1. Implement biometric authentication

According to Decision No. 2345/QD-NHNN dated December 18, 2023, from July 1, 2024, customers are required to authenticate with biometrics when making certain online transactions, such as money transfers worth VND 10 million or more or total transaction value in a day of over VND 20 million.

Banks are "sprinting" to authenticate biometrics before the deadline of January 1, 2025. Many banks and e-wallets have actively supported users to authenticate biometrics on multiple channels, including integrating electronic authentication services via the VNeID application, to ensure smooth and safe transactions.

Implementation results:

As of December 2024, approximately 38 million customers have successfully registered their biometric information.

After more than 3 months of implementation, the number of fraud cases decreased by 50% and the number of accounts receiving fraudulent money decreased by over 70% compared to the average of the first 7 months of 2024.

2. Credit growth management results

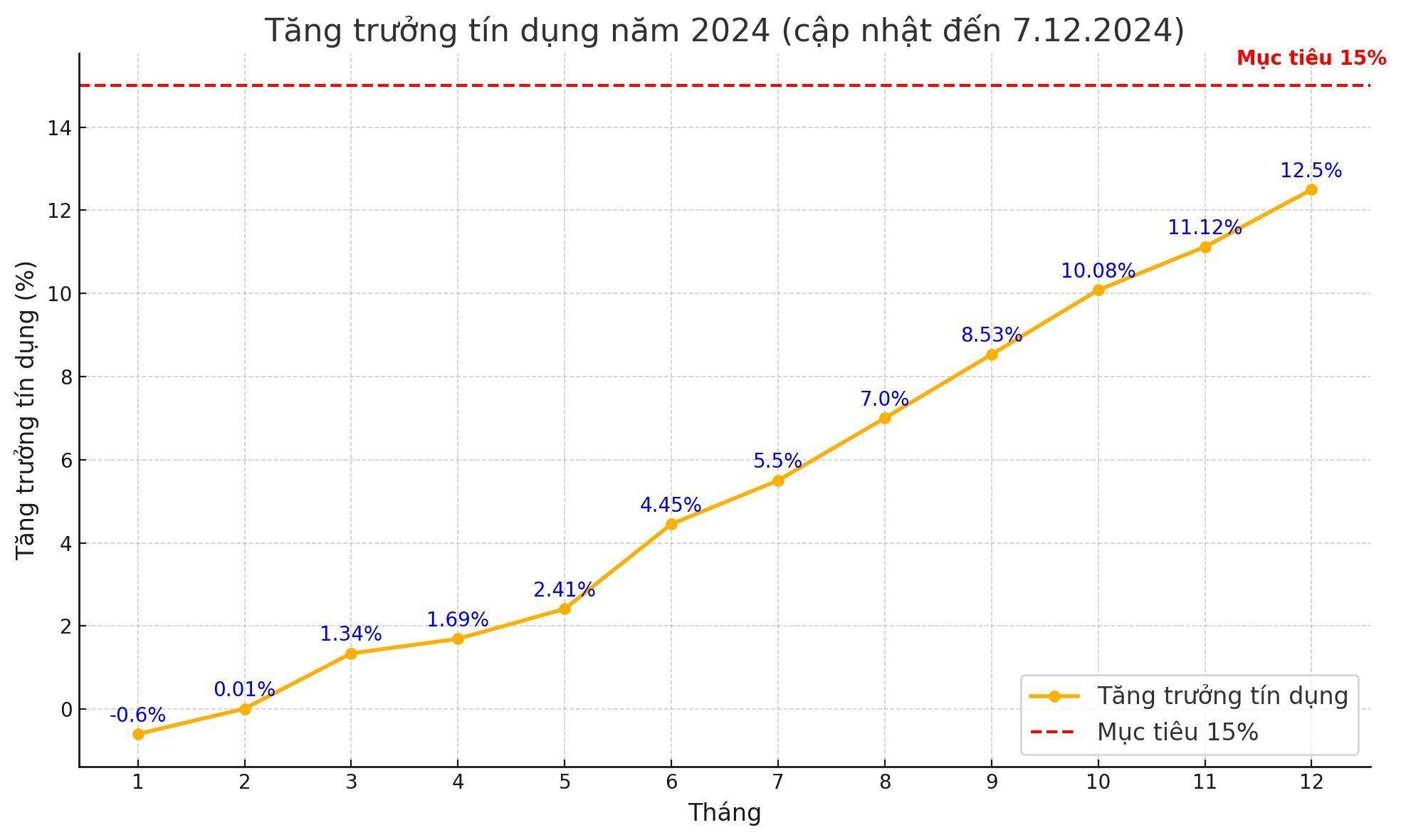

In 2024, the State Bank of Vietnam (SBV) targets credit growth of about 15% to support economic growth and control inflation.

Although in the first quarter of the year, credit growth in the first quarter of 2024 reached 0.98% compared to the end of 2023. However, as of December 7, 2024, credit growth reached 12.5%, higher than the same period in 2023 (9%), showing acceleration in the last months of the year.

Achieving the credit growth target of 15% in 2024 is considered a highlight, contributing significantly to supporting economic growth and controlling inflation.

3. Exchange rate stability

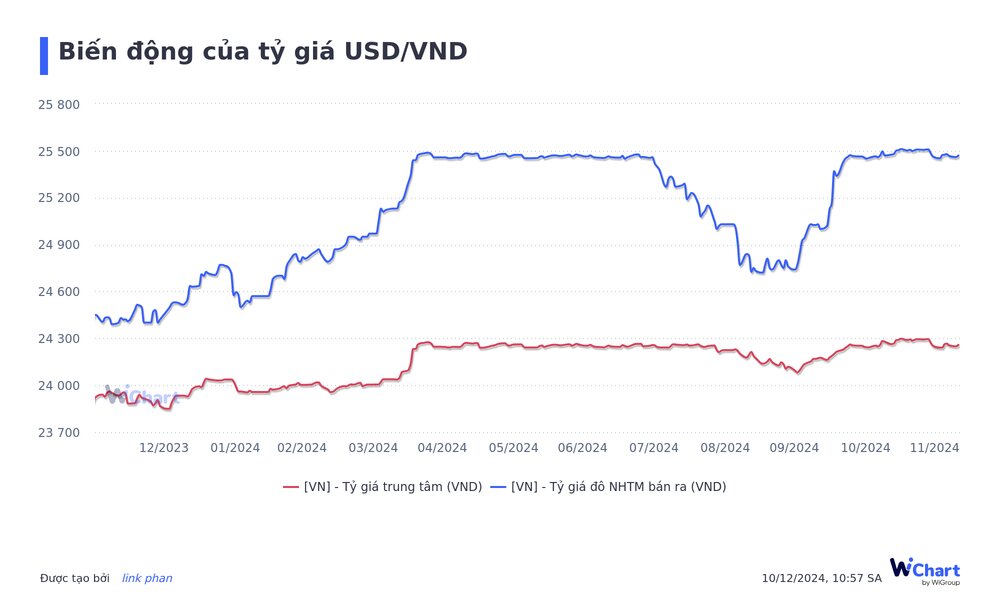

In 2024, the State Bank of Vietnam implemented a proactive and flexible exchange rate management policy to stabilize the foreign exchange market and support the economy.

The State Bank has flexibly managed exchange rates in accordance with domestic and foreign market developments, contributing to macroeconomic stability.

The central exchange rate of Vietnamese Dong to US Dollar announced by the State Bank of Vietnam on December 10, 2024 is 24,258 VND/USD, showing stability throughout the year.

The foreign exchange market operates stably, liquidity is guaranteed, contributing positively to controlling inflation and supporting economic growth.

The above results show that the SBV has flexibly and effectively managed exchange rates in 2024, contributing significantly to stabilizing the macro economy and supporting the development of the Vietnamese economy.

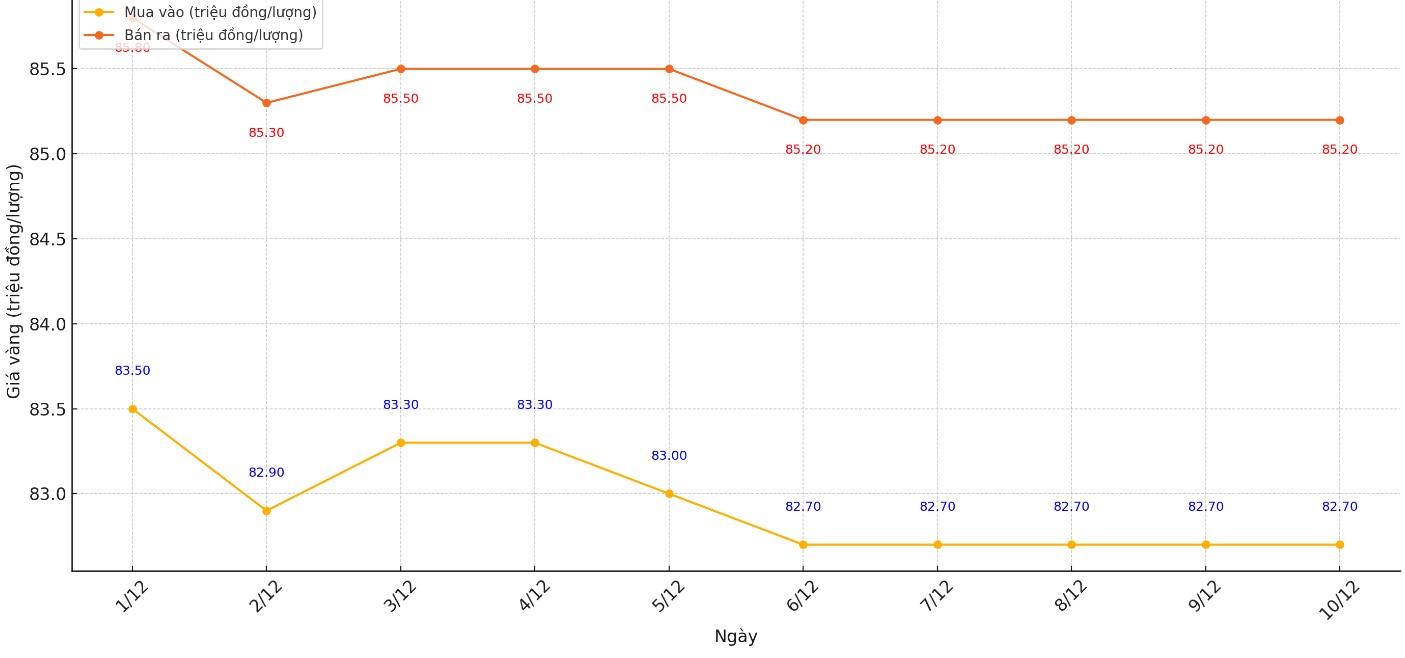

4. Stabilize the gold market, narrow the gap between domestic and international gold prices

Gold bar auction returns after 11 years: In 2024, the State Bank of Vietnam returned to organizing gold bar auctions in April 2024, after nearly 11 years of suspending this activity.

Accordingly, the State Bank of Vietnam organized a total of 9 SJC gold bar auctions, supplying more than 48,000 taels of gold to the market. However, on May 27, 2024, the State Bank of Vietnam announced the suspension of gold bar auctions.

Although the State Bank of Vietnam has increased the supply of gold through auctions to reduce the price gap between domestic and international gold, the results have not been as expected. State Bank Governor Nguyen Thi Hong said: "After nine auctions, the gold price gap has not decreased as expected."

Also this year, the SBV organized direct gold sales through commercial banks: From June 3, 2024, the SBV began selling gold directly to four state-owned commercial banks including Vietcombank, BIDV, Agribank and VietinBank and SJC Gold and Gemstone Company. These units then sold gold directly to people, aiming to narrow the gap between domestic and world gold prices.

Before implementing direct gold sales, the difference between domestic and international gold prices was up to 15-18 million VND/tael. After implementing this measure, the difference has decreased to 3-4 million VND/tael, contributing to stabilizing the domestic gold market.

5. The case of "Credit card debt of 8.5 million VND became 8.8 billion VND" at Vietnam Export Import Commercial Joint Stock Bank (Eximbank)

In March 2024, an Eximbank customer was notified that his credit card debt had increased from VND8.5 million (in 2013) to more than VND8.8 billion after nearly 11 years. The incident caused a stir in public opinion and raised many questions about the bank's method of calculating interest rates and managing credit card debt.

The State Bank of Vietnam requires Eximbank to review, evaluate and adjust policies, regulations and procedures related to interest calculation, fees and credit card management to ensure the legitimate rights of customers and comply with legal regulations.

At the same time, the State Bank of Vietnam directed credit institutions nationwide to review similar cases, especially credit card accounts that have not generated any transactions for a long time, to promptly work with customers, ensure the legitimate rights of all parties and avoid similar incidents.

6. The case related to Saigon Commercial Joint Stock Bank (SCB)

The SCB case involving Ms. Truong My Lan, Chairwoman of Van Thinh Phat Group, is one of the most serious financial and banking cases in 2024. Ms. Lan is accused of creating 1,284 fake loan applications, appropriating more than VND 368,000 billion from SCB during the period 2012-2022.

On April 11, 2024, she was sentenced to death for embezzlement of property along with other charges of credit violations and bribery. The death sentence was upheld at the appeal hearing on December 3, 2024. The case has shocked public opinion and the banking system.

On SCB's side, from the beginning of 2023 to November 2024, SCB has terminated the operations of more than 100 transaction offices nationwide, including 27 transaction offices in Ho Chi Minh City, 5 in Hanoi and other provinces and cities such as Nghe An, Hai Phong, Dong Nai, Da Nang, Gia Lai, Long An, Binh Dinh.

The State Bank of Vietnam is studying the proposal of some investors to participate in restructuring SCB, in order to urgently submit to the Government a plan to restructure this bank according to regulations.

7. Mandatory transfer of "zero-dong" banks

In 2024, the State Bank of Vietnam (SBV) will conduct the mandatory transfer of two "zero-dong" banks to restructure the banking system and ensure financial safety:

Vietnam Construction Bank (CBBank) was transferred to Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank).

Ocean Bank was transferred to Military Commercial Joint Stock Bank (MB).

The transfer process is carried out in accordance with the law and policies of the Party and State, ensuring the rights of depositors before, during and after the transfer.

8. A series of banks adjusted to increase capital

2024 will witness a strong capital increase trend of major banks. Techcombank doubled its capital to VND70,450 billion, BIDV plans to issue private shares, Vietcombank received an additional VND20,695 billion from the Government, and Agribank had its capital increased by the State Bank to VND51,639 billion.

These moves not only help banks meet international capital adequacy standards but also improve their ability to support the economy and prepare for increasingly fierce competition in the industry.