Maintaining economic stability, effectively handling unprecedented challenges

The 1st Congress of the State Bank of Vietnam Party Committee, term 2025 - 2030, will take place on August 13-14, 2025.

Looking back at the 2020-2025 term, in the context of the COVID-19 pandemic, geopolitical conflicts, climate change and many global fluctuations, the banking sector has steadfastly achieved the goal of stabilizing the macro economy, controlling inflation, supporting economic recovery and growth.

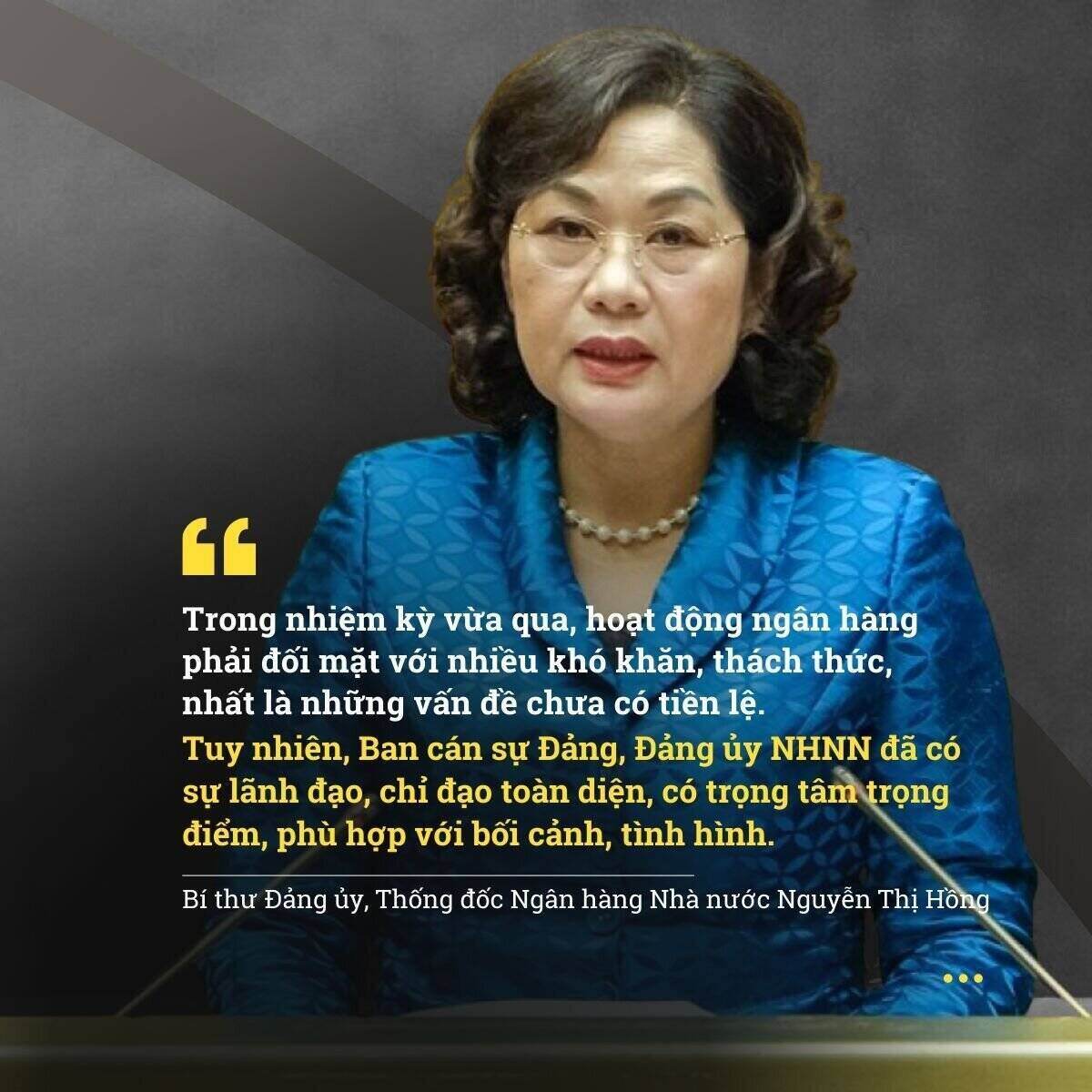

Governor of the State Bank of Vietnam Nguyen Thi Hong emphasized: "During the past term, banking activities have faced many difficulties and challenges, especially unprecedented issues. However, the Party Committee and the State Bank's Party Committee have had comprehensive leadership and direction, with a focus on key points, suitable to the context and situation".

Accordingly, in the past term, the SBV has completed 5/5 assigned projects, issued and submitted to issue 208 legal documents, including three important laws: Law on Prevention and Control of Money Laundering (2022), Law on TCTDs (2024) and Law on amending and supplementing a number of articles of the Law on TCTDs (2025). This is an important legal foundation to improve the effectiveness of monetary policy management, ensure the safety of the credit institution system, promote digital transformation and protect national monetary security.

In addition, monetary policy is managed proactively and flexibly, synchronously, harmoniously, closely coordinated with fiscal policy and other macro policies, contributing to supporting the promotion of economic growth associated with controlling inflation and stabilizing the macro economy.

Accordingly, closely following market developments, the SBV has synchronously operated solutions to maintain stability and reduce interest rates; directed credit institutions to apply reasonable lending interest rates to share difficulties with customers. At one point, the SBV boldly decided to lower interest rates, reversing the trend of increasing interest rates in most countries in the world. These are important, strategic decisions, demonstrating courage, political determination, daring to think, daring to do, daring to take responsibility. Thereby, contributing to promoting production and business, economic development.

At the same time, foreign exchange rates and markets are stable and smooth, and legal foreign currency demand is fully met. In particular, in the post-COVID-19 period, the international market has become complicated, global inflationary pressures have increased, the USD has increased sharply, and there is great devaluation pressure on currencies of emerging countries, but the VND is still one of the currencies with the least devaluation compared to countries in the region and the world. Foreign exchange reserves increase.

Credit growth management is also constantly being innovated. From 2024, the SBV will assign all credit growth targets for the whole year to credit institutions and actively implement a limited roadmap, moving towards eliminating the management of assigning targets to each credit institution. Credit growth is managed in an expanded direction associated with improving quality, prioritizing capital for production and business, key and feasible areas of growth drivers for projects, works, and policy credit programs; strictly controlling areas with potential risks.

The strong and flexible decisions of the SBV have maintained stability in the currency market. In particular, the efforts in modernizing and enhancing transparency within the framework of monetary and exchange rate management of the SBV have been highly appreciated by the US Treasury Department for removing Vietnam from the list of countries that manipulate currency.

At the same time, inspection work is focused on; inspection is focused and key, in line with existing resources; promote thematic inspections, aiming to effectively focus inspection resources on subjects and areas with high potential risks, prone to negativity, corruption and violations.

Supervision work continues to achieve many positive results; the operation of credit institutions is closely monitored, on that basis, potential risks have been identified, assessed and timely warning and correction documents have been issued...

The tasks and solutions stated in the Project on restructuring the system of credit institutions associated with bad debt handling in the period of 2021 - 2025 (Project 689) are also being vigorously implemented according to the direction of competent authorities. The work of preventing and combating corruption and negativity has also been implemented synchronously and drastically, "no forbidden areas", "no exceptions" associated with the successful implementation of the political tasks of the banking sector.

The Governor said that the SBV Party Committee "determined to lead and direct the handling of outstanding issues such as the official transfer of compulsory purchase banks; when mass withdrawals occur, threatening the safety of the system, maintaining the safety of the system and stabilizing the economy".

In particular, the banking industry is always a pioneer, taking the lead in implementing digital transformation, recognized by the Party and the State and highly appreciated by international financial and monetary organizations; the diversity of the banking digital ecosystem has brought many attractive utilities to users. Cashless payment activities have achieved impressive results. Many basic operations have been fully digitized. Many credit institutions achieve over 95% of transactions on digital channels. To date, more than 87% of Vietnamese adults have bank accounts.

Regarding the organization and personnel work, identifying this as the key to the key, the resource, and the main pillar that decides successfully. In the recent term, the SBV Party Committee has carried out key tasks: perfecting, standardizing, and synchronizing the system of regulations, rules, and personnel work processes and implementing the results of the revolution in perfecting the organizational structure of the apparatus, associated with streamlining the staff as a foundation; Absolutely complying with the regulations on controlling power in personnel work associated with tightening discipline and order in the entire industry as a top priority; building a culture of innovation, creativity, improving the ability to adapt, adapt quickly, be ready to overcome difficulties, overcome and overcome all unprecedented challenges as a breakthrough.

The SBV Party Committee has also implemented a revolution of streamlining the organizational apparatus with a spirit of urgency, determination, and efficiency with the highest political determination. The State Bank of Vietnam is one of the first ministries and branches to complete the reorganization project, ensuring smooth, continuous, safe, efficient operation, no interruption, no congestion, no impact on credit institutions, people and businesses.

Administrative reform work has also achieved many outstanding results. From 2021 to present, the SBV has always been in the group of leading ministries and branches in the Administrative Reform Index (Par Index).

Determined to innovate leadership methods, towards three strategic breakthroughs

Entering the 2025-2030 term, the international context continues to fluctuate unpredictably, the trend of digital transformation, green transformation, and sustainable development requires improving forecasting capacity, proactively responding, not being subjective to inflation, maintaining macroeconomic stability, the currency - foreign exchange market and system safety.

The industry will improve legal institutions on currency, credit and banking activities; thoroughly handle weak credit institutions; promote green credit; improve credit quality, limit bad debts; develop electronic payments and connect national credit data.

The Governor emphasized: "The leadership and direction methods of the Executive Committee and the Standing Committee of the SBV Party Committee must constantly innovate, be flexible, and adapt quickly to successfully implement targets and tasks, contributing to the realization of major decisions of the Party and the State".

Three strategic breakthroughs for the new term include:

Synchronously perfecting legal institutions on currency, credit and banking activities.

Promote science, technology, innovation, and apply technology to green credit.

Build a streamlined and elite cadre team to meet the requirements of the new era.

With the spirit of "Innovation - Creativity - Discipline - Democracy - Flexible - Efficiency", the banking industry is determined to join the country in a period of prosperous and sustainable development.