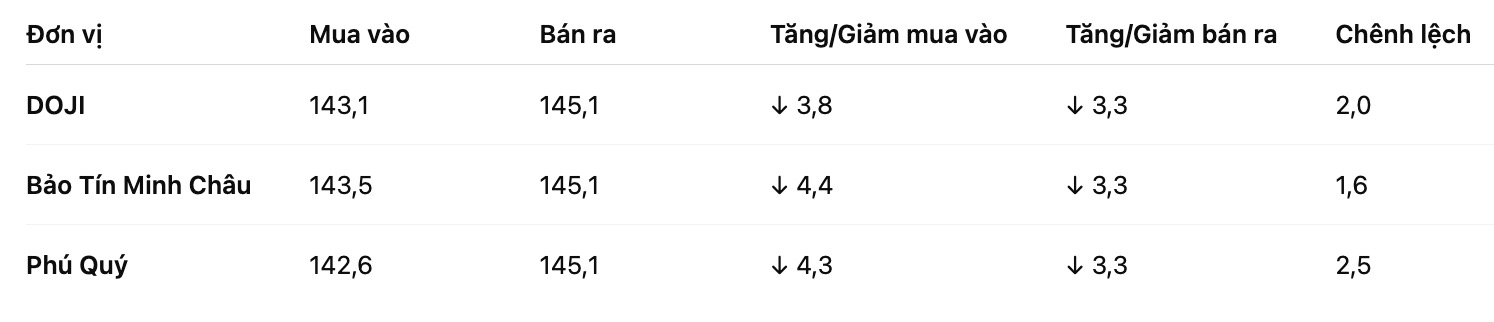

SJC gold bar price

As of 6:30 p.m., DOJI Group listed the price of SJC gold bars at 143.1-145.1 million VND/tael (buy - sell), down 3.8 million VND/tael for buying and down 3.3 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 143.5-145.1 million VND/tael (buy - sell), down 4.4 million VND/tael for buying and down 3.3 million VND/tael for selling. The difference between buying and selling prices is at 1.6 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 142.6-145.1 million VND/tael (buy - sell), down 4.3 million VND/tael for buying and down 3.3 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

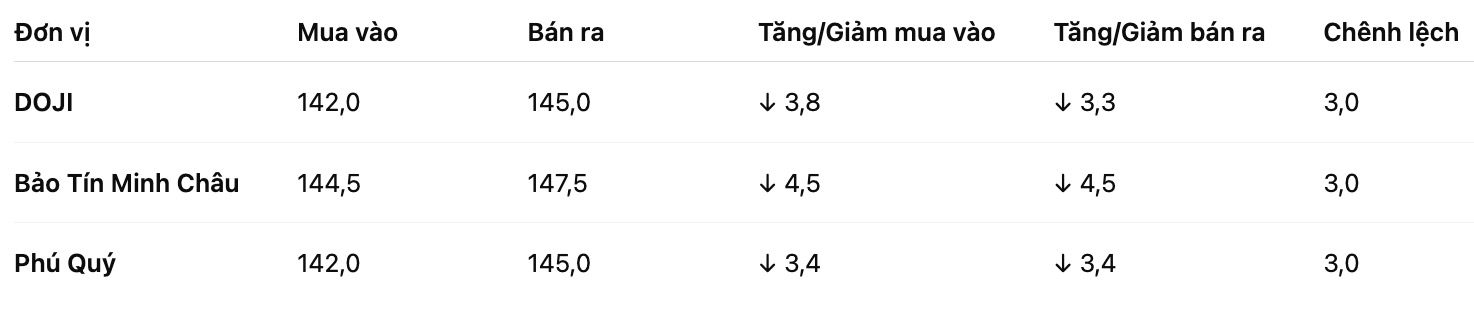

9999 gold ring price

As of 6:30 p.m., DOJI Group listed the price of gold rings at 142-145 million VND/tael (buy - sell), down 3.8 million VND/tael for buying and down 3.3 million VND/tael for selling. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 144.5-147.5 million VND/tael (buy - sell), down 4.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 142-145 million VND/tael (buy - sell), down 3.4 million VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

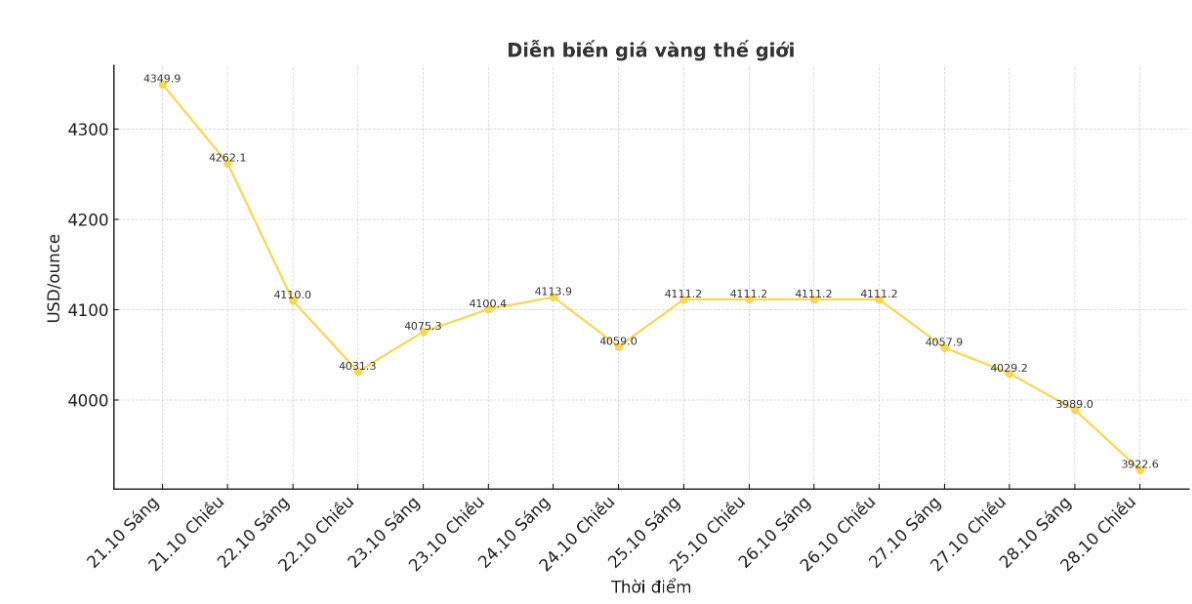

World gold price

The world gold price was listed at 6:35 p.m. at 3,922.6 USD/ounce, down 106.6 USD compared to a day ago.

Gold price forecast

Gold prices continued to fall in the session on October 28, approaching a three-week low, due to optimism about the possibility of reaching a trade deal between the US and China weakening demand for this precious metal, while investors awaited a series of policy decisions from major central banks during the week.

The frozen US-China trade relationship has partly caused gold prices to fall due to the decline in safe-haven cash flow, said Mr. Tim Waterer, chief market analyst at KCM Trade.

Over the weekend, top US and Chinese economic officials agreed a framework for US President Donald Trump and Chinese President Xi Jinping to consider this week.

Mr. Trump expressed his confidence that an agreement with China will be reached soon, and announced a series of important trade and mineral agreements with four Southeast Asian countries in the first phase of his 5-day trip to Asia.

The Asian stock market continues to maintain its upward momentum as expectations of a global trade ease help risk-off sentiment increase.

Investors are awaiting the results of the Fed meeting on October 30, with the FED forecasting a rate cut, while paying attention to Chairman Jerome Powell's orientation statements. The European Central Bank (ECB) and the Bank of Japan (BOJ) are expected to keep interest rates unchanged this week.

Since the beginning of the year, gold prices have increased by about 53%, reaching a record of 4,381.21 USD/ounce on October 20, supported by economic and political instability, expectations of interest rate cuts and buying activities of central banks.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...