Full set of Bac A Bank interest rates at all terms

Bac A Bank has just continued to increase deposit interest rates by 0.2% - 0.3%/year for terms from 6-36 months.

Accordingly, for deposits under 1 billion VND, the 6-11 month term increased by 0.3%/year to 6.5%/year; the 12-month term increased by 0.25%/year to 6.55%/year; the 13-15 month term increased by 0.2%/year to 6.6%/year; the 18-36 month term increased by 0.2%/year to 6.7%/year.

For deposits of VND1 billion or more, it is 0.2%/year higher than the above interest rate table. The 1-5 month term is 4.75%/year; the 6-11 month term is 6.7%/year; the 12-month term is 6.75%/year and the 13-15 month term is 6.8%/year and the highest is up to 6.9%/year with a term of 18-36 months.

After interest rate increases, Bac A Bank is the bank with the highest deposit interest rate in the market today.

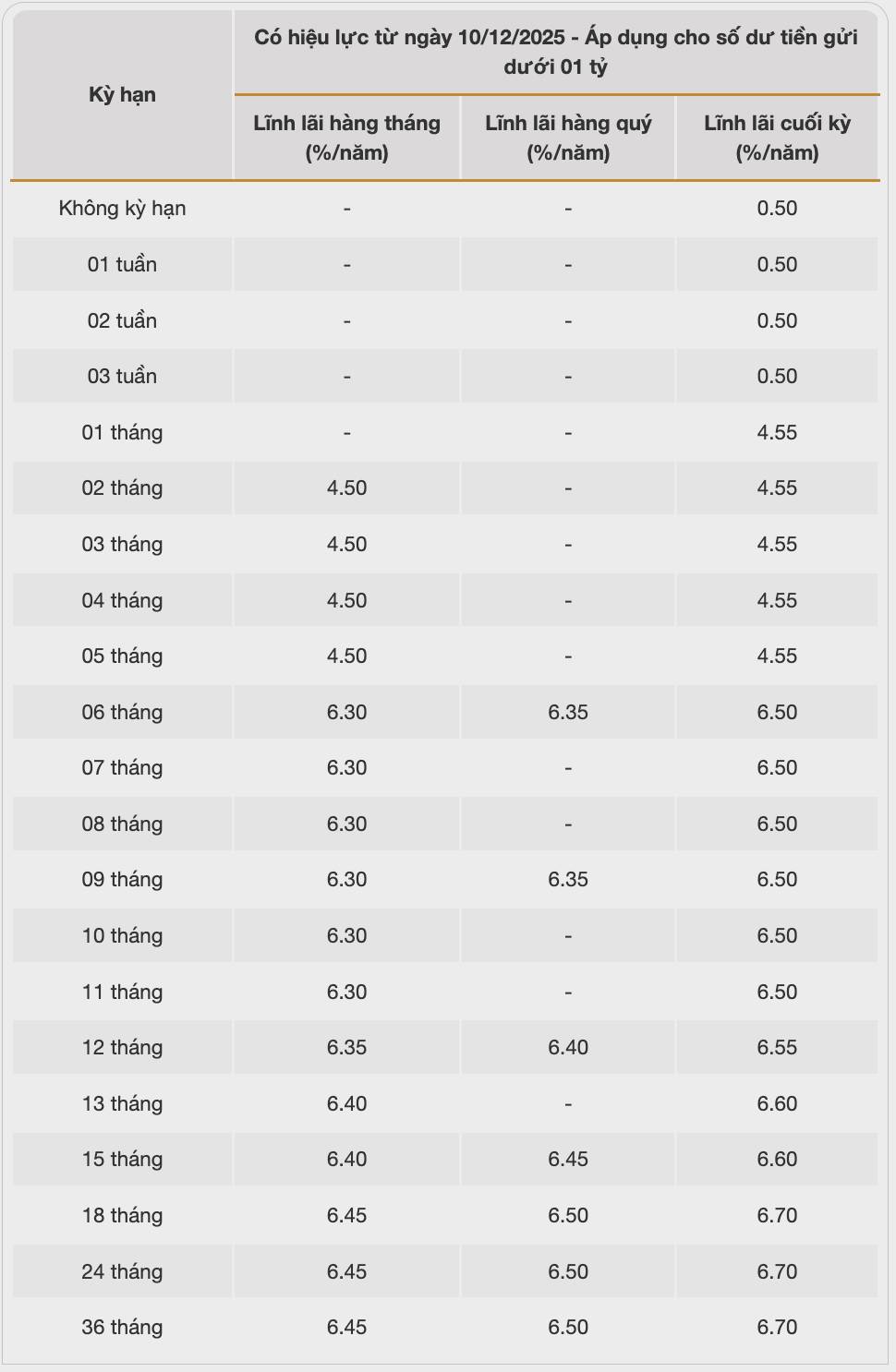

According to Lao Dong, the savings interest rate of Bac A Commercial Joint Stock Bank (Bac A Bank), applied to deposit balances under 1 billion VND, with interest paid at the end of the term currently ranging from 4.55%/year to 6.7%/year.

The savings interest rate table of Bac A Bank is currently listed as follows:

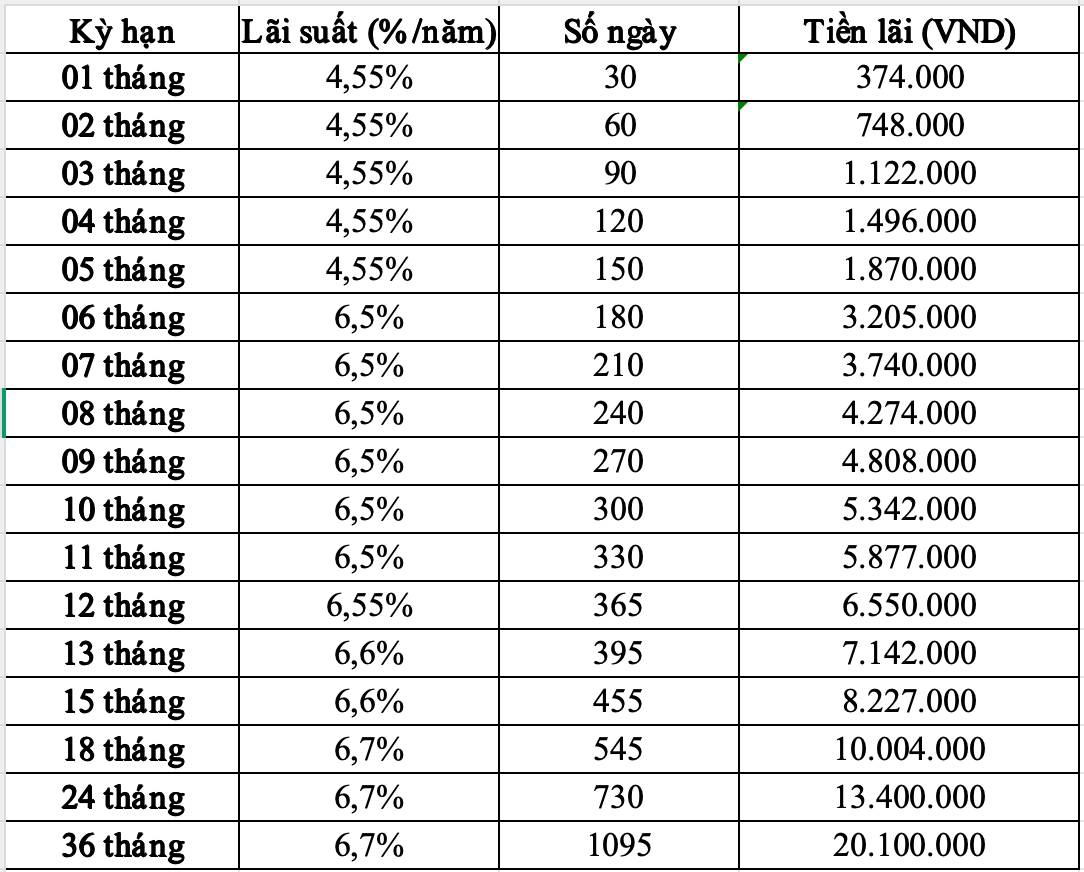

Depositing 100 million VND at Bac A Bank, how much interest will you receive at each term?

Readers can calculate bank deposit interest using the following formula:

Interest amount = Deposit amount * interest rate (%/year) * actual deposit date/365

Thus, depositing 100 million VND at Bac A Bank, customers can receive the highest interest rate as follows:

Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more articles on interest rates HERE.