From 2026, tax management for business households enters a period of tightening when the 2025 Tax Administration Law officially takes effect. One of the most important but confusing contents is the tax arrears period. Many households still believe that tax arrears only stop at 5 years, but in fact, according to new regulations, this period can be extended to 10 years if the act is identified as showing signs of concealing revenue or tax evasion. This misunderstanding makes many business households push themselves into legal risk without knowing.

False declaration, even if unintentional, can still be retroactively confiscated for 5 years

According to Article 127 and Article 128 of the 2025 Tax Administration Law (Law No. 108/2025/QH15), acts of incorrect declaration but without intentional signs such as insufficient revenue declaration, incorrect application of tax rates, incorrect determination of exemption and reduction subjects or professional errors belong to the group of administrative violations. For this group, tax authorities are allowed to recover for a maximum of 5 years from the time of detection.

These violations often stem from business households not understanding regulations, incomplete accounting systems, or not updating tax policies in time. However, "unintentional" does not mean "not being handled".

Taxpayers still have to pay additionally the entire amount of tax deductible, being fined according to Decree 125/2020/ND-CP (amended by Decree 310/2025/ND-CP) and bearing 0.03%/day late payment according to the 2025 Tax Administration Law. In many cases, the amount of late payment accumulated over many years causes the financial burden to increase sharply.

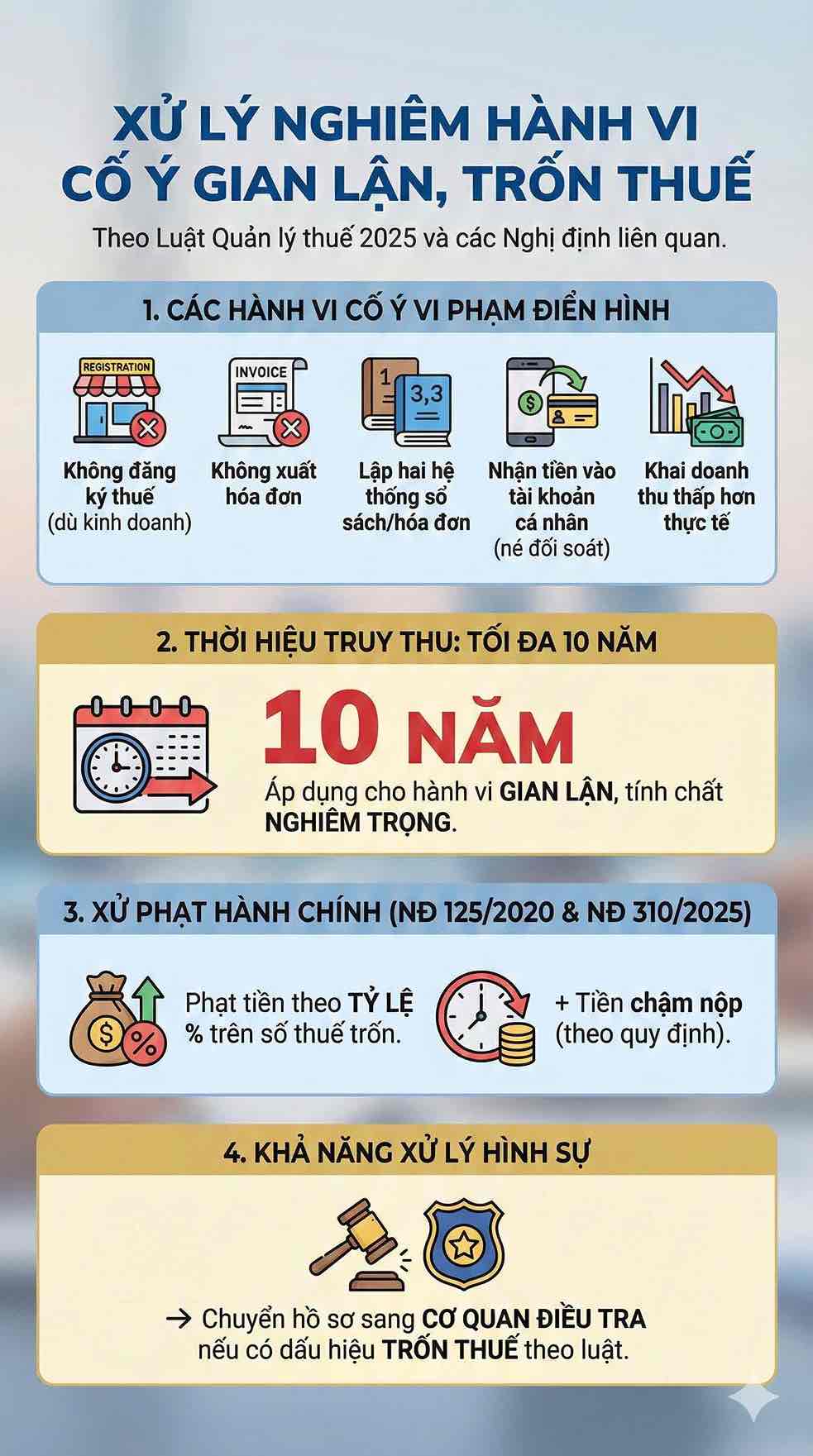

Concealing revenue, tax authorities have the right to retroactively pursue for 10 years

For acts with signs of intentionally not registering taxes even when doing business, not issuing invoices, creating two invoice systems, receiving sales money into personal accounts to avoid counter-examination or intentionally declaring revenue lower than reality, the 2025 Tax Administration Law stipulates a maximum retroactive period of 10 years. This is a time frame for acts considered fraudulent, showing more seriousness than the usual administrative violation group.

In addition to retroactive collection, Decree 125/2020/ND-CP and amendments to Decree 310/2025/ND-CP stipulate administrative penalties corresponding to the nature of the violation, including penalties at a percentage rate on the amount of tax evasion and late payment according to current regulations. The transfer of dossiers to the investigating agency may occur if the tax authority determines that there are signs of tax evasion according to the provisions of law.

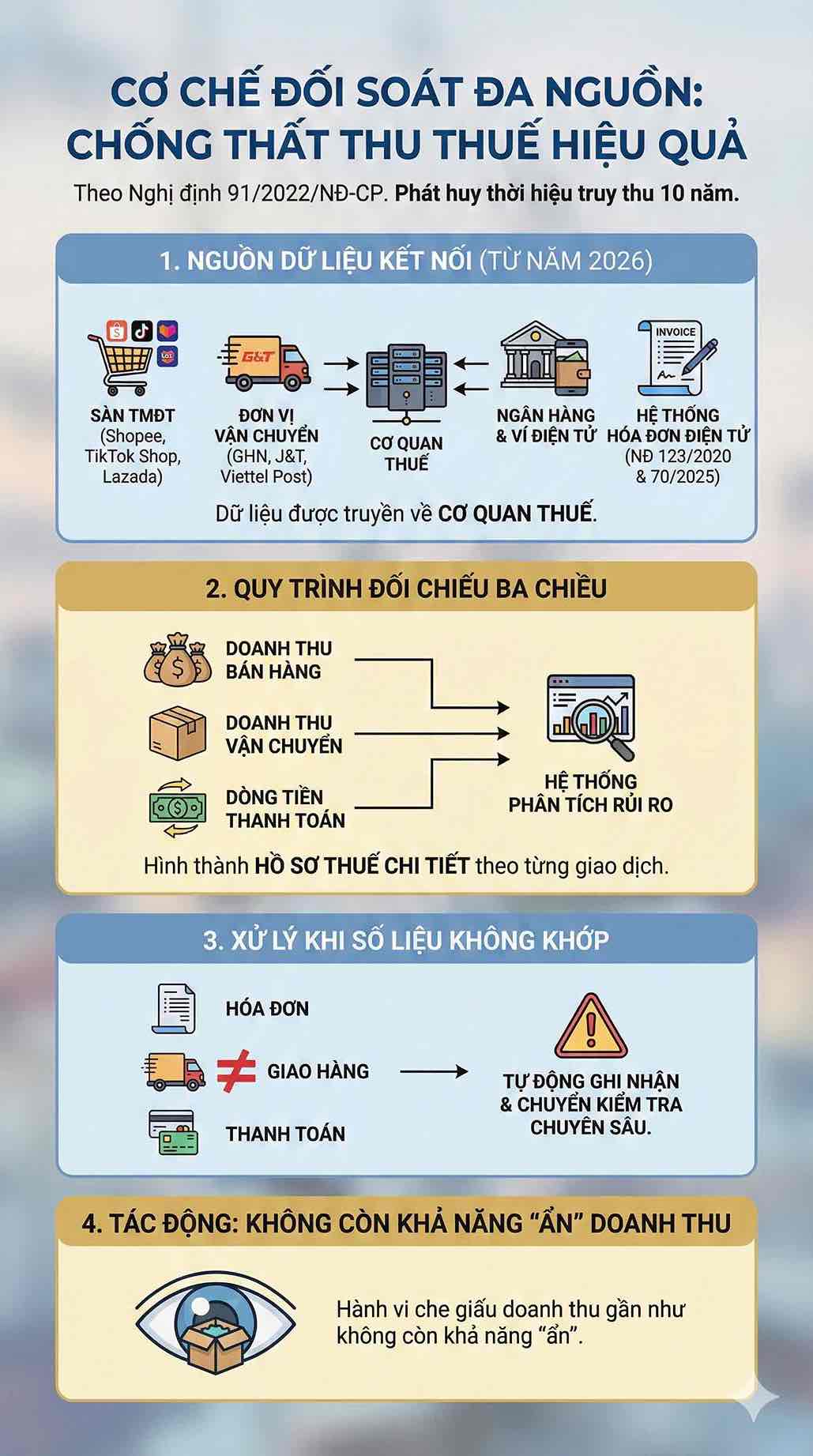

Multi-source control makes tax evasion almost impossible to hide

The 10-year retroactive period is only truly effective when the tax authority has sufficient data to prove fraudulent acts. This is ensured thanks to the multi-source control mechanism under Decree 91/2022/ND-CP. From 2026, data is transmitted to the tax authority from:

- E-commerce platforms such as Shopee, TikTok Shop, Lazada;

- Transportation units such as GHN, J&T, Viettel Post;

- Banks and e-wallets;

- Electronic invoice system under Decree 123/2020 and Decree 70/2025.

The three-dimensional comparison of sales revenue, transportation revenue and cash flow helps tax authorities form detailed tax records according to each transaction of each business household. As long as the data between invoices, delivery data and payment data are not matched, the risk analysis system will automatically record and switch to in-depth inspection. This makes the act of concealing revenue almost unlikely to be "hidden" as before.

Excessive collection deadline easily pushes business households into risk

The habit of relying on old regulations in the context that tax authorities did not have enough data for comparison makes many business households still believe that tax arrears are limited to 5 years. However, the 2025 Law on Tax Administration clearly distinguishes:

- 5 years for cases of unintentional incorrect declaration

- 10 years for tax evasion and revenue concealment

The core change point is not only the deadline, but the transition from a document management model to a data-based management model. A small deviation from many years ago, when counter-examined by an interconnected data system, can completely become a basis for tax authorities to consider retroactive collection for many years.

Mispronunciation is a risk step over many years

In the era of tax management using real-time data, business households need to increase the level of compliance with the law. Full tax registration, using standard electronic invoices according to Decree 70/2025/ND-CP and honestly declaring revenue is not only an obligation but also a shield to avoid being judged fraudulently. Full data storage according to legal deadlines becomes especially important, because data loss, file deletion or lack of comparison documents will easily be considered as acts of not preserving documents according to regulations.

When the tax system completely switches to a management model based on interconnected data, the right to retroactively collect for 5 years or 10 years is not only a legal issue but a practical operation. With just one error or one data matching, the tax authority can completely conduct in-depth reviews for many years and apply corresponding time-stamps. For business households, complying with standards from the beginning is the only way to avoid prolonged retroactive risks.