In order to improve quality and open up the ability to attract large-scale, stable and long-term international investment capital flows for the Vietnamese stock market, on July 30, Lao Dong Newspaper in coordination with the Ministry of Finance organized a workshop on "Upgrading the stock market, expanding capital mobilization channels for the economy".

Lao Dong Newspaper respectfully introduces to readers the paper: "Brightening the market, a sustainable operating platform of the stock market" of the Ho Chi Minh City Stock Exchange - HOSE.

On July 28, 2000, Ho Chi Minh City Stock Exchange - the predecessor of the Ho Chi Minh City Stock Exchange (HOSE) officially opened its first trading session, marking the birth of the Vietnamese stock market. Over the past 25 years, HOSE has matured along with the increasingly strong transformations of the Vietnamese stock market and constantly created valuable foundations, bringing sustainable confidence to the securities industry in particular and the Vietnamese economy in general.

From the first trading session with 2 listed enterprises and 4 securities companies, the capitalization reached only 0.28% of GDP, then by the end of June 2025: the market had over 1,600 listed and registered enterprises; the capitalization of the stock and bond market reached nearly 100% of GDP; the average liquidity of the stock market in the first 6 months of 2025 reached over VND 21,000 billion/session; 82 securities companies and 43 fund management companies; and over 10 million securities investment accounts... The Vietnamese stock market is one of the vibrant markets, with the leading capitalization and liquidity in the ASEAN region.

On the built foundation, the stock market is facing an urgent need to change in quality, in which the goal of upgrading the stock market from a frontier market to an emerging market is the goal to strive to achieve in the stock market development strategy to 2030. That determination has been concretized by a series of systematic actions, including completing the development of legal documents in the securities sector, upgrading infrastructure and increasing the quality of goods supply, in order to be transparent and standardize operations for the stock market to develop sustainably, attracting long-term investment capital.

Developing legal documents in the securities sector

Law amending and supplementing the Securities Law dated November 29, 2024. This is an important reform aimed at improving transparency and efficiency of operations on the stock market.

In addition, Circular 68/2024/TT-BTC clearly stipulates the roadmap for digital transformation in English for listed organizations and public companies, which has helped reduce the risk of information asymmetry between domestic and foreign investors, all investors have access to complete, timely and accurate information, thereby increasing the attractiveness of Vietnam's stock market.

The Ministry of Finance has submitted to the Government a draft amendment to Decree 155, and management agencies are also urgently amending Decrees and Circulars guiding the Decree, in which integrating the IPO and listing process is an important amendment, helping to shorten procedures, speed up the listing process, and put securities into trading after the enterprise successfully IPO.

Technology infrastructure

From May 5, 2025, the KRX trading system invested by HOSE has officially been put into operation, opening up new opportunities for the stock market. This is a unified, consistent, and consolidated platform for SGDCKs and Securities Depository and Clearing Corporation. The system is expected to standardize and modernize market operations, including standardizing trading processes, being ready for many new types of products and services in the future, improving market monitoring capabilities, helping to early warn of unusual transactions, ensuring transparency and safety on the stock market.

The implementation of IT application and technical solutions to improve the quality of IT for LLCs is also implemented synchronously: 100% of LLCs on HoSE have implemented IT via the ECM system, no need to send unusual IT card to the Department; technology solutions to connect and exchange data between the State Securities Commission and the Department are deployed from the beginning of 2024, to unify a reporting unit and IT card for listed organizations. This contributes to reducing administrative procedures, saving compliance costs and improving market efficiency.

Quality of goods listed on HOSE

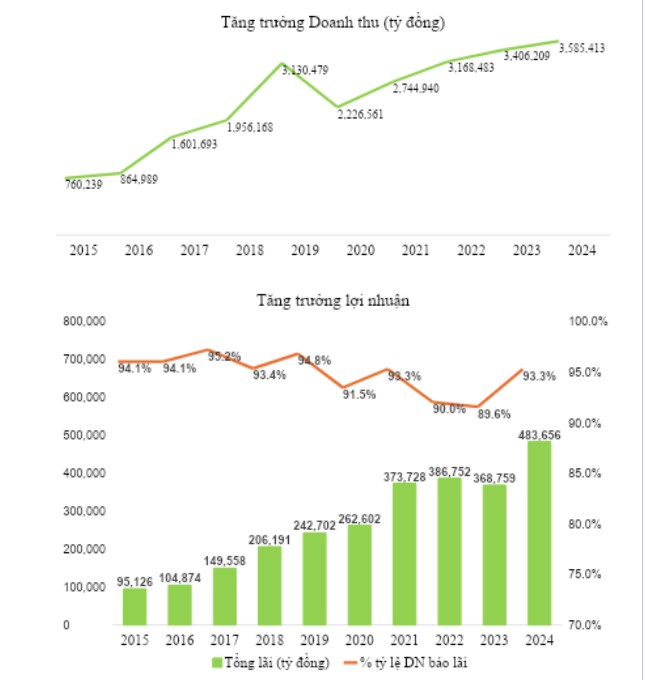

On the 25-year development journey, HOSE creates a foundation for listed companies to develop remarkably in both scale and quality, maintaining sustainable growth momentum. Data for the period 2015-2024 shows that the revenue and profit of listed enterprises tend to improve significantly over time. The rate of interest-reporting enterprises remains stable, reflecting the efficiency of capital use after listing as well as positive changes in governance and development strategy.

Becoming a listed company not only opens up growth opportunities, but also comes with stricter requirements for transparency and governance. From information disclosure, internal management to shareholder responsibility, businesses are forced to comprehensively upgrade to meet increasingly high monitoring standards from management agencies. As a frontline in supervision, HOSE continuously improves the mechanism in a proactive, transparent and consistent manner. Violations in information disclosure were handled seriously and at the right time, contributing to improving market discipline. In the past 10 years, the number of enterprises violating information disclosure has decreased by nearly 80%; from 2022 to present, 13 enterprises have had their listings canceled due to serious violations of information technology, a figure that shows that the compliance level is being significantly improved, contributing to improving the quality of listed goods.

Many large-scaleNY enterprises also proactively widely disclose information that is not subject to disclosure, such as: Monthly business results, cooperation contracts, mergers and acquisitions (M&A)..., and expand to non-financial information related to corporate risk management for the environment, society and governance (ESG). Commitments and efforts of enterprises are recognized in most aspects of governance: providing documents and information related to the Annual General Meeting of Shareholders to ensure rights and fair treatment of shareholders; CBTT on ownership ratio, shareholder structure, information on ownership and independence of Board members, specializing the supervision activities of the Board of Directors through increasing the rate of enterprises forming specialized committees (Auditing Committees, Human Resources/Pages Committees, ESG Committees...)...

In addition, the application of practices stated in PTBV Reporting standards such as GRI, TCFD, ISSB... has made certain progress, creating fair opportunities for information access for all shareholders and potential investors. Data from the results of VNSI's 2025 periodic assessment shows that more than 65/100 VNS100 employees proactively respond to information on ESG implementation at enterprises. This is the highest figure since the index was launched in 2017.

Issues that need improvement:

In addition to the positive side, DNNY's information transparency also has some limitations and challenges:

The fear of transparent information and services still exists in some financial institutions, especially small enterprises, where public information is formal, incomplete, and sometimes inaccurate;

Practices in corporate governance such as the Company Governance Principles Code (CG Code) issued by the State Securities Commission and IFC, although issued since 2019, many small and medium-sized enterprises have not considered good QTCT as a competitive advantage of enterprises, and have not yet formed a management system according to standards and principles;

Data standardization, especially in ESG Information and Communications, is still inconsistent and comparable, not in line with the international standard framework;

Solutions

To promote transparency and standardize operations on the stock market, creating a solid foundation for the goal of market upgrading, HoSE and management agencies will resolutely implement the following solutions:

As a frontline supervisor, HoSE strengthens inspection and supervision of the performance of DNNY's obligations, detects and promptly reports to the State Securities Commission for handling violations according to its authority, for acts such as delay in payment and clearing, incorrect and incomplete payment and clearing; DNNY violates regulations on Company Governance (failure to comply with operations, structure of the Board of Directors/Controlling Committee/Auditing Committee; report on related party transactions, manager's remuneration; procedures for boarding meetings...). Violations are not only subject to administrative sanctions, but the public disclosure of administrative procedures also affects the image and reputation of the enterprise, and the issuance of decisions by investors on the stock exchange.

Increasing the supply of quality goods to the market: with the push of Resolution 68 on private economic development, the market expects to have more congruent enterprises in the future with a healthy financial foundation, transparent governance and real growth potential to increase attraction for long-term investors.

Diversifying the index to create a foundation for the development of derivatives, green and sustainable investment tools in the market.

Support DNNY to prepare resources to convert from VAS to international financial management standards (IFRS) in accordance with the Ministry of Finance's roadmap to make the financial situation transparent according to international standards.

Strengthen training for Investors and market members: Training programs, legal seminars and thematic consultations are organized regularly to support businesses in understanding regulations and flexibly handling real-life situations. HOSE also encourages businesses to increase investor relations (IR) activities, improving connectivity with the investment public. In particular, raising investors' awareness of stock investment funds, one of the fundamental solutions towards sustainable market development.