At the World Gold Market Association (LBMA)'s World Gold quarterly Conference, the Bank of Korea expressed its intention to add to its gold reserves.

Mr. Heung-Soon Jung, Director of Reserve Investment Department of the Reserve Management Group of the Central Bank of Korea, said in a presentation that although the bank has not bought more gold since 2013, it is considering the possibility of buying additional in the medium and long term.

The bank will continue to monitor developments in the domestic foreign exchange market and trends in the international gold market to determine the appropriate investment timing and scale. As a hedge against inflation and an alternative asset to the US dollar, gold is clearly one of the assets worth considering in the long term, Jung said.

Meanwhile, in an interview with Bloomberg on the sidelines of the conference, Aivo Andrianarivelo - Governor of the Central Bank of Japan, said the country could increase its gold reserves from the current level of about 1 ton to 4 tons.

The demand for gold by global central banks has increased by more than 1,000 tons over the past three years. However, analysts say that most of these purchases are concentrated in a few central banks, especially China. However, many developing countries are still looking to reduce their dependence on the US dollar and diversify foreign exchange reserves.

In the first half of this year, central banks bought about 415 tons of gold, down from nearly 525 tons in the same period in 2024, but this level is still significantly higher than the long-term average. Analysts predict that the total official gold purchases of the region could reach 900 tons this year.

According to the World Gold Council (WGC) annual report released in June, nearly half of the world's central banks participated in the survey, of which 43% of reserve managers said they plan to increase their gold holdings this year - a sharp increase compared to 29% last year. At the same time, 95% of participants believe that global gold reserves will continue to increase in the next 12 months.

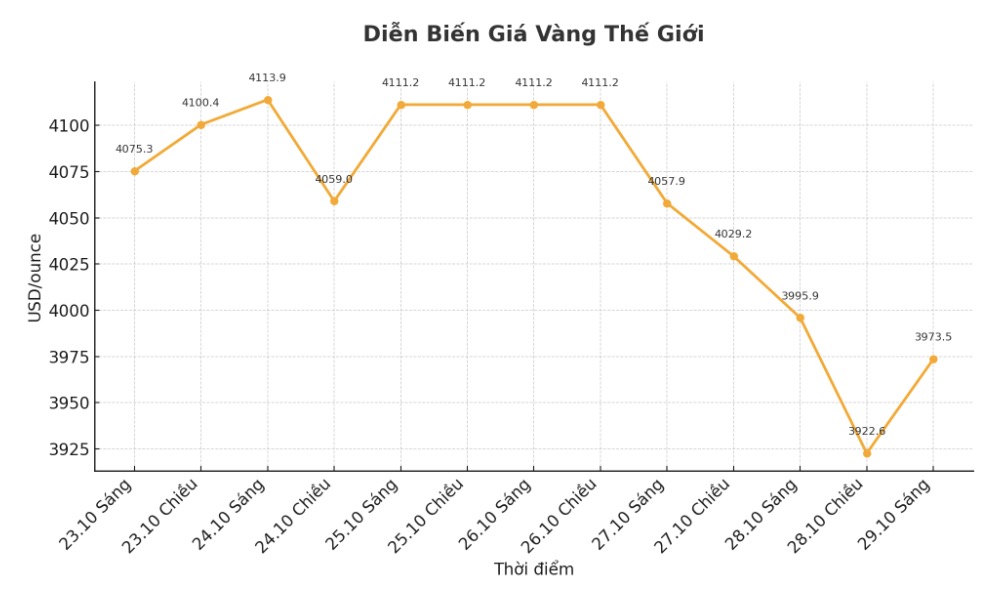

Although gold prices have fallen sharply below below $4,000/ounce, many experts believe that the long-term outlook is still positive, as demand from central banks continues to play a key role in maintaining value and creating motivation for investors.

See more news related to gold prices HERE...