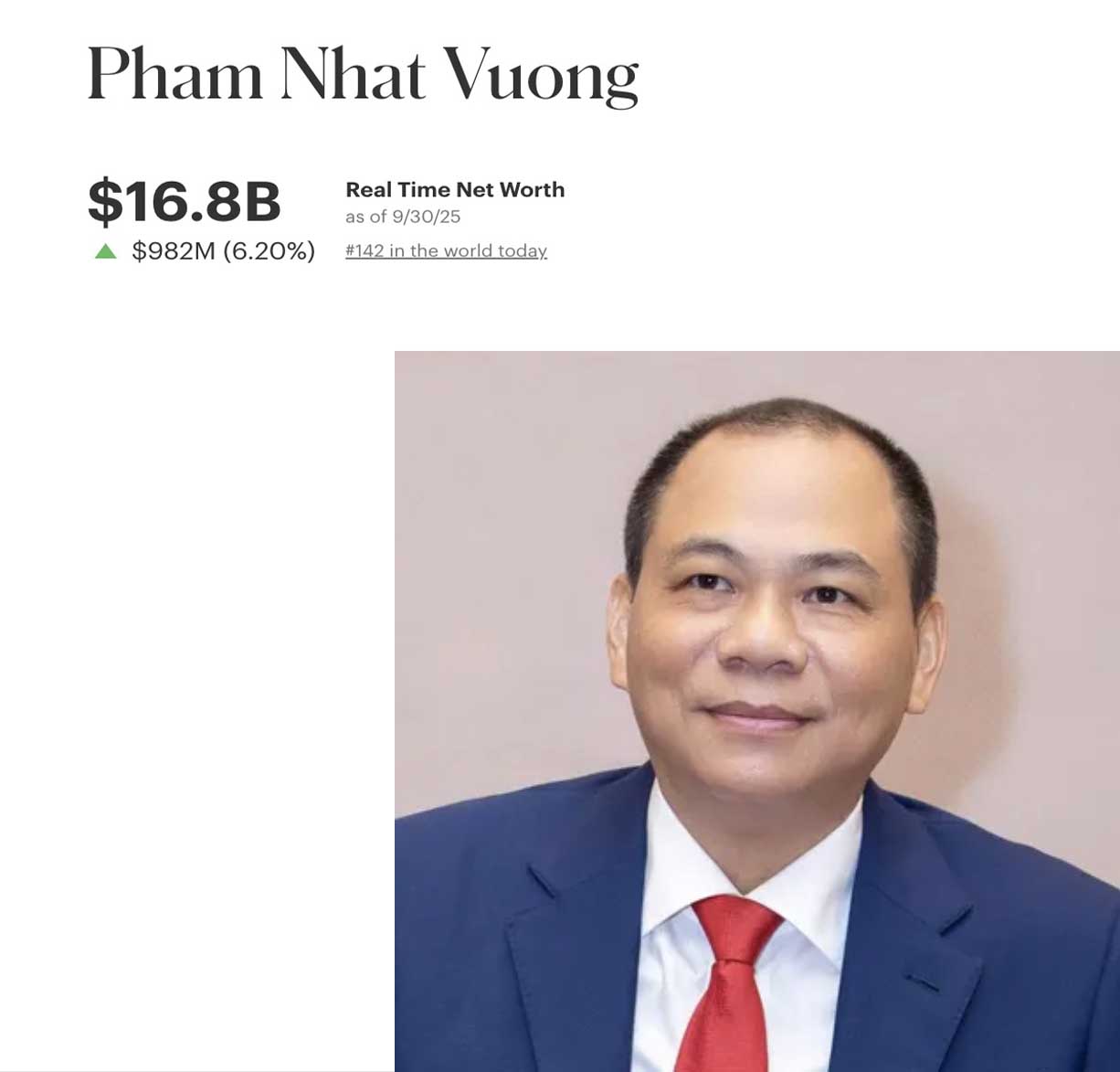

According to Forbes' real-time statistics table, in today's trading session, September 30, billionaire Pham Nhat Vuong's net assets recorded an impressive leap, increasing by 982 million USD, bringing the total value to about 16.8 billion USD.

Previously, at the end of June this year, the owner of Vingroup Corporation became the first Vietnamese to be recognized by Forbes as owning assets worth over 10 billion USD. This milestone not only has symbolic significance but also opens a strong breakthrough period for the billionaire associated with the "Vin" ecosystem.

After only two months, Mr. Vuong's net asset value has continuously increased, directly reflecting the improvement of VIC shares and many other stocks in the ecosystem.

On August 26, Forbes recorded his assets at 13.8 billion USD, putting the billionaire in the group of 200 richest people on the planet. Less than a month later, on September 18, this figure increased to 14.3 billion USD, helping him rise to 186th place in the list of billionaires in the world.

The strong increase did not stop there. Recent trading sessions have witnessed VIC shares and "Vin" stocks continuing to set new records, attracting Mr. Vuong's assets to make a spectacular breakthrough.

Billionaire Pham Nhat Vuong's assets continue to increase sharply in the context of the "Vin" group of stocks performing positively. In recent sessions, this group of stocks has continuously accelerated.

At the end of yesterday's trading session (September 29), Vingroup's VIC stock market price increased sharply by 5.3%, to 172,800 VND/share. By the session of September 30, VIC's market price reached VND 174,900/share, up 1.2% compared to the reference price, this is also the highest price in the history of this code.

Since the beginning of the year, VIC shares have increased by more than 300%. Vingroup's capitalization has therefore increased to VND 673,892 billion, holding the position of the largest listed enterprise on the stock exchange. Similarly, VRE and VHM also continuously increased, at the end of the session on September 30, both codes also increased by over 1% compared to the reference price.