More banks have interest rates exceeding 6%

GPBank's interest rates have been adjusted to increase by 0.2% per year for all deposit terms. After the adjustment, the 1-month term increased to 3.4% per year; the 2-month term increased to 3.9% per year; the 3-4-5-month term increased to 3.92% - 3.94% - 3.95% per year, respectively; the 6-month term increased to 5.25% per year; the 7-month term 5.35% per year; the 8-month term increased to 5.5% per year; the 9-month term is 5.6% per year; the 12-month term interest rate is 5.95% per year; the terms from 13-36 months are listed at 6.05% per year.

LPBank also adjusted the interest rate for deposits with terms from 12 to 60 months up by 0.1% per year. After the adjustment, the online interest rate for 12 to 16 month terms at LPBank is 5.6% per year; for 18 to 60 month terms, it is 5.8% per year.

Thus, since the beginning of November, 8 banks have increased their deposit interest rates, including: Agribank, ABBank, Techcombank, MBBank, VIB, VietBank, VietABank and IVB. Meanwhile, the market has not recorded any banks reducing interest rates this month.

Thus, since the beginning of November, 11 banks have increased their deposit interest rates, including: Agribank, ABBank, Techcombank, MBBank, VIB, VietBank, VietABank, IVB, Nam A Bank, GPBank and LPBank. Of which, Agribank has increased interest rates twice since the beginning of the month.

Meanwhile, the market has not recorded any bank reducing interest rates this month.

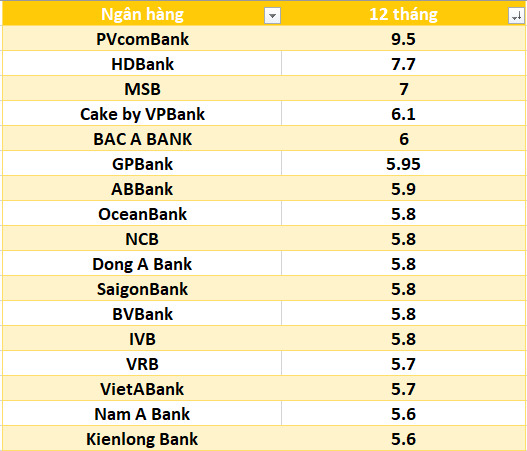

Special interest rate highest 7-9.5%

Many banks list interest rates at high levels, up to 7-9.5%. However, to receive this interest rate, special conditions must be met.

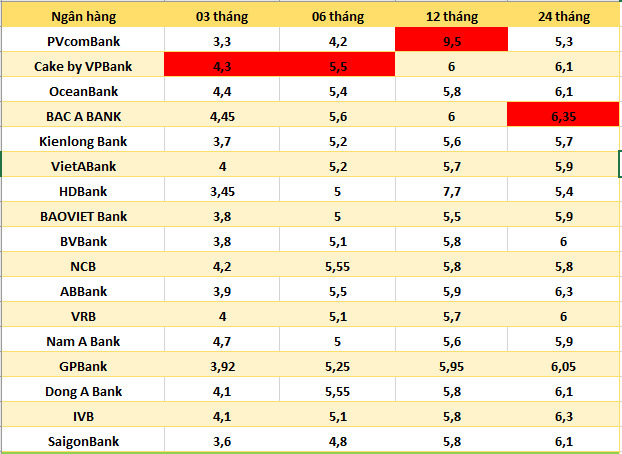

PVcomBank is currently leading in special interest rates when customers deposit money at the counter, with 9.5% for a term of 12-13 months. However, the condition to receive this interest rate is that customers must have a minimum deposit balance of VND 2,000 billion.

Next is HDBank with a particularly high interest rate, up to 8.1%/year for a 13-month term and 7.7% for a 12-month term, with a minimum balance of VND500 billion. This bank also applies a 6% interest rate for an 18-month term.

MSB applies interest rates for deposits at the counter up to 8%/year for a 13-month term and 7% for a 12-month term. The applicable conditions are that the savings book is newly opened or the savings book is opened from January 1, 2018, automatically renewed with a term of 12 months, 13 months and the deposit amount is from 500 billion VND.

Dong A Bank has a deposit interest rate of 13 months or more, with the final interest rate applied to deposits of 200 billion VND or more at 7.5%/year. This bank also applies an interest rate of 6.1% for a 24-month term.

Bac A Bank applies an interest rate of 6.35% for a 24-month term, applicable to deposits over 1 billion VND. In addition, an interest rate of over 6%/year is also being listed by some banks for long-term deposits but without a minimum deposit requirement.

Currently, Cake by VPBank applies an interest rate of 6.1% for a 12-month term; OceanBank applies an interest rate of 6.1% for a 24-month term; ABBank applies an interest rate of 6.3% for a 24-month term; IVB applies an interest rate of 6.3%/year for a term of 24 months or more and 6.1%/year for a term of 18 months; GPBank applies an interest rate of 6.05% for terms from 13-36 months.

BVBank and Cake by VPBank also apply 6% interest rate for 24-month and 12-month terms; VRB and Dong A Bank apply 6% interest rate for 24-month terms; VietABank applies 6% interest rate for 36-month terms; SaigonBank applies 6% interest rate for 13, 18 and 24-month terms, 6.1% for 36-month terms.

Statistics of banks with the highest savings interest rates today:

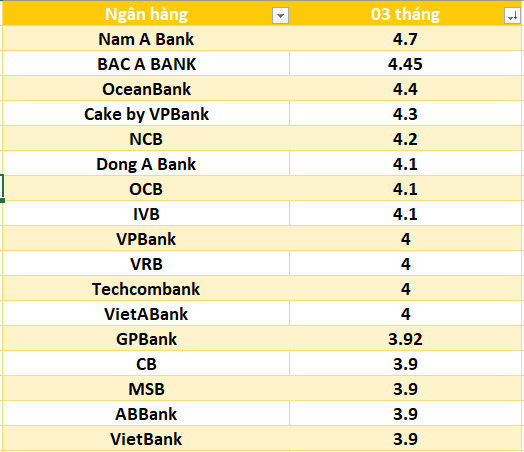

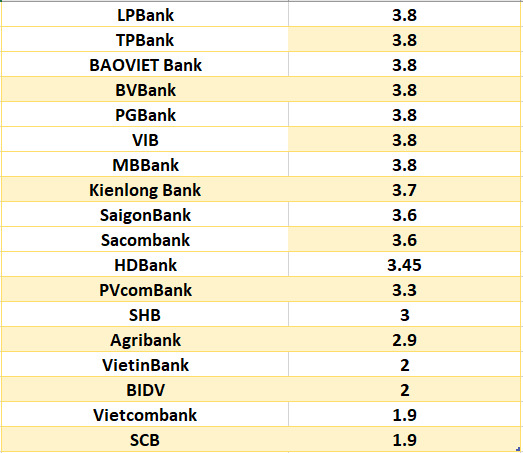

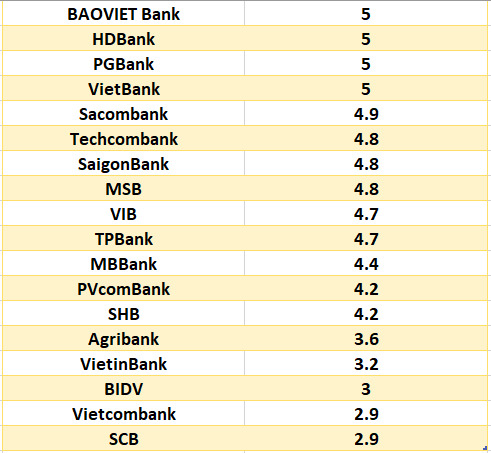

Compare highest bank interest rates for 3-month term

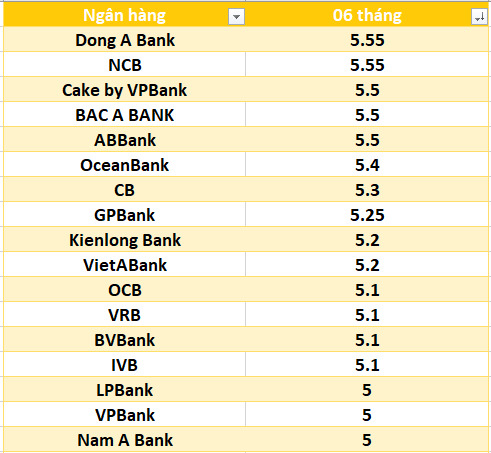

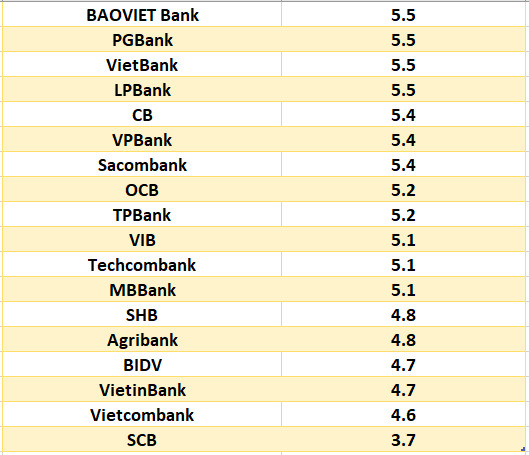

Interest rates on 6-month savings deposits at banks

Want to save for 12 months, which bank has the highest interest rate?

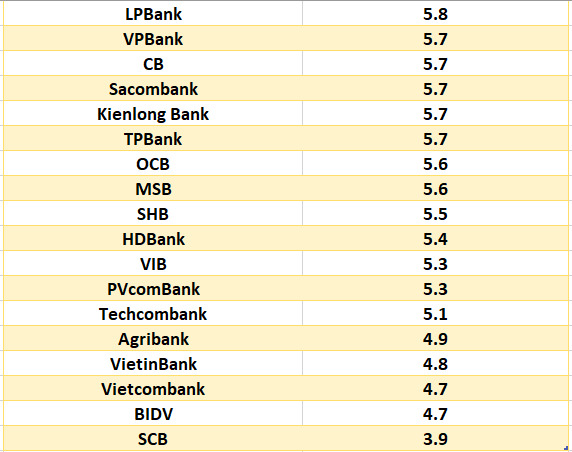

Latest update of Agribank interest rates, Sacombank interest rates, SCB interest rates, Vietcombank interest rates... highest for 24-month term.

Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more articles about interest rates HERE.