Technical trends are drawing very high gold price points for 2026, but the big question is whether the "hiding metal" is still strong enough to continue?

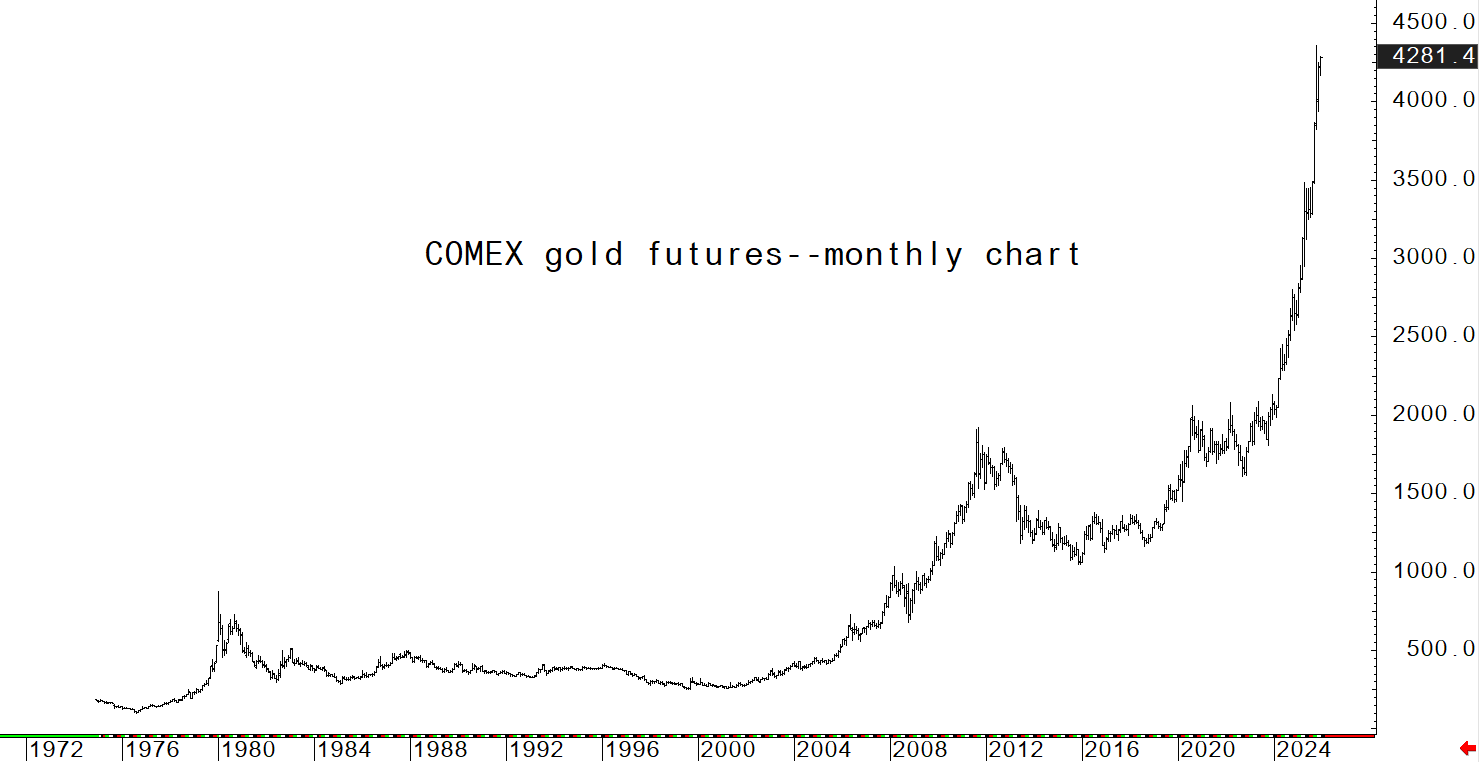

2025 is considered one of the most successful years of the "upside" in the gold market. COMEX gold futures have risen around $1,700 an ounce in just one year - a rare increase in the history of precious metals trading.

With such a strong upward momentum, expecting gold prices to continue to increase more strongly in 2026 is clearly a big challenge.

Even optimistic analysts admit that as the increase in 2025 could become the largest increase ever, it is very difficult to repeat or surpass this achievement in 2026.

However, the commodity market, especially gold, is unpredictable. Geopolitical fluctuations, interest rates, inflation or defensive psychology of global investors can quickly reverse all forecasts.

On long-term price charts, the trend of gold prices is in a state that traders call a "parabolic" - a price line that is almost standing on the monthly chart. This often shows that a prolonged rally is getting closer to the end stage, rather than just starting.

However, the history of commodity markets shows that the final stage of a large growth cycle is sometimes the most explosive stage. Prices can increase very quickly, very strongly, before reaching the peak and entering deep adjustment. This factor makes the forecast scenarios for gold prices in 2026 both attractive and risky.

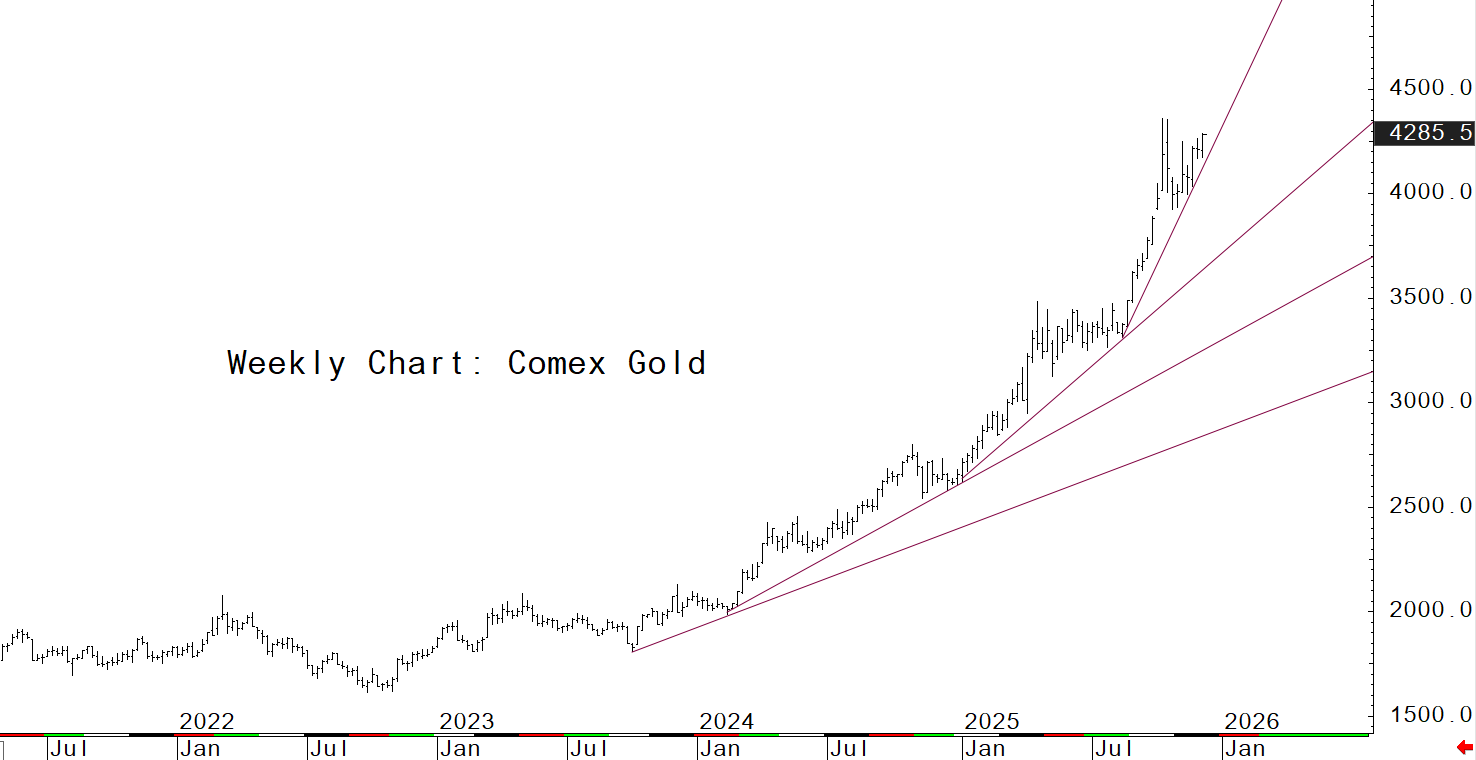

Based on the trend lines drawn from the most recent weekly chart of gold contracts on the COMEX exchange, some price milestones for reference for 2026 have been given by Kitco experts.

However, even the authors of these forecasts emphasized that this was an illustrative analysis, not an investment recommendation.

Gold price milestones are forecast for 2026 based on technical trends, according to Kitco:

Early February 2026: About 4,475 USD/ounce

Early May 2026: About 5,180 USD/ounce

Early August 2026: About 5,857 USD/ounce

End of December 2026: Maybe up to 6,893 USD/ounce

These figures, if realized, will take gold prices to unprecedented levels in history. However, the authors themselves have once again warned investors not to bet all on these forecast milestones.

With 2026, gold prices may have many surprises, both positive and negative. The important thing for investors is not to chase "dream" numbers, but to manage risks in the context of the market being at the most sensitive stage of the increase cycle.

World gold prices closed last week's session at a high of 4,300.000 USD/ounce, up 18.60 USD, equivalent to an increase of 0.43%.

Domestically, the price of SJC gold bars is trading around 154.3 - 156.3 million VND/tael (buy - sell); 9999 Bao Tin Minh Chau gold ring price is trading around 152.3 - 155.3 million VND/tael (buy - sell).