In the context of the roadmap to eliminate contract tax and switch to declaring based on actual revenue from 2026, many small-scale, low-income businesses expressed concern: "If they are not subject to tax, why can they still be fined?".

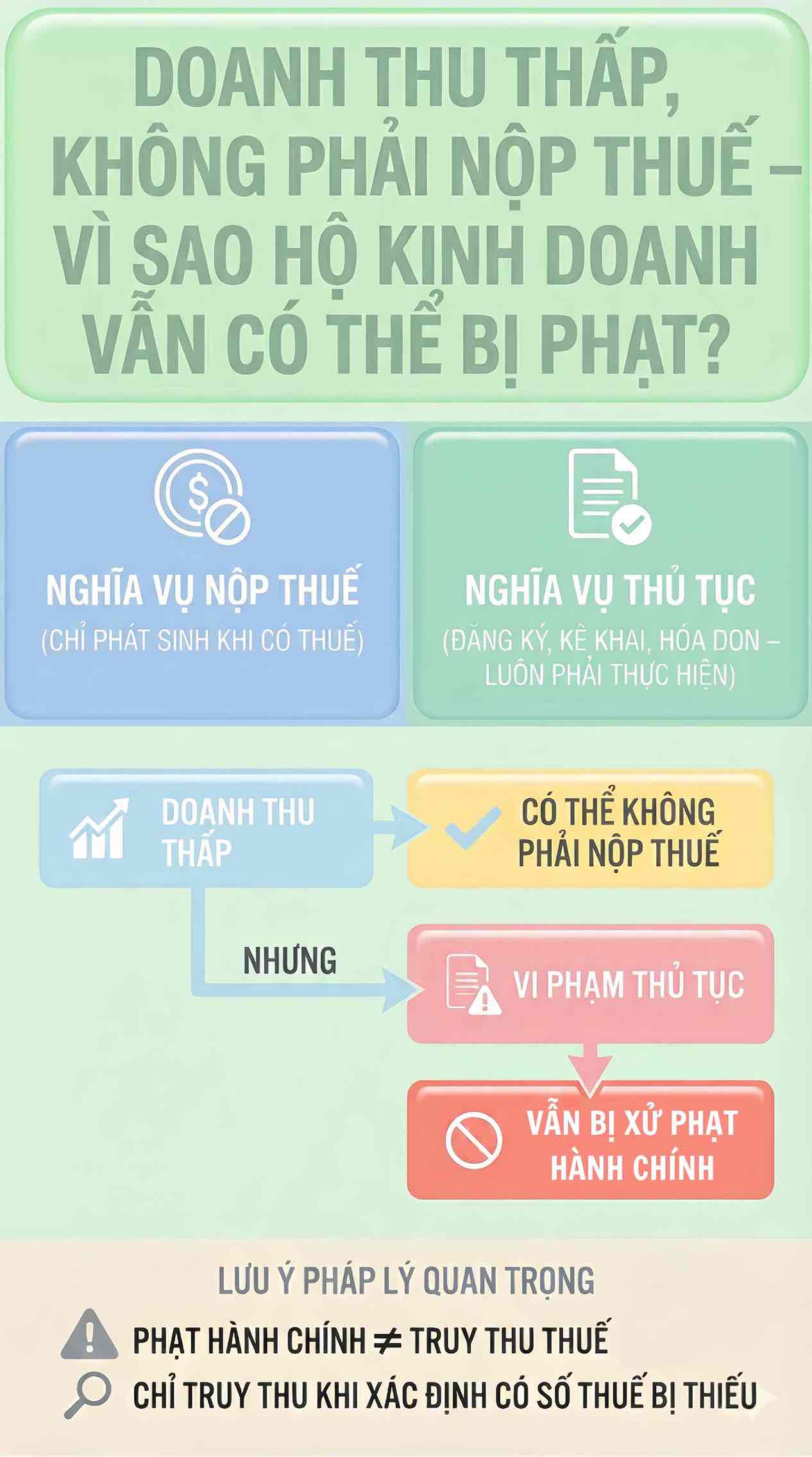

In fact, current tax laws clearly separate tax payment obligations and obligations to comply with management procedures, but the confusion between these two obligations is causing many businesses to misunderstand the nature of sanctions.

The basis for the penalty is not based on the tax amount

Regarding administrative sanctions, Decree 125/2020/ND-CP clearly stipulates: Violations of tax procedures are punished according to the violation, regardless of whether or not the tax is incurred. Accordingly, business households can still be fined if they fall into cases such as:

- Not registering for tax according to regulations;

- Failure to submit tax declaration or late payment;

- Not making invoices when selling goods or providing services;

- Not providing or providing incomplete information as required by the tax authority.

These acts are determined to be administrative violations in the tax sector, regardless of low revenue or no tax payment obligations.

Understand correctly to avoid risks when eliminating contract tax

When the contract tax mechanism is gradually replaced by declaration according to actual revenue, the procedural obligations of business households will be clearer and more regular. Although the fine remains unchanged, the possibility of detecting violations will be higher due to management based on electronic invoices and comparison data.

In reality, most of the cases currently punished do not stem from tax evasion, but due to failure to fully comply with procedures. Understanding legal regulations correctly and proactively performing declaration, registration and invoice obligations is considered an important solution for business households to limit risks when entering the new tax management stage from 2026.

Note:

Business households need to clearly distinguish:

No tax must be paid as if there are no procedural obligations.

Violating tax procedures can still be subject to administrative sanctions, even if there is no obligation to pay taxes.

Only collect taxes when the tax authority determines that there are missing taxes.

Fully complying with procedures is not only to avoid being fined, but also a basic basis for protecting business households when checking and comparing data later.