Circular No. 48/2024 issued by the State Bank is a Circular regulating the application of deposit interest rates (savings interest rates) in Vietnamese Dong of organizations and individuals at credit institutions and foreign bank branches.

To ensure consistency in legal basis during implementation, the State Bank of Vietnam issued decisions regulating deposit interest rates, in which the legal basis for issuance was revised and deposit interest rates remained unchanged, including Decision No. 2411.

Accordingly, the maximum interest rate applied to demand deposits and deposits with terms of less than 1 month is 0.5%/year;

The maximum interest rate applied to deposits with terms from 1 month to less than 6 months is 4.75%/year, while the maximum interest rate for deposits in Vietnamese Dong at people's credit funds and microfinance institutions is 5.25%/year.

Interest rates on deposits with terms of 6 months or more are determined by credit institutions and foreign bank branches based on market supply and demand of capital.

This Decision takes effect from November 20, 2024.

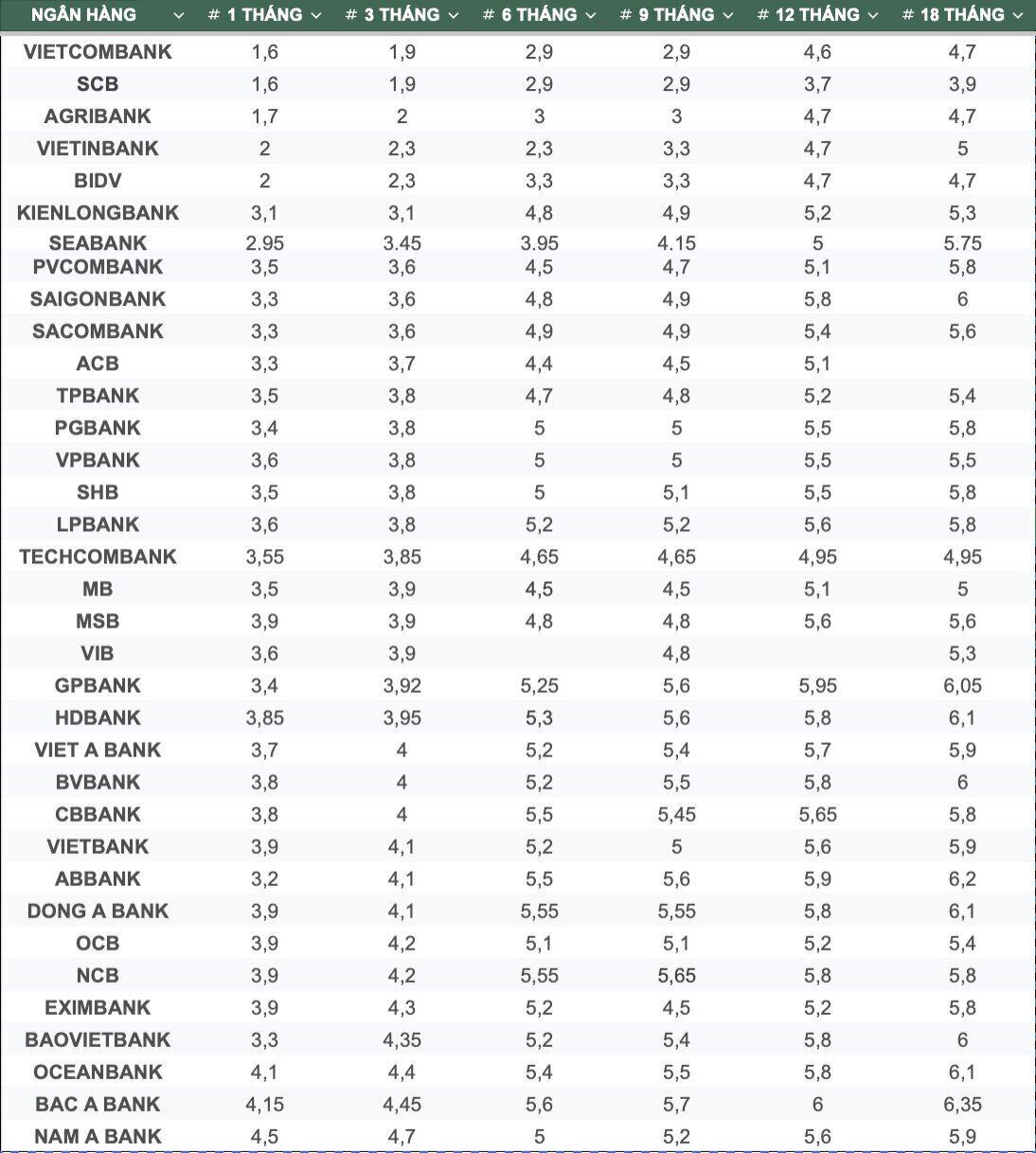

Meanwhile, according to statistics from Lao Dong at 37 commercial banks, the current lowest savings interest rate for terms from 1 to less than 3 months is 1.6%/year, and the highest is 4.5%/year.

Latest bank savings interest rates on November 20, 2024