Which bank is leading?

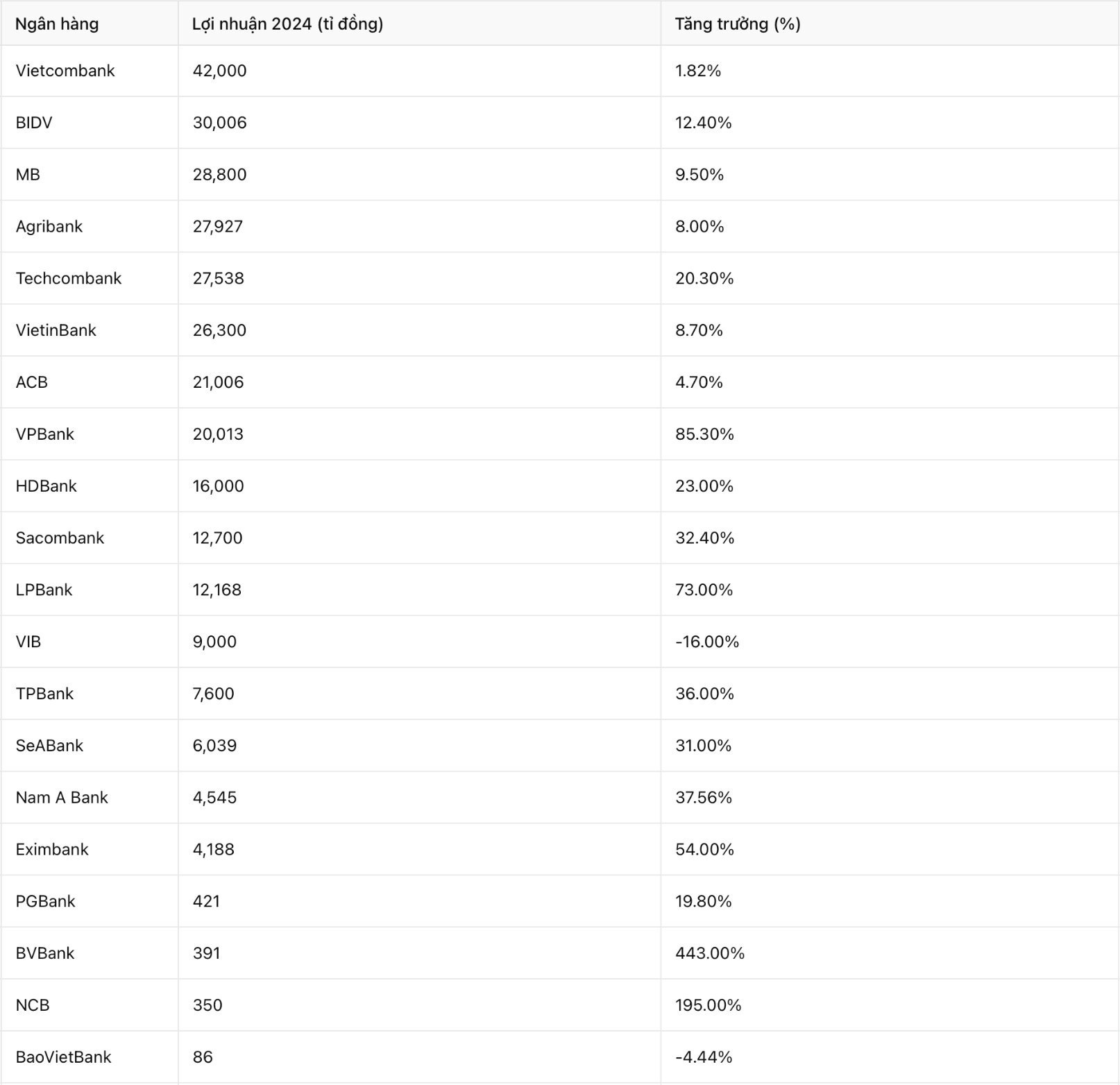

According to a survey by Lao Dong Newspaper of 20 banks announcing their business results for the whole year of 2024, 8 banks recorded profits exceeding 10,000 billion VND, with big names such as Vietcombank, BIDV, Agribank, Techcombank, MB and LPBank.

In the Big 4 banking group, Vietcombank continued to affirm its leading position with an estimated individual profit of more than VND42,000 billion, up 1.82%. BIDV ranked second with pre-tax profit of more than VND30,000 billion, up 12.4%. Agribank maintained its performance with a profit of VND27,927 billion, up 8% over the previous year.

According to the announcement, credit growth is one of the reasons helping the Big 4 group to have good profit growth by the end of 2024.

In 2024, Vietcombank tightly controlled costs and had the lowest bad debt ratio in the industry (0.97%), with a bad debt coverage ratio of 223%. In addition, credit growth reached 13.7%, total assets exceeded 2 million billion VND (+12.9%).

At BIDV, credit growth increased by 15.3% to over VND2,000 billion, with a strategy to boost lending to businesses. Capital mobilization reached VND2,140 billion (+13.1%), helping to maintain the bad debt ratio at 1.3%.

Agribank focuses on agricultural and rural credit, outstanding credit increased by more than VND 170,000 billion (+11%), while total assets increased by VND 200,000 billion (+10%).

Vietinbank has increased credit balance (+16.88%), combined with good control of operating costs and maintaining a bad debt ratio below 1%.

Private banks make strong breakthroughs

Private banks recorded outstanding results such as Techcombank with a profit of VND27,538 billion, up 20.3%, thanks to increased net interest income (+28%) and effective cost control. CASA ratio reached 39%, the highest in the industry.

MB recorded consolidated profit of VND28,800 billion, up 9.5%, with credit growth of 25%, the highest in the industry.

LPBank entered the "10,000 billion VND Club" for the first time with a profit of 12,168 billion VND, up 73%.

Sacombank achieved pre-tax profit of VND12,700 billion, up 32.4%, exceeding the plan assigned by the General Meeting of Shareholders.

Small banks also make their mark

Smaller banks also posted impressive results:

BVBank achieved pre-tax profit of VND 391 billion, 5.4 times higher than in 2023 (equivalent to growth of 443%)

NCB is also a bank with high profit growth, up 195%, reaching 350 billion VND.

Eximbank and Nam A Bank recorded profits of VND4,188 billion and VND4,545 billion, up 54% and 37.56% respectively.

SeABank and TPBank reached VND6,039 billion and VND7,600 billion respectively, up 31% and 36%.

Only two banks reported lower profits in 2023, namely VIB and BaoViet Bank.

Despite positive business results, the banking industry still faces many challenges. Analysts from securities companies said that compliance with Basel III regulations and the requirement to increase equity capital are putting great pressure on banks. In addition, competition in capital mobilization and credit risk control are also concerns.

However, with the strategy of promoting digital transformation and expanding credit activities, large banks are expected to continue to maintain their leading position. 2025 is expected to be a year of fiercer competition, as small banks strive to rise up, while the "big guys" focus on consolidating their position in the market.