Controlling credit growth for potentially risky sectors

The State Bank of Vietnam has just issued a notice stating that credit growth in 2026 for the entire system is expected to be about 15%, with adjustments to increase and decrease in accordance with developments and actual situations, ensuring inflation control, macroeconomic stability; and at the same time supporting economic growth and the safety of the system of credit institutions.

This agency also requests credit institutions to strictly control credit growth rates for potentially risky sectors, real estate sectors, direct capital flows into production and business, priority sectors and growth drivers of the economy, while ensuring the stability of monetary market liquidity and the safety of operations of the credit institution system.

Real estate is not a priority area for loans

Specifically for the real estate sector, assessing the picture in 2025, Dr. Can Van Luc - Chief Economist of BIDV said that the biggest positive point of the market is the clear recovery of the construction and real estate sectors. Citing data from the Statistics Office, he said that the construction sector in 2025 increased by 9.62%, higher than the national average GDP growth rate (8.02%). The real estate business sector increased by 4.63%, the highest level in the last 6 years, contributing about 3.5% of GDP.

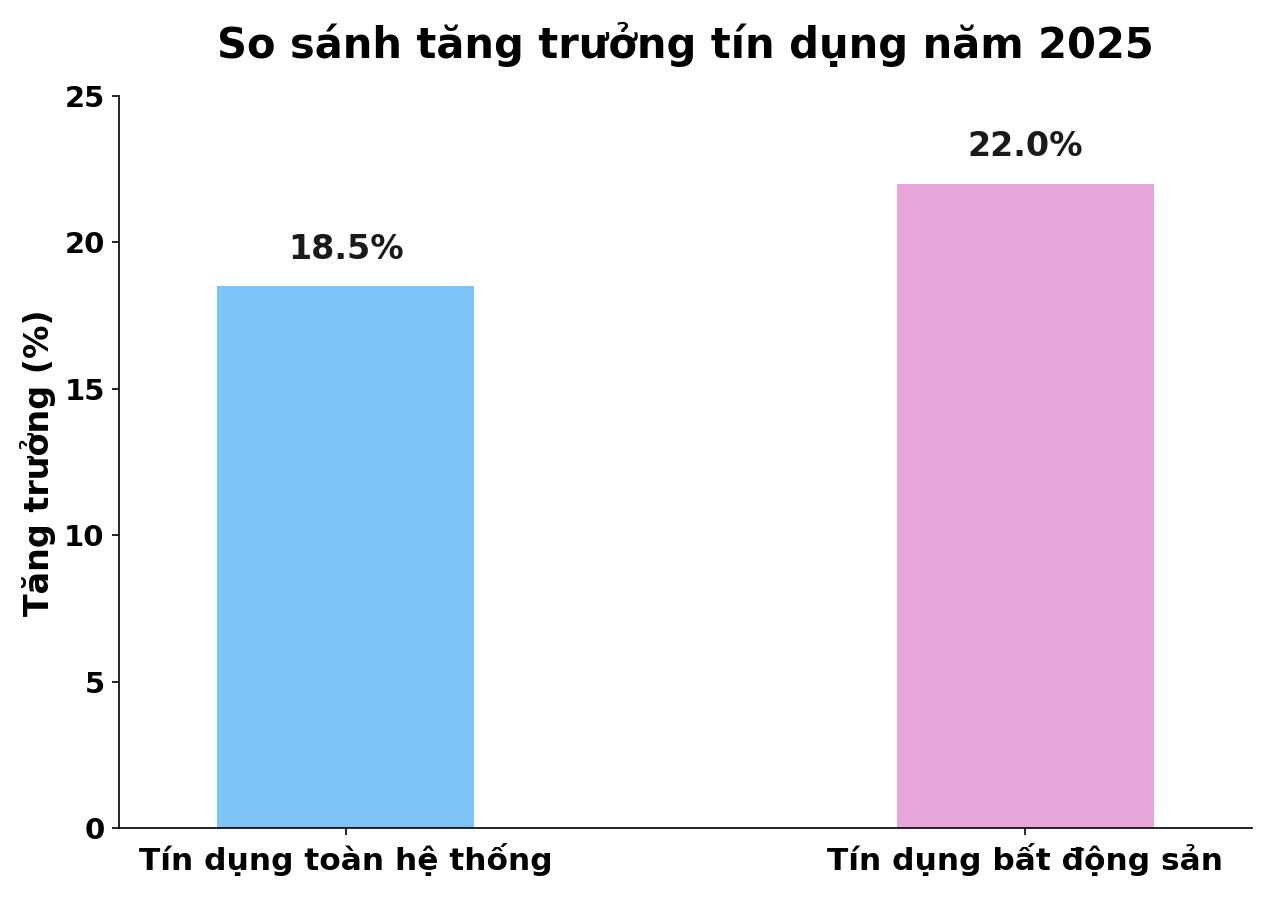

2025 recorded about 2,700 newly established real estate businesses, an increase of 27% compared to the previous year. Regarding capital flows, real estate credit is estimated to increase by about 22%, higher than the average credit growth rate of the entire banking system (18.5%). In which, real estate investment and business loans increased by about 24%, while loans for buying and repairing houses increased by 14%-15%.

While credit increased sharply, capital mobilization of the banking system only increased by about 14.5%, forcing banks to adjust to increase interest rates both input and output, thereby forming a new interest rate level in the market.

According to Dr. Can Van Luc, real estate is not a priority area for borrowing capital in the banking system, except for social housing and industrial parks. Therefore, the real estate market must accept a higher level of loan interest rates.

New challenges for real estate businesses

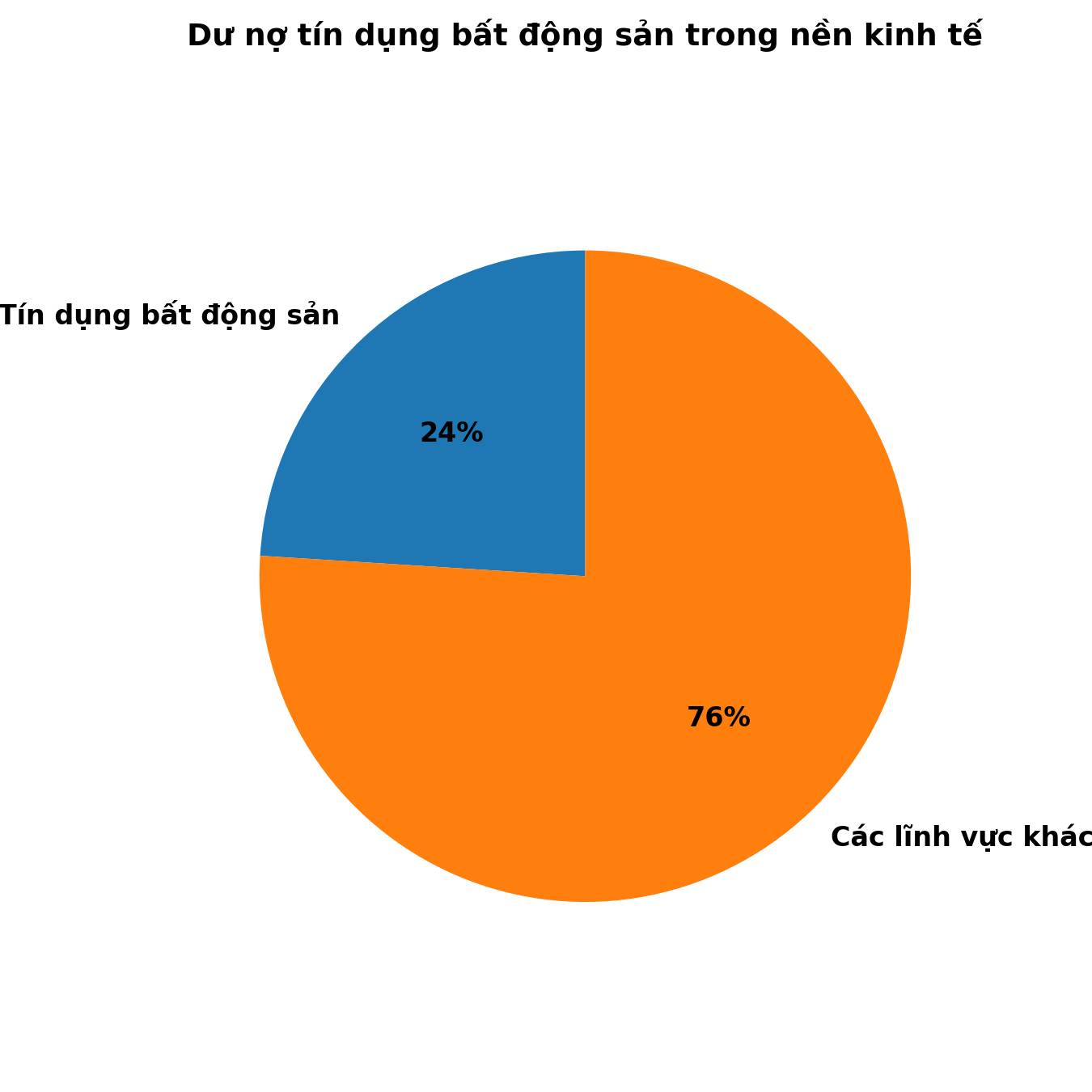

Currently, real estate credit balance accounts for about 24% of the total outstanding debt of the entire economy, a relatively high level, in which real estate business investment loans are increasing faster than general credit.

In that context, Dr. Can Van Luc made important recommendations for real estate businesses. First of all, businesses need to improve forecasting and risk management capabilities, especially interest rate and cash flow risks. Lack of flexible financial scenarios will make businesses easily fall into a passive position when capital costs increase.

Second, it is necessary to end the mindset of spreading investment. According to him, many businesses simultaneously implement dozens of projects, largely dependent on loans and bonds. When the market is favorable, this model can hide risks, but when financial conditions tighten, the risk of liquidity breakdown will be revealed very quickly. Businesses need to focus resources on projects with clear legal status, good consumption capacity and suitable to market needs.

Third, product restructuring is a mandatory requirement. Dr. Can Van Luc believes that the market is surplusing high-end supply but seriously lacking mid-range housing and social housing. Shifting to segments serving real needs not only helps businesses improve liquidity but also makes it easier to access credit support policies from the State.

Increased interest rates will reduce real estate investment activities

Regarding the impact of the general interest rate on the real estate market, Mr. Nguyen Van Dinh - Chairman of the Vietnam Association of Realtors (VARS) shared that in 2025, speculation and investment activities are stronger than real housing needs, partly due to "cheap" cash flow.

The Government's direction mentioned the requirement to study market regulatory measures, including tax and credit tools. According to Mr. Dinh, these tools need to be applied but must have a roadmap, clearly defining each group of subjects, avoiding assimilation with real housing needs, because the main goal is to combat speculation and reduce investment activities that are detrimental to the market.

Regarding credit policy, in the past time, the banking system has made great efforts to support the economy and the real estate market to recover.

However, when the market begins to show signs of "not being standard", even there is a situation of taking advantage of cheap cash flow to promote investment, the Government's request to adjust and banks to adjust interest rates is inevitable, because banks themselves must also ensure their business operations and interests.

According to Mr. Dinh, when interest rates increase, it will certainly affect the real estate market in some aspects, especially reducing investment activities. However, according to Mr. Dinh, any monetary, credit or other policies must be adjusted appropriately when signs of adversity for the market appear.