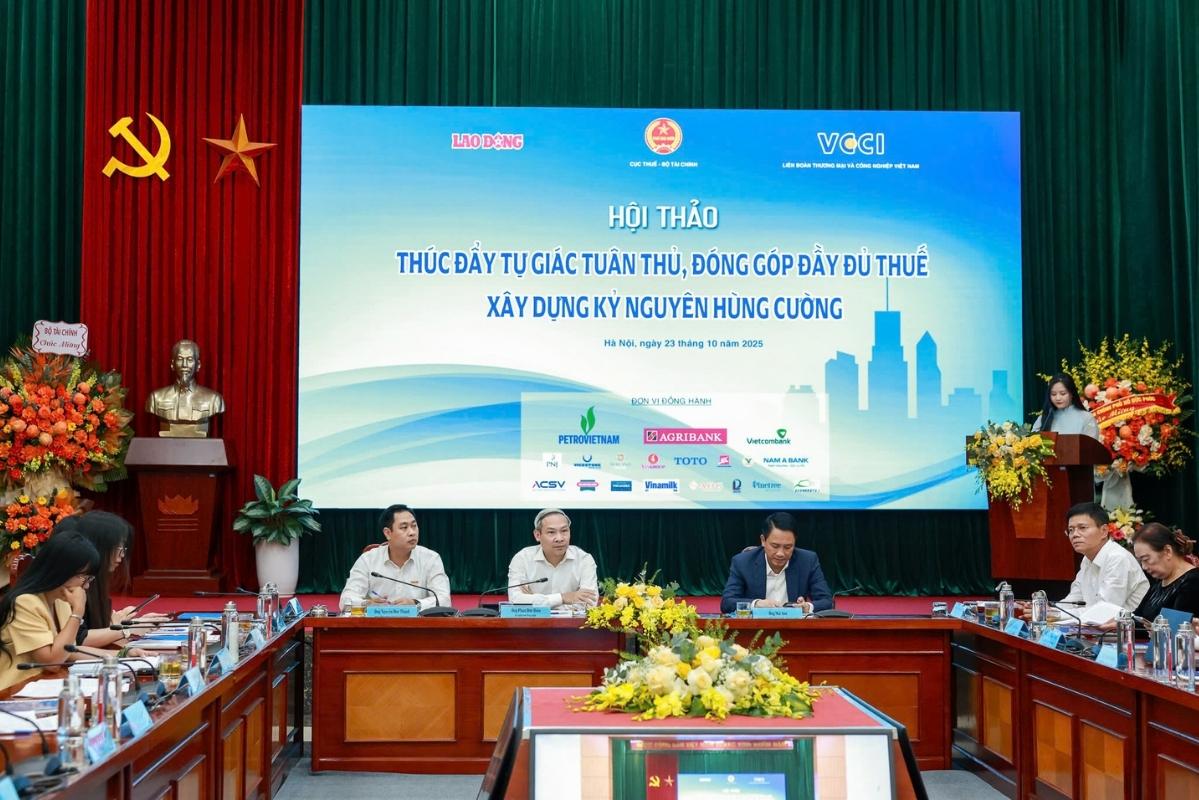

Most business households have switched to the declaration method

Information at the Workshop "Promoting self- comply with and contributing fully to taxes - Building a strong era", Ms. Le Thi Chinh - Deputy Head of the Tax Department's Professional Department said that in reality, in the first 9 months of 2025, more than 18,500 business households have paid concessionary taxes to the declaration method, nearly 2,530 business households have switched to the business model.

In particular, 98% of the business households that have declared have declared and paid taxes electronically; over 133,000 business households registered to use electronic invoices generated from cash registers. These figures have proven that businesses are confident in conversion and proactively familiarise with the declaration method.

Along with that, most business households are actively preparing for the journey to eliminate contract tax in accordance with the spirit of implementing Resolution No. 68-NQ/TW dated May 4, 2025 of the Politburo, Resolution No. 198/2025/QH15 of the National Assembly, Resolution No. 138/NQ-CP and 139/NQ-CP of the Government on private economic development, the Ministry of Finance has issued the Project "Converting tax models and methods for business households when eliminating contract tax" attached to Decision No. 3389/QD-BTC.

Accordingly, identify fundamental solutions to complete the goal of officially eliminating contract tax from January 1, 2026, creating an important shift in tax management for business households and individuals.

Tax authorities transform to accompany business households

To help business households feel secure in converting, the Tax authority has, is and will resolutely focus on implementing synchronous solutions in the Project "Converting tax models and methods for business households when eliminating contract tax" in the spirit of accompanying taxpayers, the Deputy Head of the Tax Department's Professional Department emphasized the implementation of 3 groups of solutions:

First, perfect institutions and policies, ensure transparency and fairness, and be easy to implement. Accordingly, preside over the development of the Law on Tax Administration; advise and propose amendments to the Law on Personal Income Tax (expected to be submitted to the National Assembly at the 10th session - October 2025).

At the same time, the Circulars and Guiding Decrees will be reviewed for synchronous amendments, ensuring synchronous implementation and achieving results. The goal is to build a clear, transparent legal framework, simplify and automate declaration forms to help businesses do it themselves and feel secure when converting from contract tax to the declaration method.

Second, simplify procedures, develop smart electronic tax services. Implement the simplification of forms, increase the provision of smart, automated electronic tax services.

Third, innovate propaganda work, support taxpayers, and guide taxpayers to understand and do things easily. Go to each person and each location to help people implement.

The transition to the tax declaration method marks the transition from an inspection-based and supervisory management model to a confident and data-based model. Accordingly, it will enhance the role and proactiveness of taxpayers in fulfilling their obligations to the state, promote voluntary compliance and transparency in declaration to help people clearly see the tax calculation mechanism, understand why and how much to pay, thereby forming a self-awareness and proactive compliance.

At the same time, the application of digital technology in tax declaration and payment plays an important role in facilitating compliance. With just an electronic tax account, businesses can declare and pay taxes right on the phone - operating quickly, transparently, and saving time.