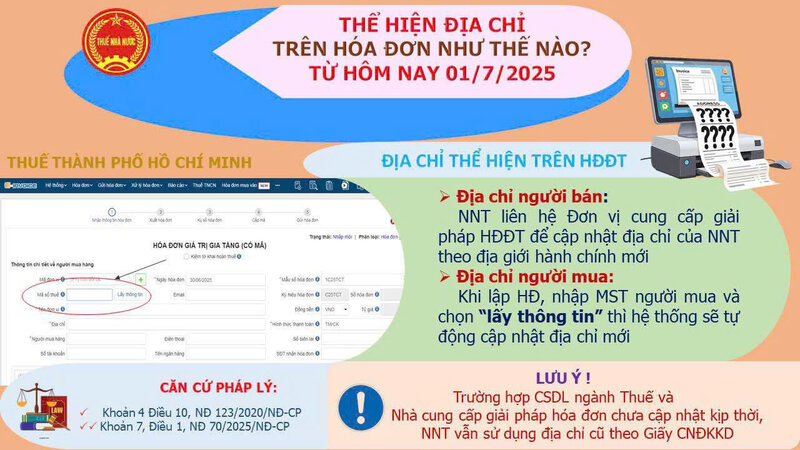

From July 1, 2025, the address on the electronic invoice will be updated according to the new administrative boundaries. According to the instructions of the Ho Chi Minh City Tax Department, taxpayers need to pay attention to some changes in displaying addresses on invoices to ensure compliance with current regulations.

The seller's address will be updated by the electronic invoice solution provider based on the taxpayer's registration information. Therefore, businesses need to proactively contact software providers to adjust addresses according to the new administrative boundaries announced by the authorities.

For the buyer's address, when making the invoice, the seller enters the buyer's tax code and selects the function " get information". The system will automatically update new addresses from the Tax sector database.

In case the database is not updated in time, or the software is not updated in time, the business can still use the old address according to the valid Business Registration Certificate.

The adjustment of the address on the invoice is implemented according to the provisions of Clause 4, Article 10 of Decree 123/2020/ND-CP and Clause 7, Article 1 of Decree 70/2025/ND-CP.

The tax authority recommends that business organizations and individuals proactively review tax registration information, coordinate with electronic invoice software providers to fully update, and avoid errors when issuing invoices from July 1, 2025.