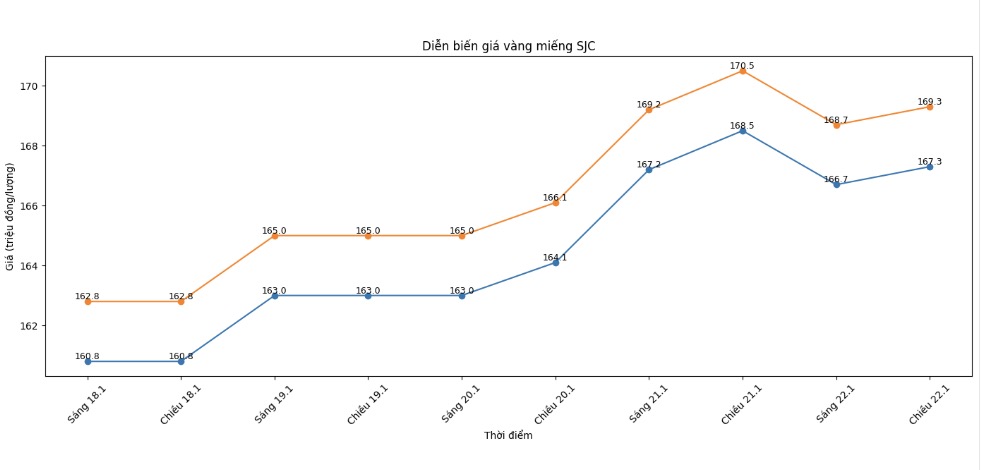

SJC gold bar price

As of 6:45 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 167.3-169.3 million VND/tael (buying - selling), down 1.2 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 167.3-169.3 million VND/tael (buying - selling), down 700,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at the threshold of 166.6-169.3 million VND/tael (buying - selling), down 900,000 VND/tael on the buying side and down 1.2 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 2.7 million VND/tael.

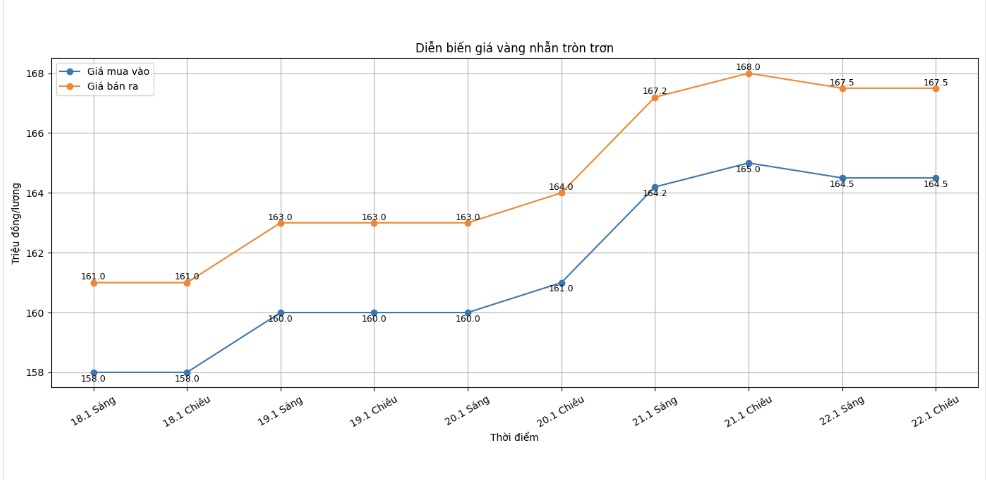

9999 gold ring price

As of 6:45 PM, DOJI Group listed the price of gold rings at 164.5-167.5 million VND/tael (buying - selling), down 500,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 166.3-169.3 million VND/tael (buying - selling), down 700,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 165.2 - 168.2 million VND/tael (buying - selling), down 800,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

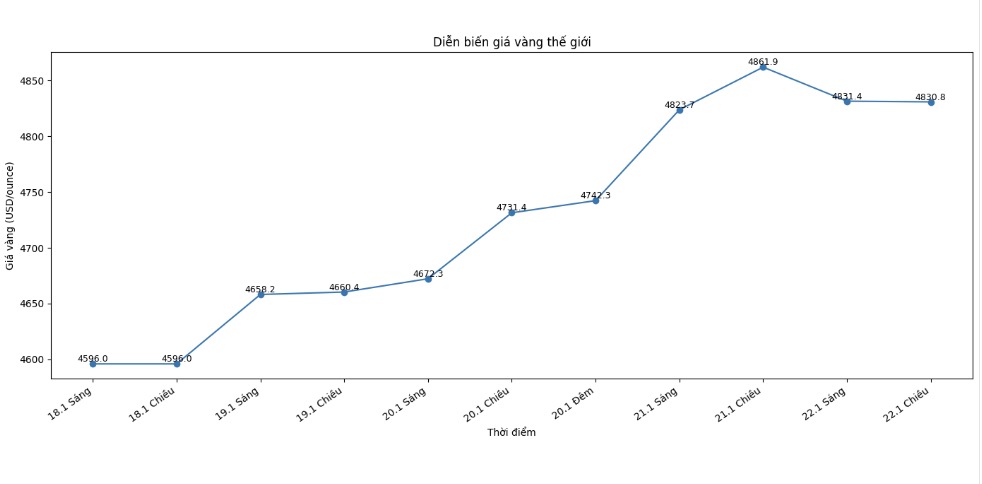

World gold price

At 6:45 PM, world gold prices were listed around the threshold of 4,830.8 USD/ounce, down 31.1 USD compared to the previous day.

Gold price forecast

The adjustment of gold prices in the recent session mainly stemmed from the rapid changes in international market sentiment. The US administration's signal to cool down trade tensions, especially related to tariff and Greenland issues, has caused temporary cash flow to return to risky assets such as stocks. As risk appetite improves, the demand for holding gold - which is considered a safe haven - tends to weaken in the short term.

The global stock market recovered, while world gold prices retreated from the peak, showing that psychological factors are playing a strong controlling role. Mr. Bob Haberkorn - senior market strategist at RJO Futures - said that positive trade information has supported stocks to increase, thereby creating adjustment pressure on the precious metal market. However, he believes that this is just a technical correction and has not changed the long-term trend of gold.

In fact, the underlying factors supporting gold prices are still present. The global economic and geopolitical context continues to pose many risks, from trade tensions between the US and Europe to concerns surrounding public debt and monetary policy. The fact that the US Federal Reserve is forecast to maintain a low interest rate level in the near future is also a beneficial factor for gold - a non-profit asset but attractive in a low cost capital environment.

From a more long-term perspective, many experts believe that gold is still in the early stages of a new upward cycle. Mr. Ryan McIntyre - senior executive partner of Sprott Inc. - assessed that large institutional capital still has not really strongly participated in the gold market.

According to him, most institutional investors have only stopped at the observation and appraisal stage, instead of large-scale capital allocation actions. This shows that there is still room for gold to increase, as large cash flows have not been activated.

In the short term, gold prices may continue to fluctuate and appear adjustments as the market responds to economic and policy information. However, in the medium and long term, gold is still considered an effective risk hedging channel in the context that instability shows no signs of ending, thereby maintaining positive prospects for the coming months.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...