In its latest strategy report, French bank Societe Generale said it will continue to maintain an optimistic view on gold and place a strong bet on the outstanding ability of this asset in 2026.

Accordingly, Company Generale maintains the maximum allocation of 10% for gold in its multi-asset portfolio. The decision comes in parallel with the bank's significant cut in the share of fixed-income assets in the US, bringing US government bonds to 0% and reducing the share of corporate bonds by half to 5%.

Analysts said that in the context of the US bond market operating inefficiently and the weak USD eroding investment yields, gold continues to show its role as an asset that both protects risks and brings profit prospects.

Notably, Societe Generale continues to reiterate its forecast that gold prices could reach a peak of $5,000/ounce by the end of 2026. According to the bank, that outlook is supported by stable capital flows from individual investors, persistent buying by central banks and changes in US monetary policy orientation.

The report said that global individual investors are still increasing their holdings of gold through physical gold and ETFs, considering this a value preservation channel in the context of economic and geopolitical uncertainty.

At the same time, many central banks, especially those that are not closely linked to the US dollar, continue to diversify foreign exchange reserves, increase the proportion of gold to reduce dependence on assets priced in greenback.

A key factor strengthening the outlook for gold prices is the expectation that the US Federal Reserve (Fed) will pursue a softer monetary policy. Although the operating rate has decreased from the peak of 5.5% to about 4%, real interest rates after adjustment to inflation remain high, showing that monetary conditions are still relatively tight.

Experts from Societe Generale predict that the Fed could continue to cut interest rates by about 50 basis points in the coming time, bringing monetary policy closer to a neutral state.

In the context of cooling inflationary pressures but increasing risks to the US labor market, the possibility of policy easing is considered a reasonable scenario.

In addition to the expectation of price increases, Societe Generale also emphasized the role of gold in diversifying investment portfolios. In the context of the correlation between the US stock market and bonds still higher than the historical average, gold continues to be seen as a tool to help balance risks and enhance portfolio sustainability.

With the above factors, this bank believes that gold has a basis to maintain its superior position in 2026, not only as a defensive asset, but also as a strategic choice in the context of the shifting global financial order.

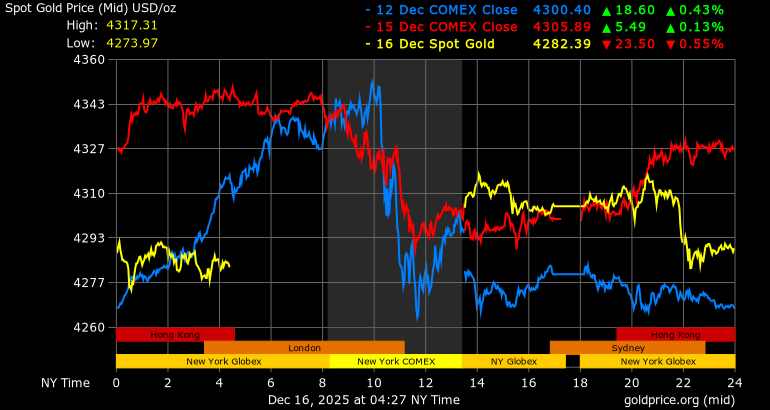

The world gold price closed at 4:15 p.m. on December 16, Vietnam time, at 4,283.4 USD/ounce, down 22.49 USD, equivalent to a decrease of 0.52%.

Domestically, the price of SJC gold bars is trading around 153.6 - 155.6 million VND/tael (buy - sell).

The price of 9999 Bao Tin Minh Chau gold rings is trading around 151.8 - 154.8 million VND/tael (buy - sell).