Foreign banks adjust unexpectedly

CIMB Bank Vietnam has just adjusted to increase the mobilization interest rate for short terms, applicable to both standard customers and priority customers. Notably, the 1 -month term increased by 0.6%/year, 2 -month term increased by 0.5%/year and 3 -month term increased by 0.2%/year.

After adjustment, the mobilization interest rate for standard customers respectively is: term 1 month 3.8%/year; 2 months 4%/year; 3 months 4.2%/year; 6 May 5%/year; 9 months 5.1%/year and 12 months 5.3%/year.

For priority customers, the bank applies the stairs interest rate policy at three levels: less than 10 billion, from 10 billion to less than 30 billion dong and from 30 billion or more. With terms from 6–12 months, the difference between deposits is 0.2%/year, and the terms of 1–3 months are applied and interest rates.

For deposits of less than 10 billion VND, the term of 1/4%/year term; 2 months 4.2%/year; 3 months 4.5%/year; 6 months 5.2%/year; 9 months 5.3%/year and 12 months 5.5%/year. The highest interest rate at CIMB is currently 5.9%/year, applicable to a 12 -month term with deposits of 30 billion or more.

For customers who send online savings via Zalo Pay platform, CIMB listed interest rate of 1 month 4.3%/year; 3 months 4.4%/year; 6 months 5.6%/year; 9 months 5.6%/year and 12 months 5.8%/year.

In contrast to the CIMB's interest rate hike, public Bank Vietnam - a bank with capital from Malaysia - has just announced the mobilized interest rate schedule in a slight decline. Accordingly, the term interest rate of 6–17 months decreased by 0.1%/year compared to before, while the remaining terms were kept the same.

The new interest rate of public Bank Vietnam for individual customers (Save Plus Package) is as follows: term 1–2 months 3.8%/year; 3–5 April/year; 6–8 May/year; 9–11 in 5.2%/year; 12–17 in 5.5%/year; 18 May 5.95%/year; 24–60 in 5.6%/year.

With basic savings packages, the listed interest rate is 0.2%/year lower than the Plus Savings package in terms of 6–60 months, while terms of less than 6 months retain the old level.

The highest special interest rate 7.5-9.65%

The highest interest rate is up to 7.5-9.65%, but to enjoy this interest rate, customers must meet the special conditions.

ABBank led the special interest rate, with 9.65%/year for new customers to open/recreate the savings deposits of VND 1,500 billion or more, 13 months term.

PVcombank also applies special interest 9%/year for term 12-13 months when depositing at the counter. Applicable conditions are customers who must maintain a minimum balance of VND 2,000 billion.

HDBank applies an interest rate of 8.1%/year for a 13-month term and 7.7%/year for a 12-month term, with the condition of maintaining a minimum balance of VND500 billion.

Vikki Bank applies the interest rate of 7.5%/year for term deposits of 13 months or more, with a minimum amount of VND 999 billion; Bac A Bank is listing the highest interest rate of 6% with a term of 18-36 months for deposits of over 1 billion; IVB applies 6.15% interest rates for 36 -month term, conditions applicable to deposits of VND 1,500 billion or more.

ACB applies an interest rate of 6%/year for 13 -month term at the end of the term when customers have a deposit balance of VND 200 billion or more.

At LPBank, with deposits of VND 300 billion or more, the mobilization interest rate applied to customers giving interest at the end of the period is 6.5%/year, the monthly interest rate is 6.3%/year and the earning interest is 6.07%/year.

Banks with interest rates exceeding 6%

Currently, the interest rate is over 6%/year being listed by some banks for long deposits but does not require a minimum deposit amount.

Cake by VPBank applies 6%/year interest rate for 12-18 months and 6.3%/year for terms 24-36 months; Vikki Bank applies 6% interest rate for 24 -month term; VietABank applies 6% interest rates for terms of 18 and 24 months, 6.1% for 36 -month term; HDBank applies 6% interest rate for 18 -month term; GPBank applies the interest rate of 6.05%/year for 12-month term, 6.15%/year for terms of 13-36 months.

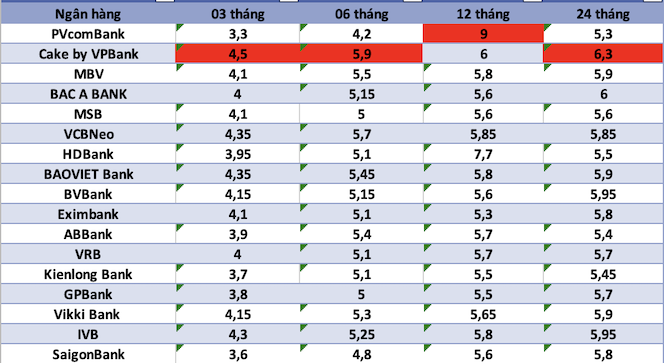

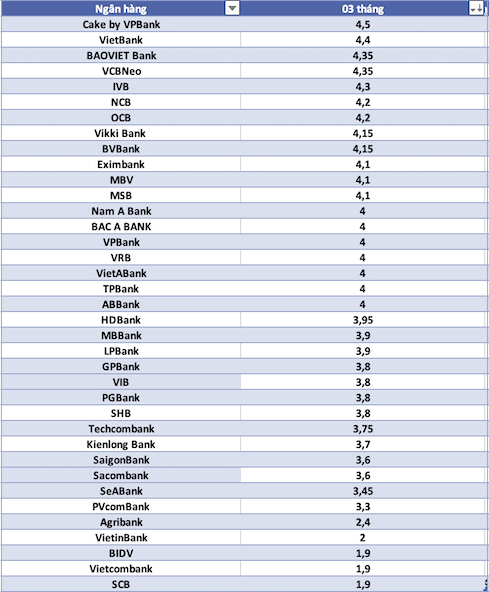

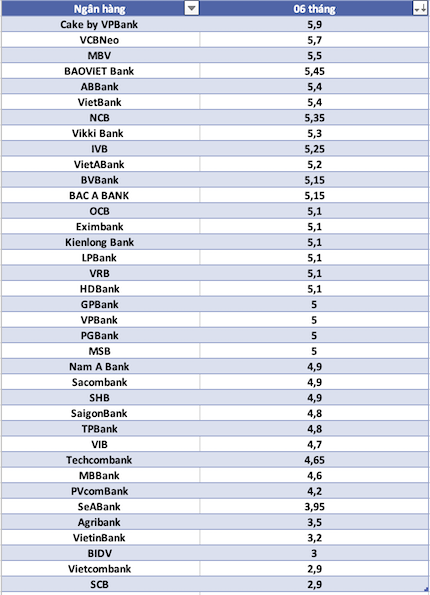

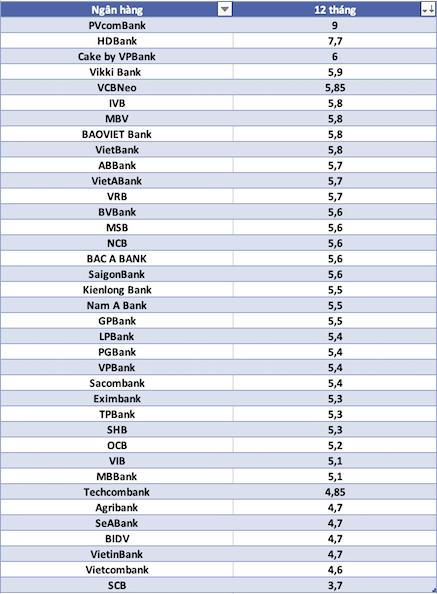

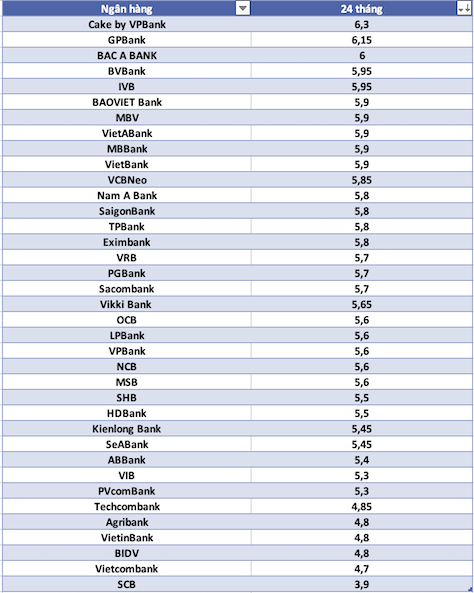

Statistics of banks with the highest savings deposit interest rates today:

Compare the highest bank interest rate in the 3 -month term

Savings deposit interest rate at 6 -month term banks

Want to save for 12 months, which bank interest rate is the highest?

Latest update of Agribank bank interest, Sacombank interest rate, SCB interest rate, Vietcombank interest rate ... The highest term of 24 months.

Information about interest rates is for reference only and may change in each period. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to articles about interest rates here.