Domestic coffee prices reverse

After many sessions of deep decline, domestic coffee prices have increased by 500 VND/kg compared to yesterday. This recovery momentum appeared after the market recorded stronger demand from exporters.

Currently, coffee prices in key areas such as Dak Lak, Gia Lai, Dak Nong have reached 130,000 VND/kg, an increase of 500 VND compared to yesterday. Lam Dong still has the lowest price, recorded 128,000 VND/kg.

World coffee prices increase slightly

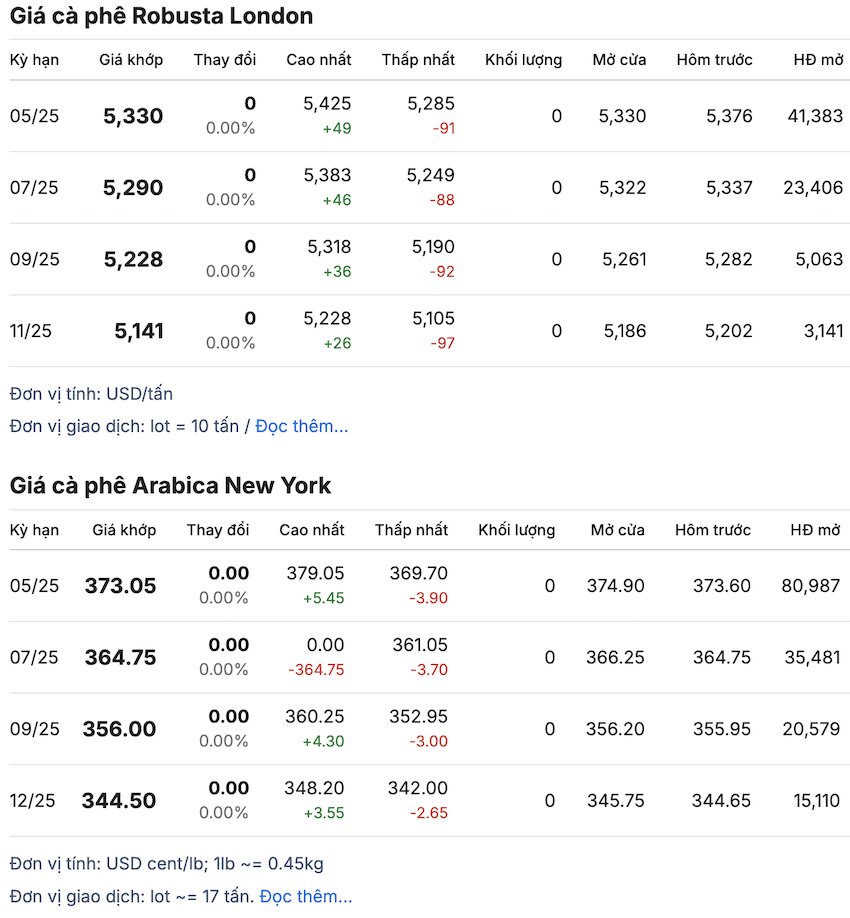

On the London Stock Exchange, Robusta coffee prices remained unchanged from the previous session, the contract for delivery in May still held at 5,330 USD/ton. On the New York Stock Exchange, Arabica delivery prices in May also remained unchanged, remaining at 373.05 cents/lb.

The market shows signs of recovery, but is not sustainable

The coffee price market still has many potential risks, as the Brazilian Real continues to weaken, encouraging farmers in this country to increase sales.

The ICE report shows that Arabica inventories at monitored warehouses remained at a 9-month low, supporting market sentiment. However, with the abundant supply of Robusta from Vietnam, coffee prices may not really enter a strong increase phase.

According to data from the General Department of Customs, from January 1, 2025 to February 15, 2025, Vietnam's coffee exports will reach 1.16 billion USD, an increase of 0.93 billion USD over the same period in 2024.

This shows that coffee export value in the first two months of 2025 has increased significantly, reflecting high demand in the international market or adjustments to export prices that are beneficial for Vietnamese enterprises.

Coffee price forecast: Will the increase continue?

Coffee prices this week may continue to recover slightly but will face many obstacles from supply and demand factors. The latest forecast from the market shows that Robusta prices may fluctuate around 5,300 - 5,400 USD/ton, while Arabica will find it difficult to surpass the 360 cent/lb mark if demand does not improve.

However, in the medium term, the market is still expected to have a better increase in mid-April when Brazil enters the new harvest, stimulating purchases from large roasters.