Gold prices extended their decline in Friday's session after a series of better-than-expected US economic data reduced the possibility of the US Federal Reserve (Fed) early cutting interest rates, while declining geopolitical tensions also weakened safe haven demand.

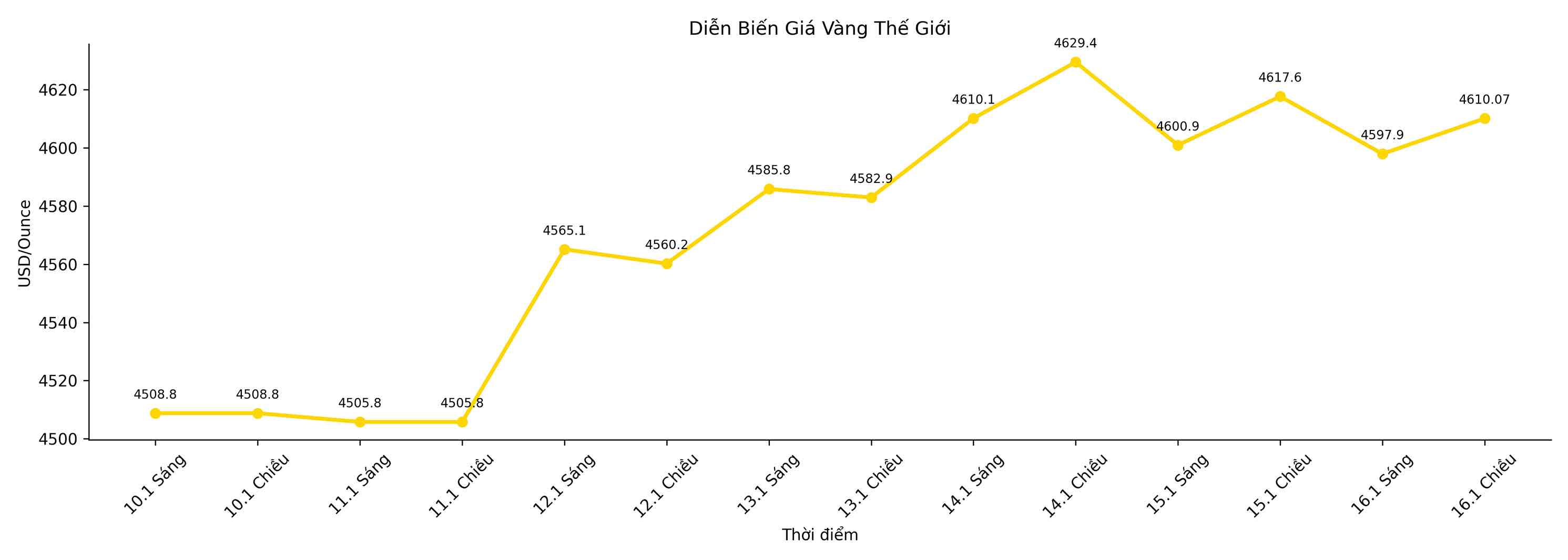

Spot gold prices fell 0.2% to 4,604.29 USD/ounce in this afternoon's trading session. However, the precious metal is still heading for an increase of about 2% this week, after hitting a historic peak of 4,642.72 USD/ounce on Wednesday.

The US gold futures for February also fell 0.3% to 4,608.90 USD/ounce.

Kyle Rodda, an analyst at Capital.com, commented: "The correction momentum of gold began mainly when the possibility of US intervention in the wave of instability in Iran decreased. In addition, the latest US economic data shows that the Fed has no urgent reason to lower interest rates.

The USD is heading for its third consecutive week of gains after the US Department of Labor announced that the number of first-time jobless claims fell by 9,000, to 198,000 – significantly lower than the forecast of 215,000 in a Reuters survey.

The strengthening greenback makes the USD-denominated metal more expensive for buyers abroad. Gold, a non-profitable asset, often benefits when interest rates are low because the opportunity cost to hold it decreases.

Sources in Iran accessed by Reuters on Wednesday and Thursday said that the protests had subsided since the beginning of the week, while US President Donald Trump also sent a softer signal about the possibility of military intervention.

Gold holdings of SPDR Gold Trust - the world's largest gold ETF fund increased slightly by 0.05% to 1,074.80 tons on Thursday, the highest level in more than 3.5 years.

In India, gold demand this week continues to be sluggish as domestic prices hit a new peak, weakening consumer purchasing power. Conversely, in China, gold is being traded at a premium level as demand remains stable before the Lunar New Year holiday.

Meanwhile, silver has become the commodity with the largest trading volume in the commodity market, according to a report by Vanda Research, as individual investors are buying at a rate described as "extraordinary".