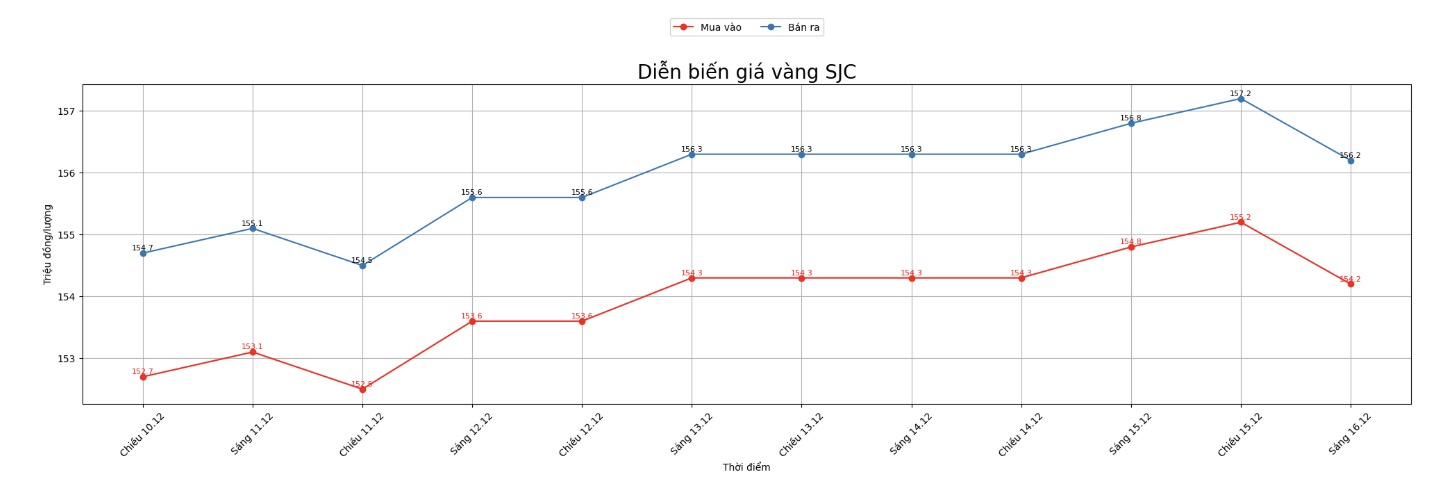

Updated SJC gold price

As of 9:05, the price of SJC gold bars was listed by DOJI Group at 154.2-156.2 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 154.2-156.2 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 153.2-156.2 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

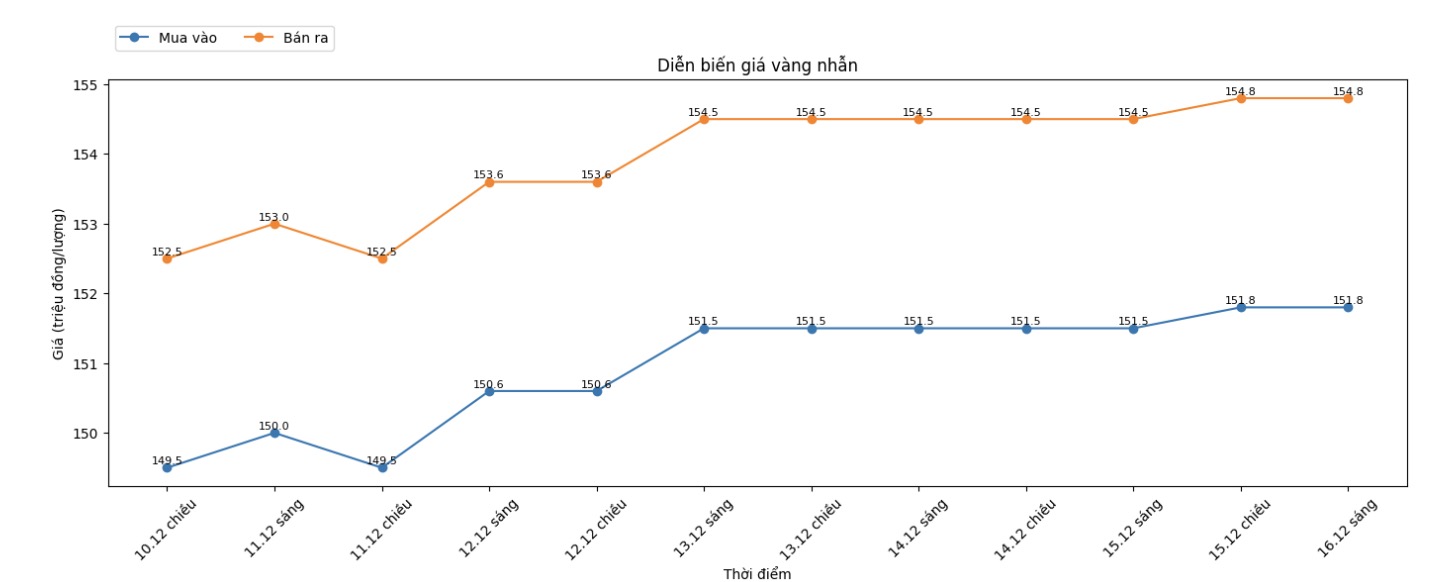

9999 round gold ring price

As of 9:05, DOJI Group listed the price of gold rings at 151.8-154.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152.2-155.2 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.7-154.7 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

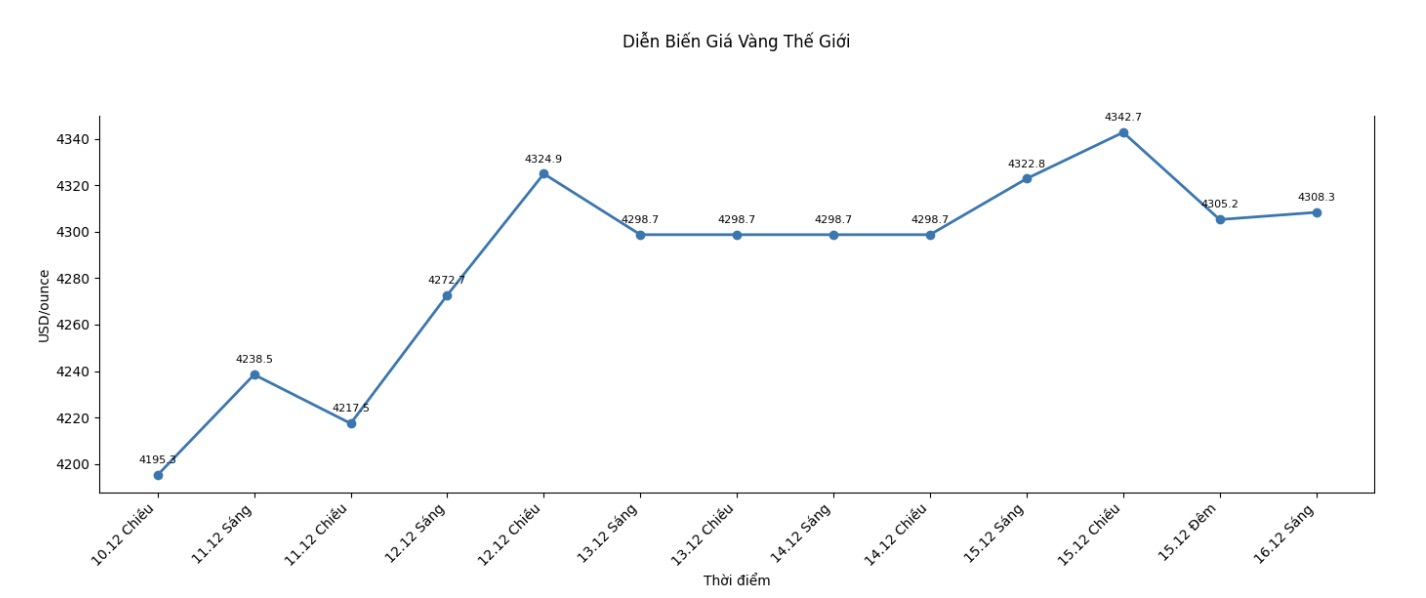

World gold price

At 9:10 a.m., the world gold price was listed around 4,308.3 USD/ounce, down 14.5 USD compared to a day ago.

Gold price forecast

Gold prices turned down due to profit-taking pressure and the risk of cooling down due to positive information about Russia-Ukraine negotiations.

Some reports say that peace talks related to the Russia-Ukraine conflict may be making further progress, thereby reducing risk-off sentiment in the market in general and putting pressure on gold prices. Some sources said that the recent negotiations in Berlin have recorded new steps forward.

On the eve of the new year, analysts at Societe Generale (a French multinational banking and financial services group, one of the largest banks in Europe) said they continue to hold a 10% stake in the multi-asset portfolio.

The French bank kept its gold allocation unchanged as it reduced the share of US anti-inflation bonds to zero and cut the share of corporate bonds by half to 5%.

In the latest analysis of gold price forecasts, Mr. Lukman Otunuga - senior market analyst at FXTM - said that gold's increase still holds a solid foundation. According to him, the precious metal is having many supporting factors to move towards higher price areas in the medium and long term.

Technically, the next bullish target for February gold delivery is to close above a solid resistance zone at a contract peak/record of $4,433/ounce. The next near-term downside target for the sellers is to push the contract price below the strong technical support zone at 4,200 USD/ounce.

The first resistance level was at last week's peak of $4,387, then $4,400/ounce. First support was identified at the bottom of Friday at $4,286/ounce, followed by $4,250/ounce.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...