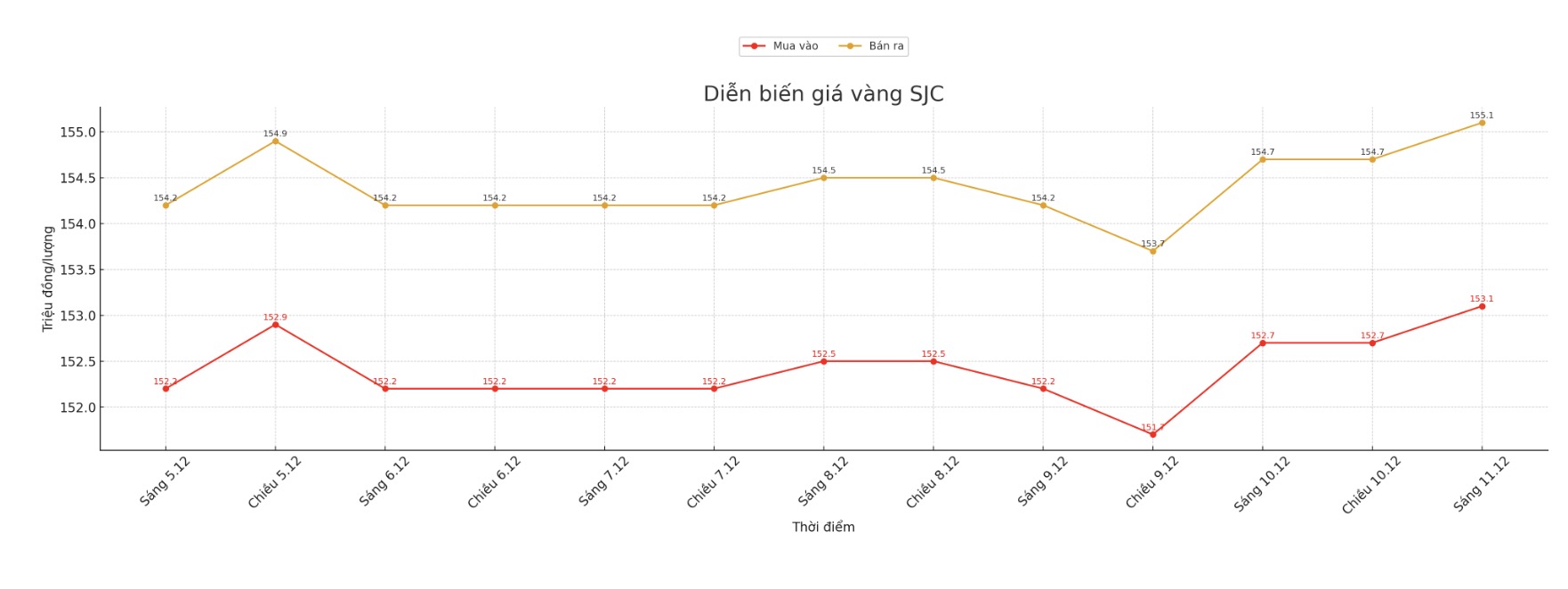

Updated SJC gold price

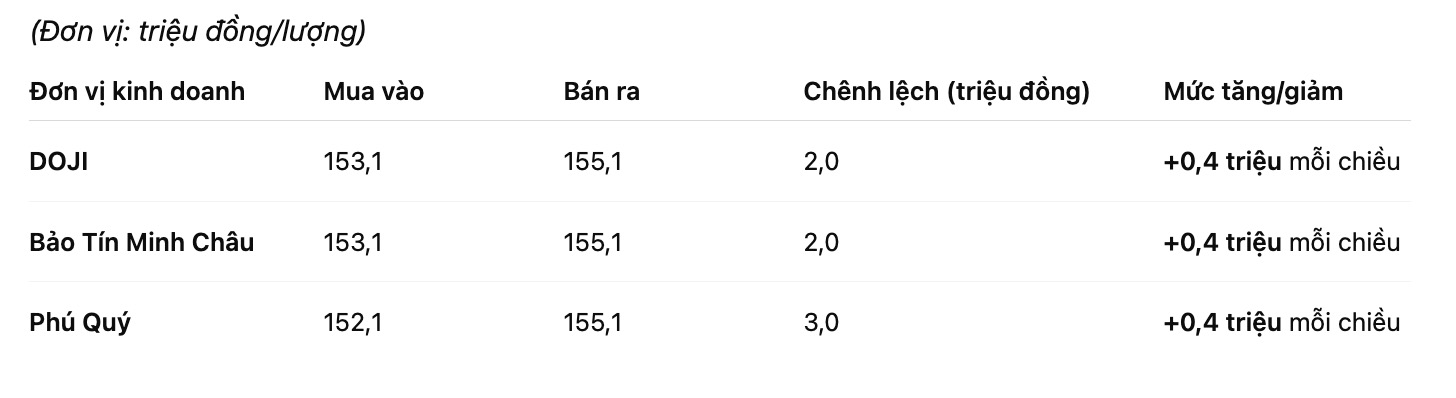

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at 153.1-155.1 million VND/tael (buy in - sell out), an increase of 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 153.1-155.1 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 152.1-155.1 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

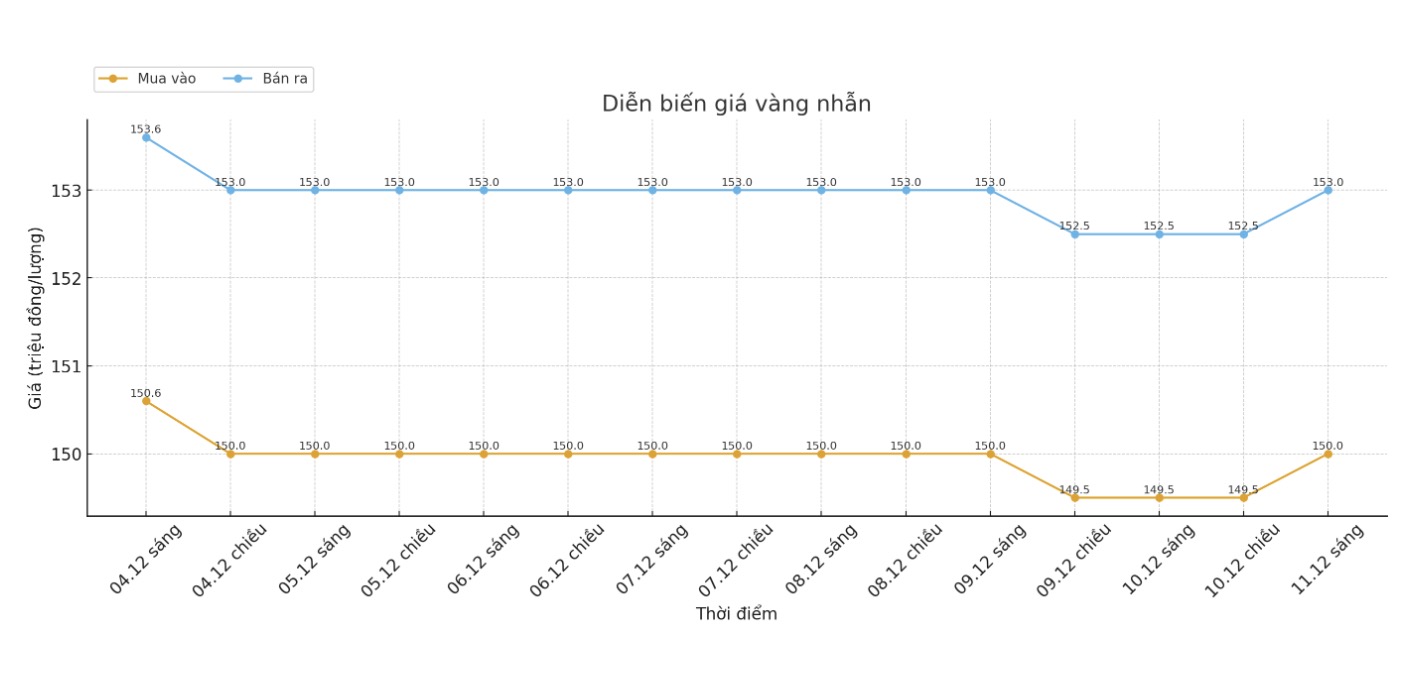

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 150-153 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 151.5-154.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150.2-153.2 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

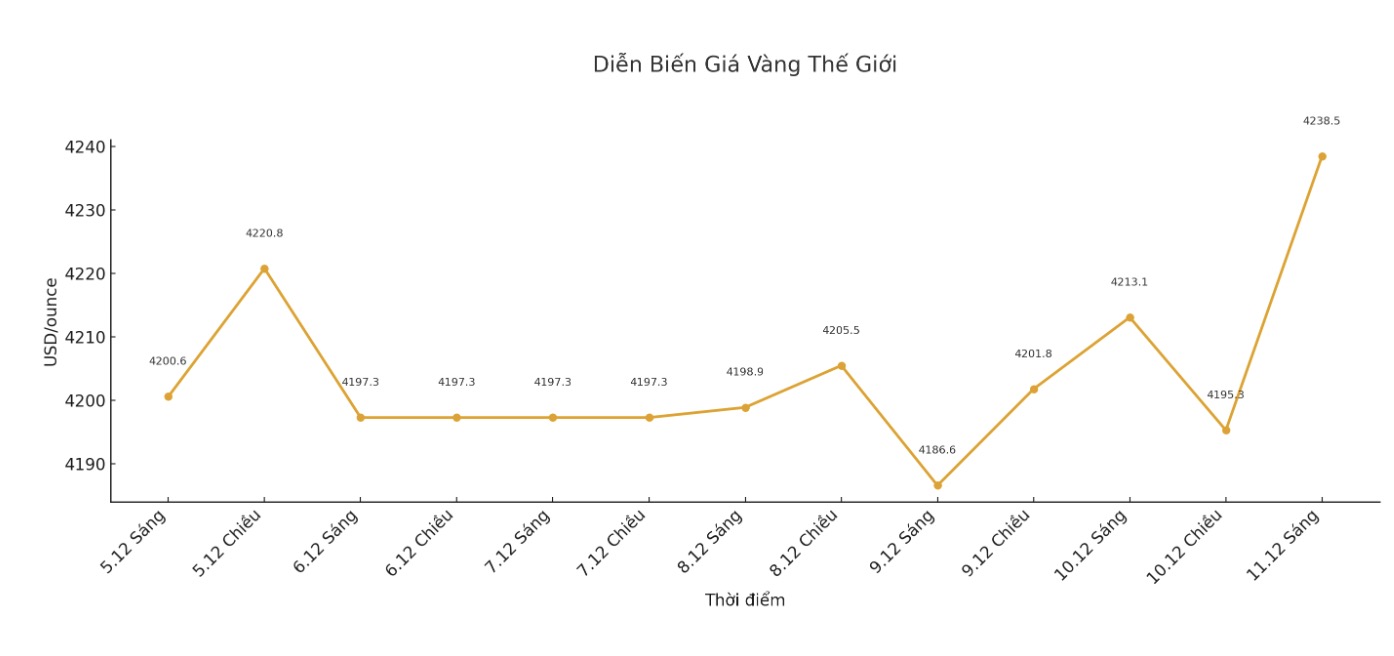

World gold price

At 9:00 a.m., the world gold price was listed around 4,238.5 USD/ounce, up 51.7 USD compared to a day ago.

Gold price forecast

Gold prices skyrocketed, right after the decision to cut interest rates was as expected by the Federal Reserve (Fed).

Although interest rate expectations have fluctuated strongly in the past month, the decision to cut 25 basis points - bringing the federal funds rate to a range of 3.50% to 3.75% is still in line with the latest forecast of the market.

The Fed did not give much directional signals in its post-meeting statement, with the content almost unchanged from the October meeting.

"The summary of existing indicators shows that economic activity continues to expand at a moderate pace. New jobs have fallen this year and the unemployment rate has risen slightly through September. Recent indicators also reflect this trend. Inflation has increased again since the beginning of the year and is still relatively high," the Fed said in its monetary policy announcement.

Naeem Aslam - Investment Director of Zaye Capital Markets, said that investors should be cautious about the risk of the market reacting excessively, because most of the Fed's prospects have been reflected in prices.

The market has a familiar short-term and cooling momentum after the Feds decision, but its important to remember that the 25 basis point cut was priced in advance, so dont expect the increase to last.

The real message is deep internal division and the possibility of a 78% chance of the Fed not taking action in January - the Fed has just broken the easing cycle strongly" - he said.

According to some economists, the most notable factor is not the interest rate cut but the division in the vote that showed no clear consensus.

Fed Governor Stephen Miran voted in favor of a 50 basis point cut, while Chicago Fed President Austan Goolsbee and Kansas City Chairman Jeffrey Schmid wanted to keep interest rates unchanged.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...