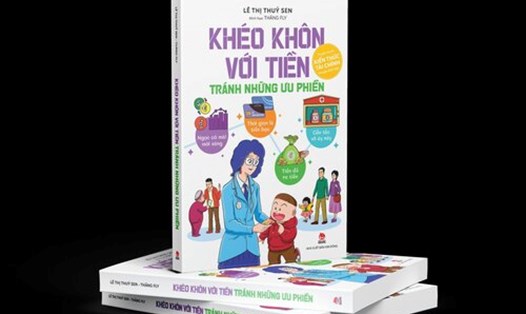

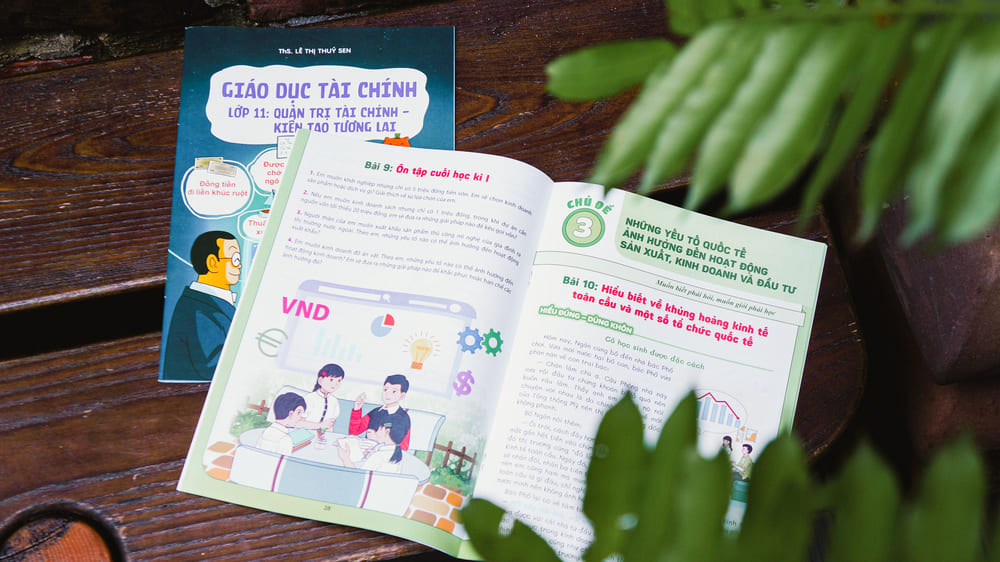

Although only a tool in the educational ecosystem, the book series "Financial Education" published by Vietnam Education Publishing House and Tan Viet Books carries a clear message that money is not only for spending, but is also associated with responsibility, goals and humanistic values.

When young people access financial knowledge through vivid lessons, connected to life - from folk songs, antique stories to modern situations - they will learn to see money as a means to serve life, instead of a single destination.

More importantly, young people will form the habit of managing resources, planning savings, understanding risks and preparing for their big steps.

"Financial education" therefore is not only about teaching economic knowledge, but also sowing the seeds of courage and aspiration. When these skills are nurtured through each school year, students from grades 1 to 12 will mature and become "Couraged financial citizens" - knowing how to set goals, manage assets, start a business confidently and live responsibly with the community.

Understanding finance early is the foundation for each child to master the future in a volatile world. This is not just a story of numbers, but also a journey to nurture personality, ability and autonomy - the factors that determine sustainable success in life.

According to some international studies, young people equipped with financial knowledge early have a level of confidence, the ability to plan and adapt economically is significantly higher than when they are older.

In particular, a survey by Next Gen Personal Finance in the US shows that students who complete a semester of "Personal Finance" can increase their lifelong benefit by up to 100,000 USD, thanks to saving, avoiding credit traps and taking advantage of safe investment tools.

In the UK, the financial education program has been included in the general education program since 2014; after 5 years, the rate of adolescents who are used to personal budgeting has increased by more than 20% compared to before.

In Vietnam, many young people leave school without being instructed on how to set a budget, manage spending or avoid consumer credit traps. In the context of widespread digital payments, e-commerce and retail investment, this gap can lead to long-term consequences.

Early financial education not only helps young people "know how to spend money", but also teaches them to think proficiently when they know how to set goals, analyze risks, respect the value of labor and balance between needs and desires. That is the foundation for forming independence, perseverance and the ability to start a business in the future.