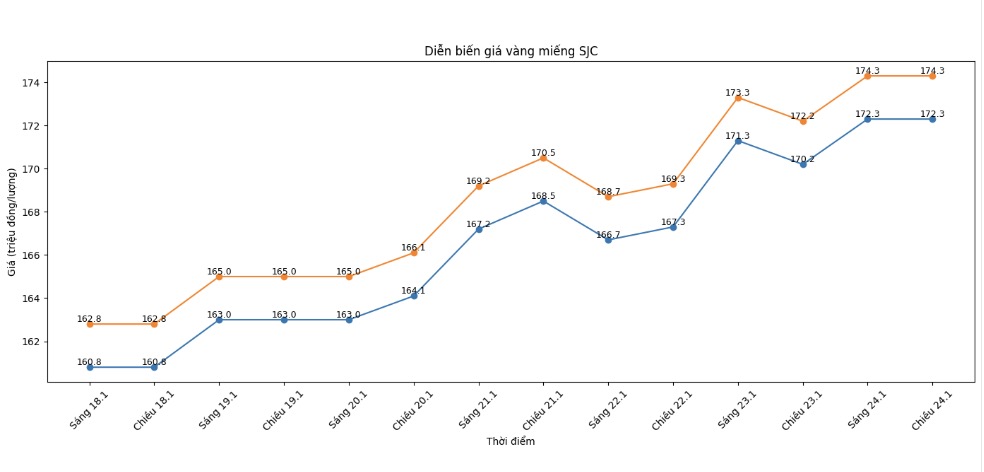

SJC gold bar price

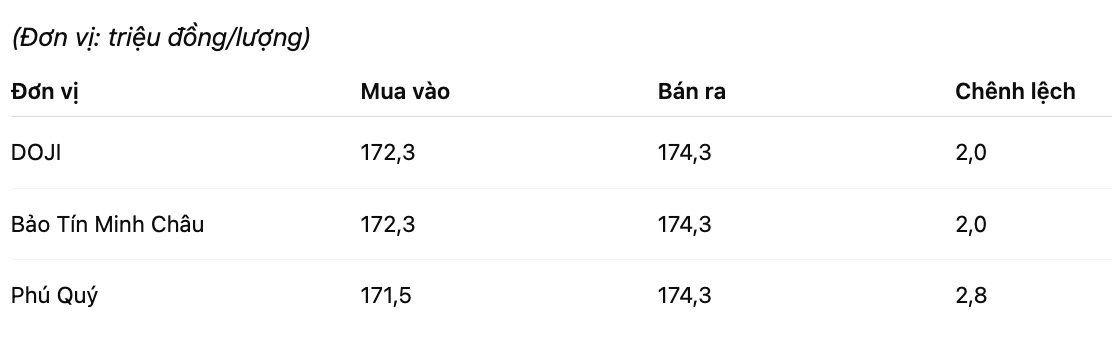

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 172.3-174.3 million VND/tael (buying - selling). The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 172.3-174.3 million VND/tael (buying - selling). The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at 171.5-174.3 million VND/tael (buying - selling). The difference between buying and selling prices is at 2.8 million VND/tael.

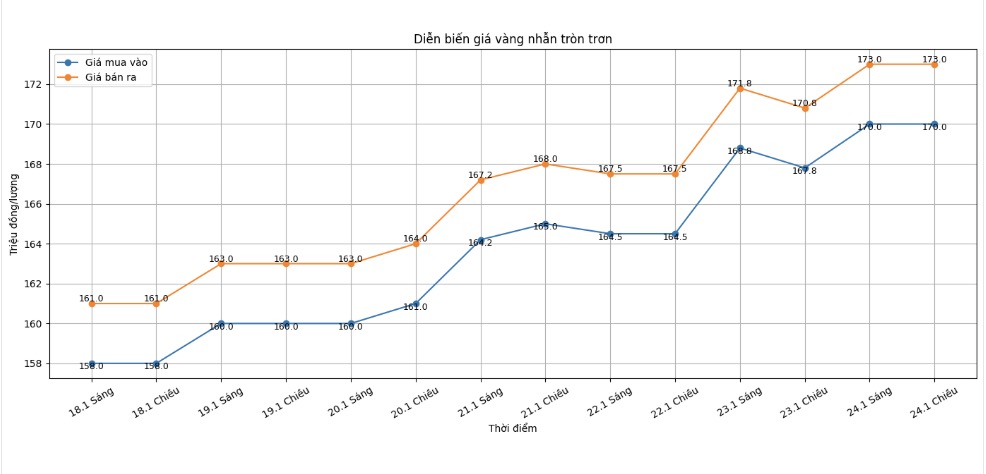

9999 gold ring price

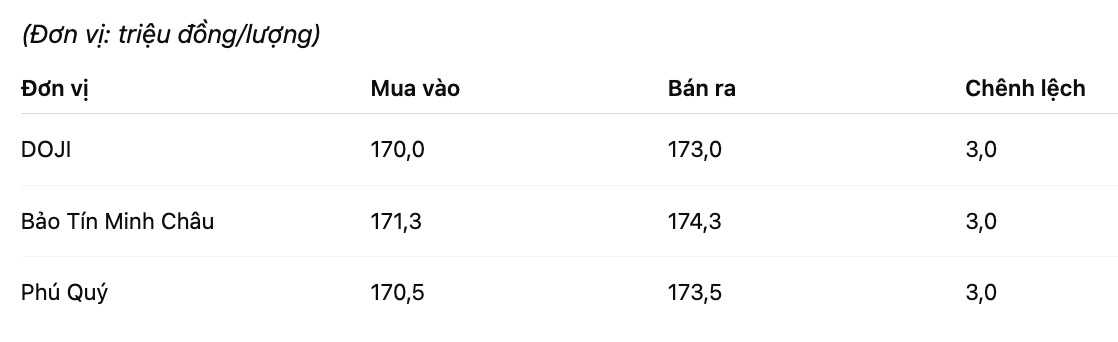

As of 6:00 AM, DOJI Group listed the price of gold rings at 170-173 million VND/tael (buying - selling). The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 171.3-174.3 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 170.5-173.5 million VND/tael (buying - selling). The buying - selling difference is at 3 million VND/tael.

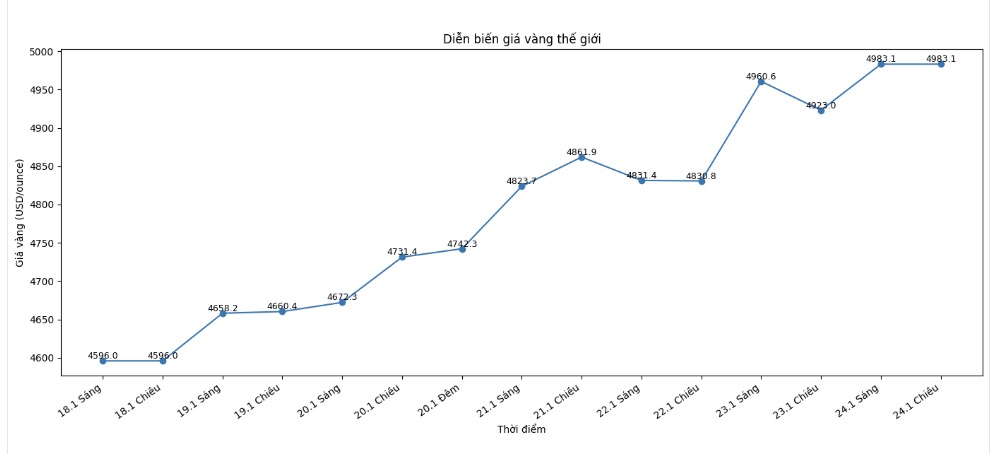

World gold price

At 6:00 AM, the world gold price was listed around the threshold of 4,983.1 USD/ounce.

Gold price forecast

The hot upward trend of world gold prices is continuing to create an important support for the domestic gold market. In the context of international gold prices approaching the 5,000 USD/ounce mark, many fundamental factors show that the upward trend is still not over, although the risk of strong fluctuations is increasingly present.

The global gold market is currently operating in parallel through two main valuation mechanisms: spot and futures contracts. At this time, December gold contracts are attracting the most attention as settlement and forwarding activities are taking place strongly in the late year. The high volume of open contracts makes the market more sensitive to information shocks, from geopolitics to monetary policy.

According to Mr. Aaron Hill - Head of Market Analysis at FP Markets, gold is showing a very rare price increase. “Each correction is quickly attracting strong buying power, showing that gold-holding sentiment still has an absolute advantage. With central banks continuing to buy in, the possibility of gold advancing to the 5,200 - 5,400 USD/ounce zone is completely possible before a clearer correction appears” - Mr. Hill said.

From a more cautious perspective, CPM Group experts believe that the current upward momentum reflects the level of global economic and political instability still at a very high level. The large number of open contracts in the futures market, especially in recent months, may create strong fluctuations in the short term when investors simultaneously shift positions.

Although the medium-term outlook for gold is still positive, in the record high price range, the risk of deep correction is a risk that cannot be ignored" - CPM Group warned. According to this analysis group, in a negative scenario, gold prices could completely retreat to the 4,500 USD/ounce area before establishing a new level of increase.

Notably, Bank of America still maintains a very optimistic view of precious metals. This bank forecasts that gold prices could reach 6,000 USD/ounce in the spring of 2026, thanks to increased investment demand, reduced mining supply and increasing production costs.

Summarizing the above factors shows that the long-term trend of gold prices is still strongly supported. However, investors need to be especially cautious with short-term corrections, especially in the context that the market is in a state of high excitement and increasing volatility.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...