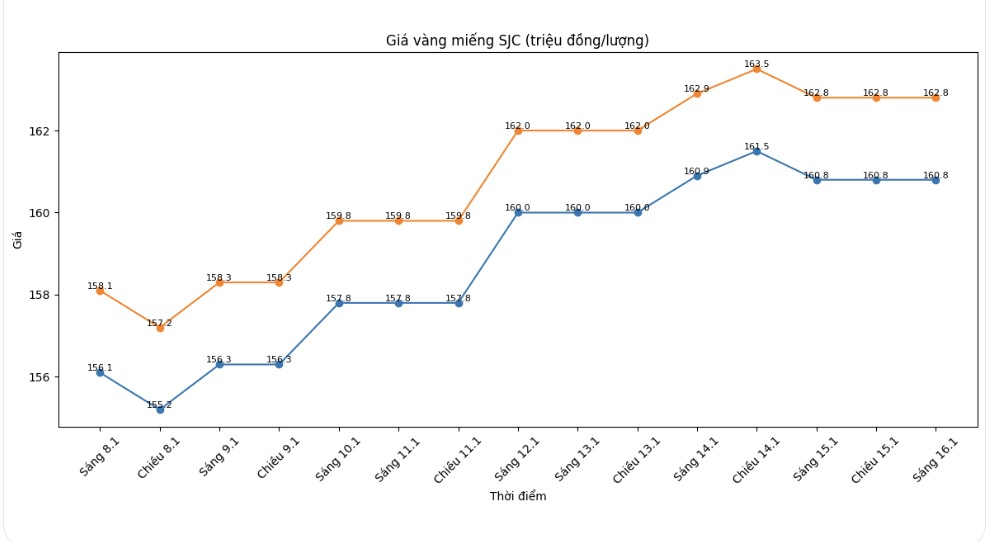

SJC gold bar price

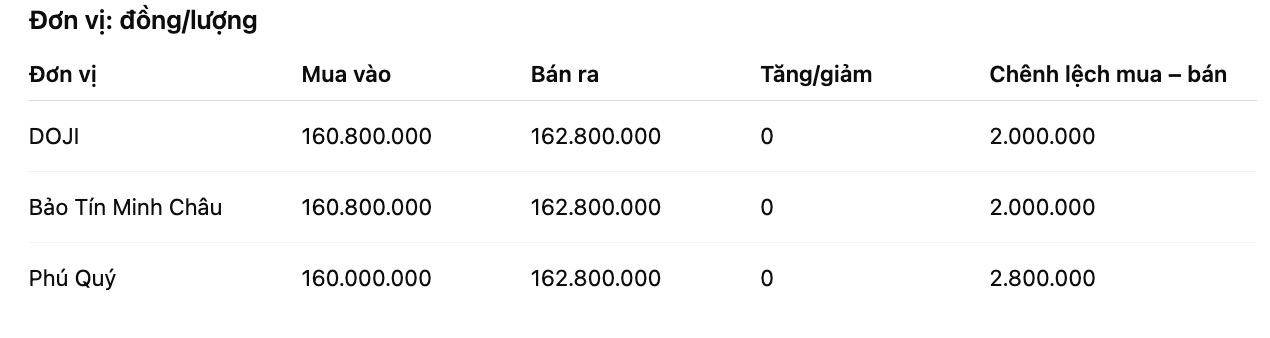

As of 9:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 160.8-162.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 160.8-162.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at 160-162.8 million VND/tael (buying - selling), going sideways in both directions. The buying - selling price difference is at 2.8 million VND/tael.

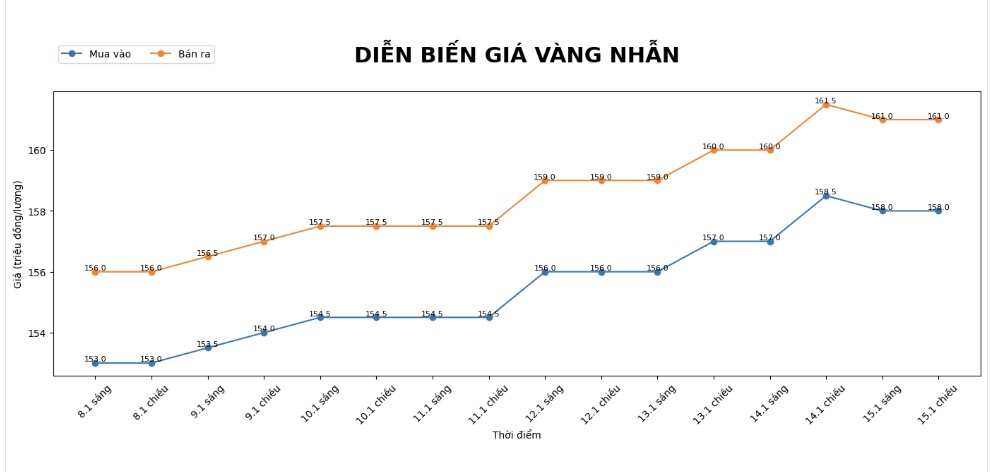

9999 gold ring price

As of 9:00 AM, DOJI Group listed the price of gold rings at the threshold of 158-161 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 1598.8-162.8 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 158-161 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

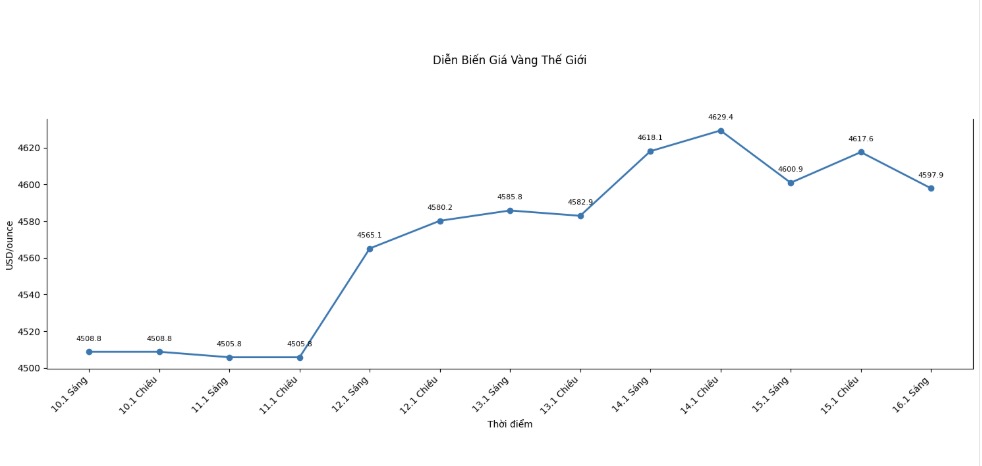

World gold price

At 9:33 am, world gold prices were listed around the threshold of 4,597.9 USD/ounce, down 3 USD compared to the previous day.

Gold price forecast

After a period of hot increase and continuously setting new records, world gold prices are showing signs of slowing down as they enter recent trading sessions. Last night, both gold and silver adjusted slightly, in the context of somewhat cooling down risk-avoidance sentiment in the international market.

The reason comes from the US's softer signals in the Middle East issue, as well as President Donald Trump's statement showing that there is no intention to intervene strongly in the operations of the Federal Reserve (Fed).

Mr. Trump's affirmation that he has no plans to fire Fed Chairman Jerome Powell has helped the market reduce concerns about the risk of currency policy disruption in the short term. Along with that, the US has temporarily not imposed new tariffs on important mineral groups, instead prioritizing negotiations to ensure the supply chain. These factors have somewhat reduced safe haven demand, creating adjustment pressure on gold prices.

According to many experts, the current downward momentum of gold is mainly technical. Mr. Ilya Spivak - Global Macro Director at Tastylive said that the cooling down of gold after reaching a historical peak does not change the larger picture of the market. Geopolitical tensions, policy risks and uncertainty surrounding the Fed's interest rate roadmap are still important supports, helping gold maintain a high price level in the medium and long term.

From another perspective, Mr. Daniel Ghali - Commodity Strategy Director of TD Securities believes that the risk to gold prices has become "two-way" more clearly. If gold was previously mainly supported by buying power from central banks, now the upward momentum is increasingly dependent on investment capital flows betting on the weakening trend of legal currencies, especially the USD.

This helps gold prices move further, even towards very high levels, but at the same time also makes the market more sensitive to psychological reversals.

Technically, the main trend of gold is still in the upward direction, as indicators show that the buying side is dominant. However, the fact that prices have been anchored in record highs makes the possibility of short-term corrections unlikely to be avoided.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...