From 2026, when the 2025 Tax Administration Law officially takes effect, business households will enter a period of stricter tax management through a data-based management model. A seemingly simple but decisive obligation is to submit a report on the situation of invoice use. Just by late payment, insufficient payment or failure to submit a report, business households may be temporarily locked from tax codes, leading to a series of legal consequences and business disruptions.

Invoice reporting obligations tightened from 2026

The use of electronic invoices has become mandatory since Decree 123/2020/ND-CP. By 2025, Decree 70/2025/ND-CP will continue to tighten management procedures and require business households to report according to synchronous data standards nationwide.

From the time the 2025 Tax Administration Law takes effect, reporting on the situation of invoice use becomes a core compliance assessment indicator. With just one period of late or unpaid reporting, the tax sector's risk management system immediately marks business households as being specially monitored.

This makes the obligation to report capital previously underestimated become a direct factor determining whether business households can continue to use tax codes or not.

Tax codes are locked if violations are reported invoices

One of the most important changes to the 2025 Tax Administration Law lies in Article 139, which grants tax authorities the right to temporarily suspend the validity of tax codes for business households that do not properly perform their invoice reporting obligations or show signs of using invalid invoices. This is considered a transition from "reminder - penalty" management to "data-based tightening" management.

When the tax code is locked, all tax activities of the business household are immediately suspended. Sellers cannot issue electronic invoices, cannot declare - pay taxes, and are even refused transactions with partners who need valid invoices.

More seriously, the "temporary lock" status is a signal for tax authorities to consider on-site inspection or expand revenue control. With such a direct and strong impact, this is considered a management measure with a greater deterrent effect than administrative fines.

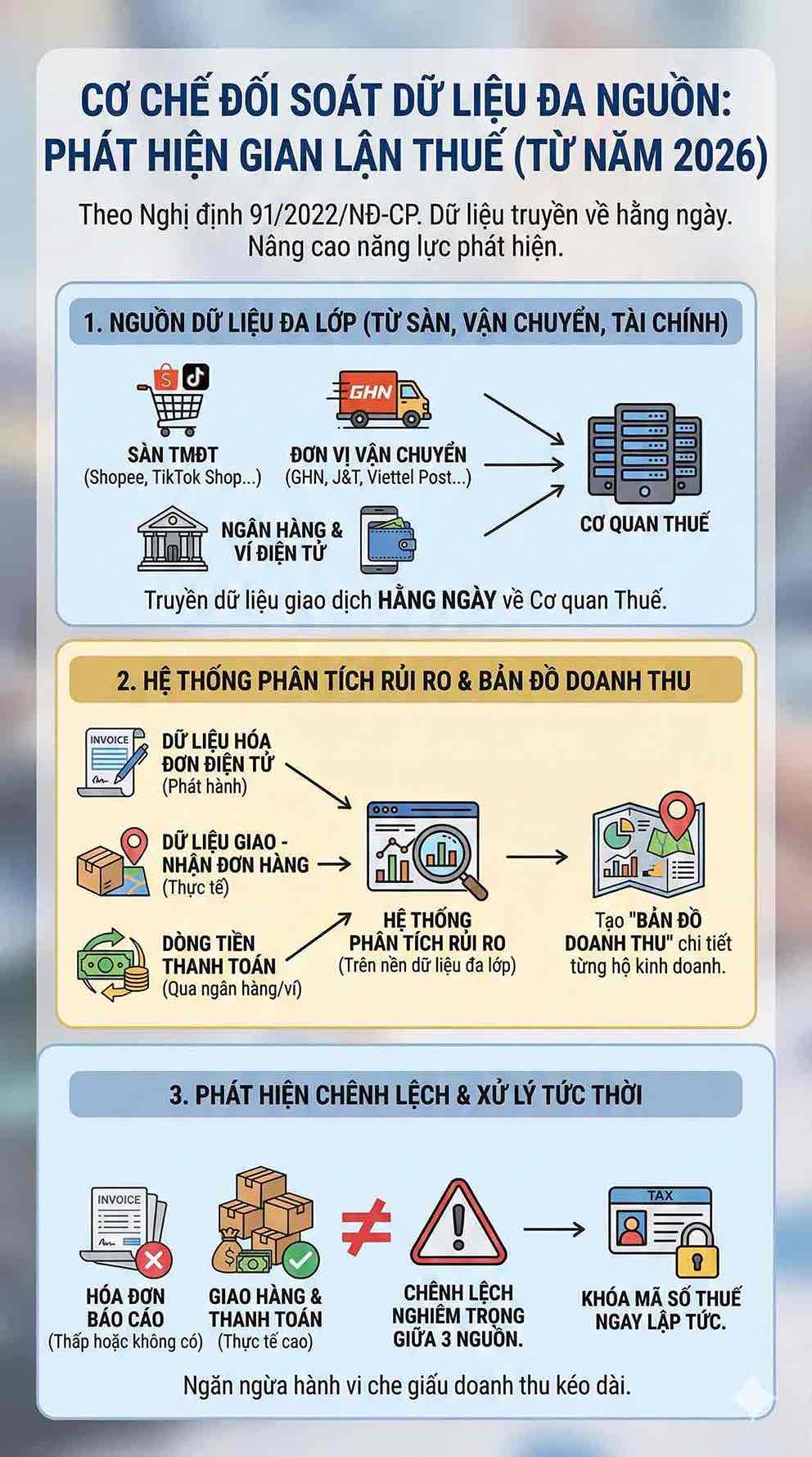

Multi-source control reveals revenue distortion

The ability of tax authorities to detect violations has increased sharply since Decree 91/2022/ND-CP requires e-commerce platforms (e-commerce platforms), transportation units, banks and e-wallets to transmit transaction data to tax authorities daily. From 2026, the risk analysis system of the tax industry operates on a multi-layered data platform, including: Electronic invoices issued; order delivery - receipt data from GHN, J&T, Viettel Post; and cash flow through banks and e-wallets.

Comparing these three data sources creates a detailed "revenue map" for each business household. If a business household regularly sells goods but reports invoices at a low level or does not send reports, the difference between sales revenue - transportation revenue - cash flow will be immediately detected by the system.

In many cases, tax authorities apply measures to lock tax codes right from the time of serious differences, in order to prevent acts of concealing revenue that last for many periods.

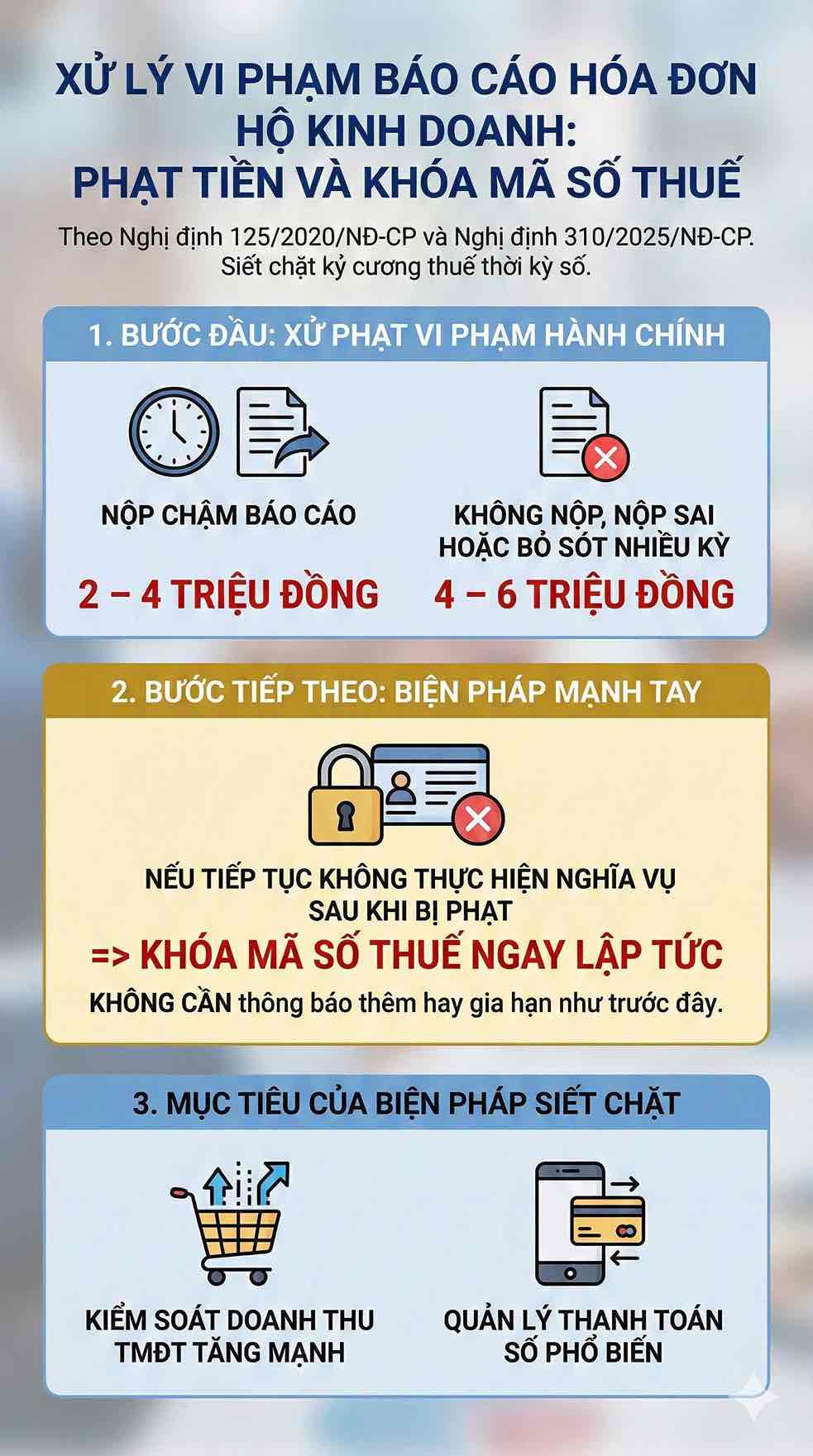

Can be fined up to 6 million VND before being locked tax code

According to Decree 125/2020/ND-CP and amended by Decree 310/2025/ND-CP, business households violating the obligation to report invoices will be penalized before their tax code is locked:

- Fine of 2–4 million VND if late submission of reports;

- A fine of 4–6 million VND if not paid, paid incorrectly or missed many periods.

However, sanctioning is only the first step. If business households continue not to fulfill their obligations after being sanctioned, the tax authority has the right to lock the tax code immediately, without further notice or extension as before.

This measure demonstrates the view of tightening tax discipline in the context of strong increases in e-commerce and digital payment revenue.

In the period of tax management based on interconnected data, invoice reporting is no longer an administrative procedure. This is the basis for business households to prove transparency and avoid the risk of being considered for tax arrears or suspicion of tax evasion.

Complying with due reports, fully storing data and using electronic invoices according to Decree 70/2025/ND-CP standards are minimum requirements for business households to maintain stable operations and avoid being locked in tax codes.