This could be a historic turning point, both opening up opportunities for diversification and posing a risk of strong fluctuations if major financial centers do not cooperate closely.

Speaking in Dublin (Ireland) on December 9, Mr. Fabio Panetta - a member of the Board of Governors of the European Central Bank (ECB) and Governor of the Bank of Italy - emphasized that the global monetary order may change. According to him, the international system may gradually drift to a more multipolar shape, where there is no longer a single currency in overwhelming position.

Mr. Panetta affirmed that the greenback will still be a key currency in international trade and finance, but the world is entering a new phase, where many strong currencies coexist and share power.

This shift could benefit from diversification, but it could also amplify volatility and risk spreading if there is a lack of policy coordination, he said.

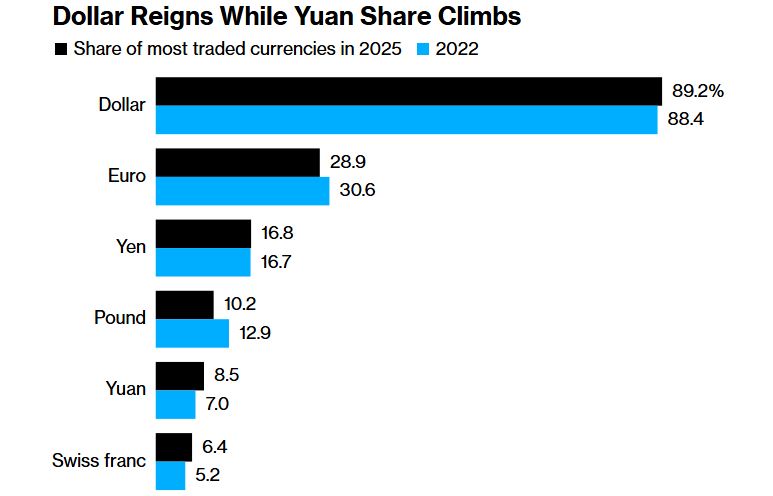

The three-year report released by the Bank for International payments (BIS) in September shows that the USD still dominates global foreign exchange transactions. The greenback appeared in 89.2% of foreign exchange transactions, up slightly from 88.4% in 2022.

In contrast, the share of the euro fell from 30.6% to 28.9%, while the Japanese Yen remained around 16.8%. These figures show that the US dollar dependence has not been able to happen for a long time.

In the context of increasing geopolitical competition, the European Union (EU) is promoting a strategic autonomy strategy, including the goal of turning the euro into a stronger global currency.

The EU has improved the cross-border payment system, strengthened liquidity mechanisms and accelerated the digitalization of financial infrastructure. This is an effort to help the euro reduce the gap with the USD and increase its use in trade, foreign exchange reserves and investment.

However, Mr. Panetta believes that Europe needs more than that: The capital market must be liquid, the economy must be stronger and investment capital must be expanded for the euro to truly have global power.

The future of the international monetary system will depend on long-term factors, including:

The weakening of traditional platforms supports the strength of the USD, in the context of the US facing political polarization, budget deficits and gradually losing its trade position.

China's rise, especially the pace of localization of the yuan and the scale of the economy.

Europe's deeper integration is a key factor in determining whether the euro can truly counter the US dollar.

Mr. Panetta warned that the post-dollar world could promote long-term stability thanks to diversification, but there is also a higher risk of financial fluctuations if there is a lack of coordination between major powers.