According to the latest report of MB Securities Company (MBS), the banking industry is forecast to continue its positive growth momentum in the third quarter of 2024. In terms of business results, banks' net profits are expected to grow by 16.5% over the same period.

In addition to some banks that are forecast to have high profit growth, MBS's list also points out some credit institutions that are likely to have lower than industry average profit growth or negative growth. Although information on the banks' Q3/2024 business results is still quite preliminary, the initial figures have revealed a picture of clearly differentiated profits in the first 9 months of the year.

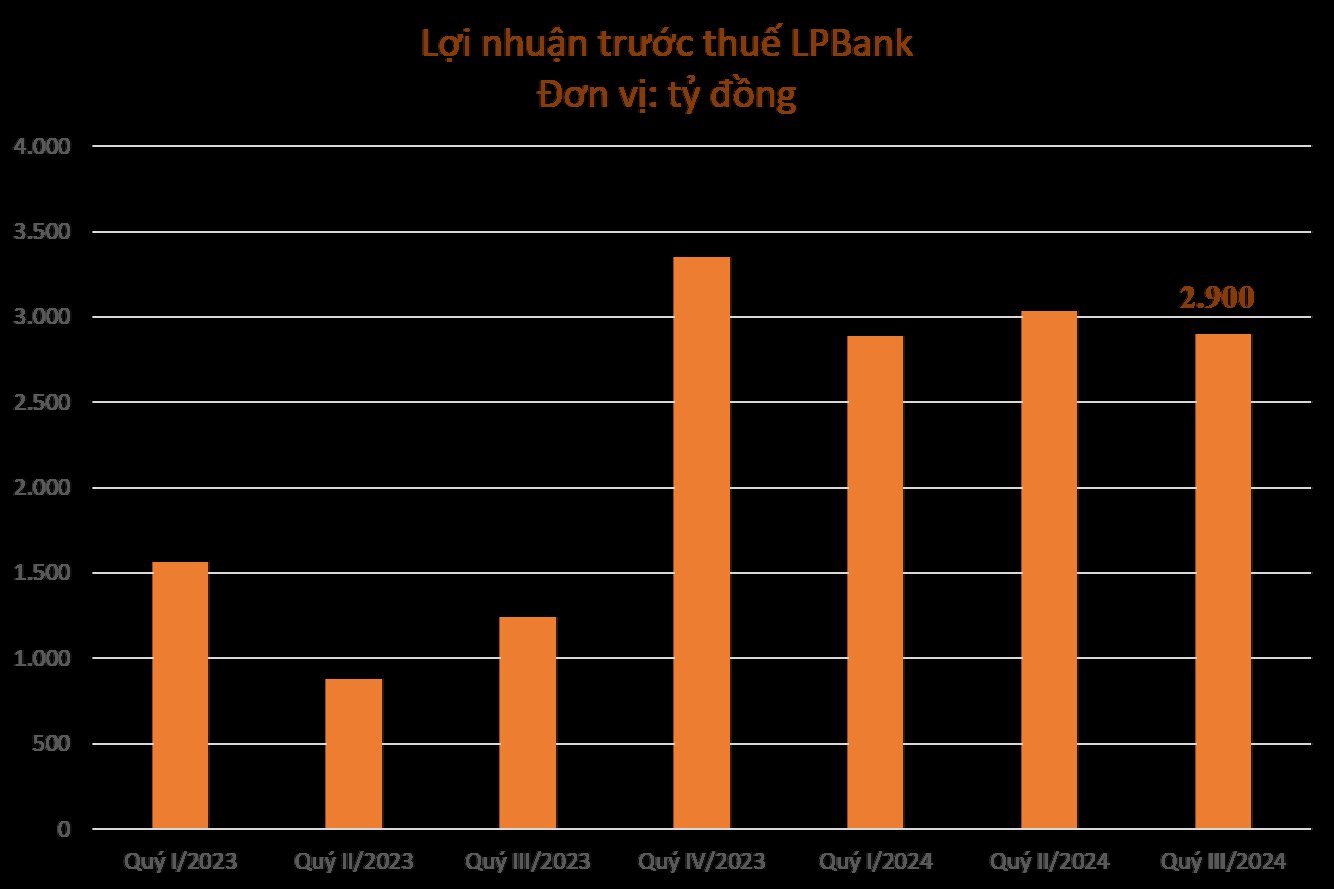

Contributing to the positive business results in the third quarter picture is Loc Phat Vietnam Bank (LPBank, stock code LPB). Accordingly, this Bank has just announced its third quarter business results with pre-tax profit reaching VND 2,900 billion, accumulated pre-tax profit for 9 months reaching VND 8,818 billion, up 139% over the same period.

With the profit target set for 2024, by the end of 9 months, LPBank has completed 84% of the pre-tax profit plan for the whole year, this is also the highest 9-month profit ever of the Bank.

Profit after tax in the third quarter and accumulated profit for the first 9 months reached VND 2,331 billion and VND 7,051 billion, respectively, both more than doubled compared to the same period in 2023.

Notably, the bank's net revenue from service activities in the third quarter increased 5 times compared to the same period, reaching 1,016 billion VND. In the first 9 months, service revenue activities brought LPBank 2,701 billion VND, 3 times higher than the same period in 2024.

LPBank representative said that the profit in the third quarter and the accumulated profit in the first 9 months of 2024 increased strongly compared to the same period, supported by: Boosting credit growth right from the first months of the year;

Good cost control with CIR (operating costs/total net income) ratio at 29%, down 7.7% compared to the end of last year and down 16.4% compared to the same period in 2023;

Efforts to diversify revenue sources, promote cross-selling of products and services such as foreign exchange trading services, remittances, import-export, money transfer... with the proportion of revenue from non-credit sources compared to total income increasing significantly from 13.98% to 23.64%.

By the end of the third quarter of this year, LPBank had maintained a capital adequacy ratio (CAR) exceeding 13%, continuing to affirm its position in the group of banks with high CAR ratios compared to the general market level. This achievement not only demonstrates outstanding risk management capacity but also contributes significantly to ensuring safety and maintaining sustainable stability for the Bank's operations.

It can be seen that, despite many difficulties, the first 9 months of the year have opened up many growth opportunities for banks. Banks with vision, effective business strategies, specific steps in each development stage, abundant capital and the ability to seize good opportunities like LPBank have brought about many impressive results.