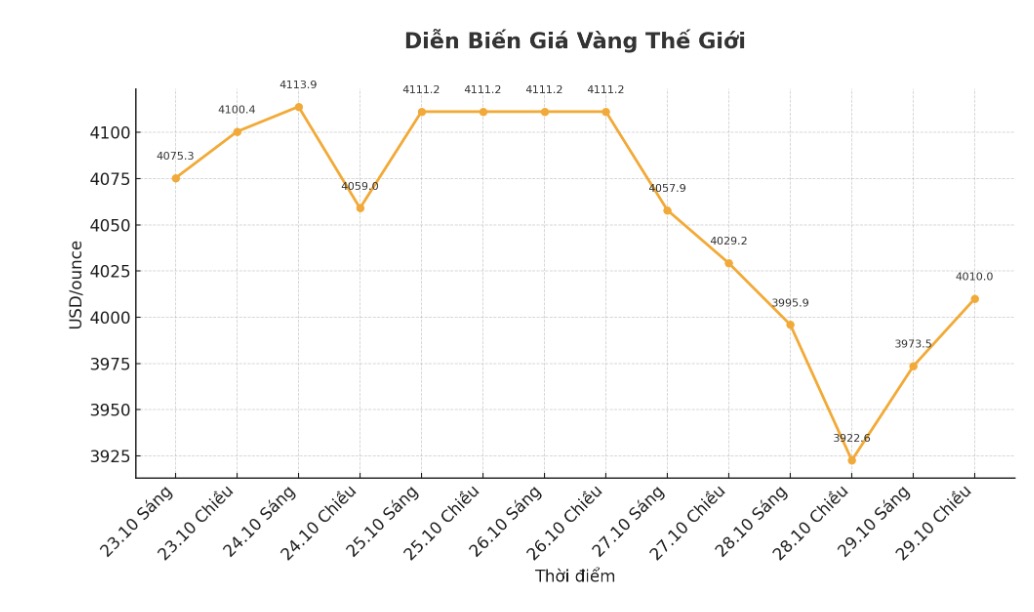

Gold prices fell to a three-week low in the trading session on Tuesday, as expectations of progress in US-China trade negotiations weakened the safe-haven attractiveness of the precious metal, while investors turned their attention to the interest rate decision of the US Federal Reserve (FED) this week.

Spot gold fell 0.4%, to $3,964.35 an ounce at 13:05 New York time (17:45 GMT), after hitting its lowest level since October 6.

US gold futures fell 0.9% to $3,983.10 an ounce.

Gold an unemployment asset and a traditional hedge against uncertainty has risen more than 51% since the start of the year, supported by prolonged geopolitical and trade tensions, and expectations of a Fed rate cut.

Mr. Jim Wyckoff - senior analyst at Kitco Metals, commented:

US-China trade tensions have cooled down significantly, with the possibility of the two sides reaching an agreement this week after a meeting between Chairman Xi Jinping and President Donald Trump. This development has a negative impact on demand for safe-haven metals such as gold".

Over the weekend, top US and Chinese economic officials have finalized the framework for a potential deal, which is expected to be considered by Chinese and US leaders at a meeting on Thursday.

Expectations of a reliever of trade tensions have fueled optimism in global markets, as Wall Street's key indicators simultaneously opened at record levels in the third session.

In addition, investors are also watching the results of the Fed's two-day policy meeting, which ends on Wednesday. The US central bank is widely expected to cut interest rates by another 0.25 percentage points.

However, the outlook for this safe haven metal is still uncertain, as some analysts expect gold prices to continue to remain high, while others remain reserved.

At the annual meeting of the London Gold Market Association (LBMA), experts predicted that gold prices could reach 4,980 USD/ounce in the next 12 months.

In contrast, two major financial institutions Citi and Capital Economics adjusted their gold price forecasts down on Monday.

Bank of America said in a report: "The market has fallen into an overbought state and that eventually led to an adjustment this week."

The bank also noted that gold prices are approaching their downward trend around $3,800/ounce in the fourth quarter of this year.

See more news related to gold prices HERE...