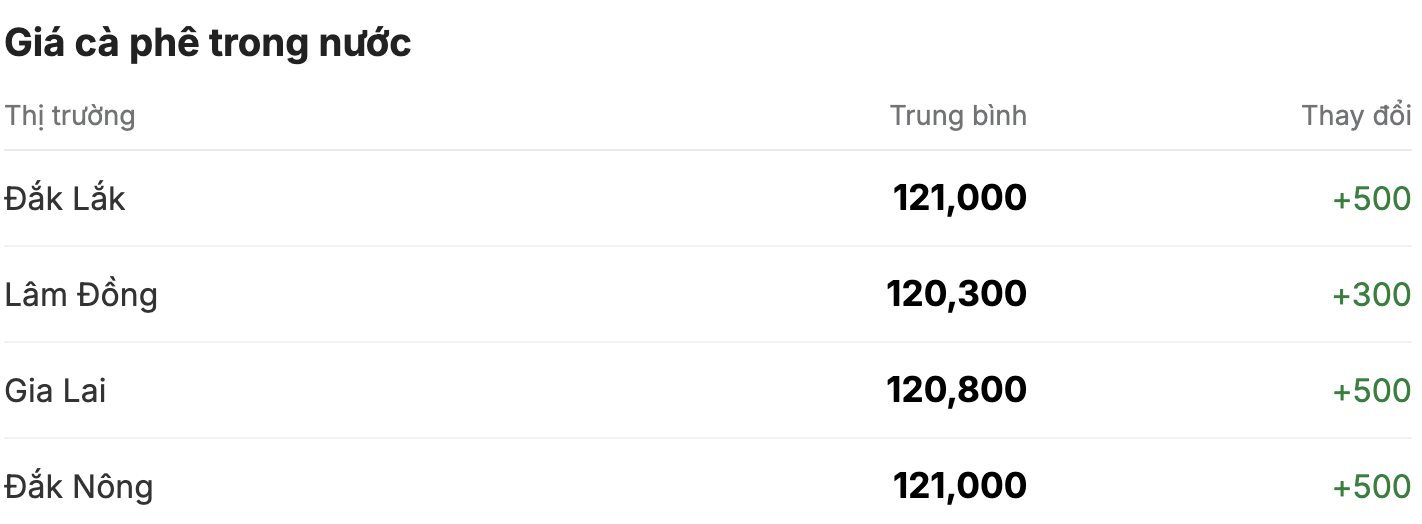

As of 11:30 a.m. today (January 7), the domestic coffee market continued to increase in price, increasing by an average of VND500/kg per session, currently the purchase price fluctuates between VND120,300 - 121,000/kg. The average coffee purchase price in the Central Highlands provinces today is VND120,900/kg.

Lam Dong is still the province with the lowest coffee purchasing price in the Central Highlands, with a difference of about 600 VND/kg compared to the average price. Compared to yesterday's slight increase, coffee prices in this region continued to increase by 300 VND/kg, reaching the market price of 120,300 VND/kg.

Purchasing at a price 500 VND/kg higher, coffee prices in Gia Lai province today increased sharply by 500 VND/kg, to 120,800 VND/kg.

Notably, Dak Lak and Dak Nong both ranked first among the provinces and cities with the highest coffee purchasing prices in the country, with the strongest increase of 500 VND/kg, reaching 121,000 VND/kg.

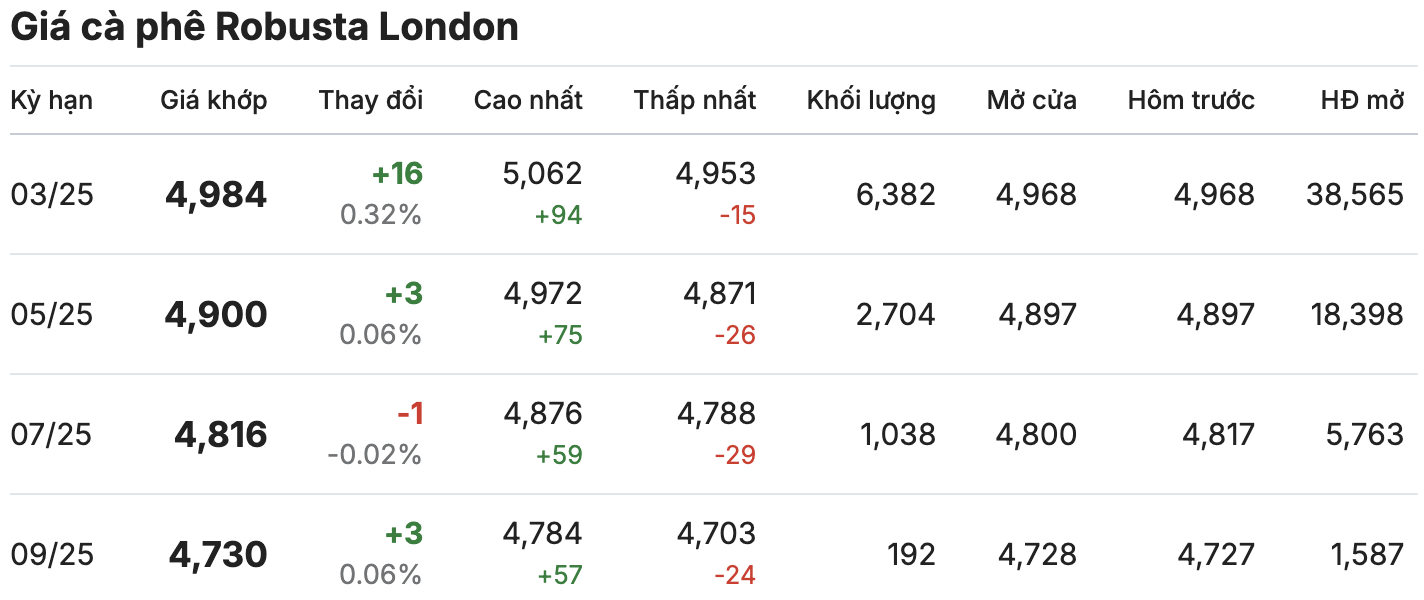

On the London and New York exchanges, the coffee market is mixed between green and red in some terms. On the London Robusta coffee exchange, coffee prices edged up slightly, approaching the peak of 5,000 USD/ton. The contract for delivery in March 2025 increased by 0.32% (equivalent to 16 USD/ton), anchored at 4,984 USD/ton. The contract for delivery in May 2025 increased "dripping" by 0.06% (equivalent to 3 USD/ton), listed at 4,900 USD/ton.

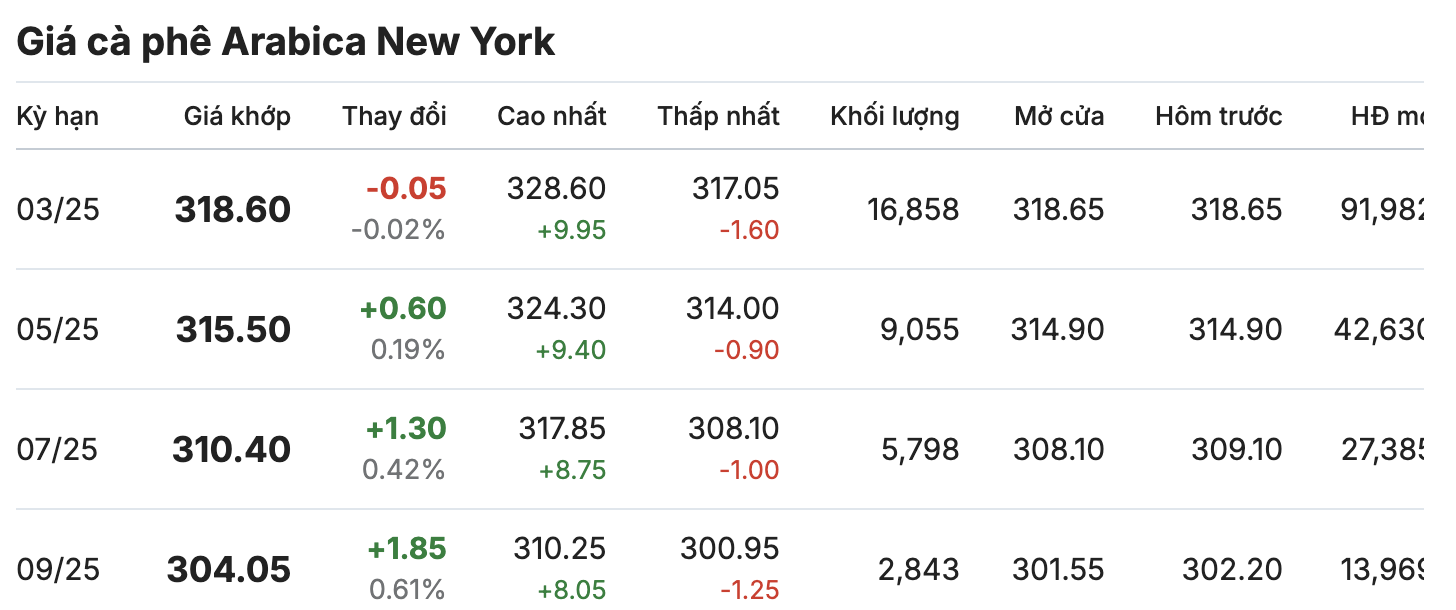

Similarly, the New York Arabica coffee market increased in almost all terms, except for the March 2025 delivery term, which decreased slightly by 0.02%. On the other hand, the May 2025 delivery term continued to increase by 0.19%, standing at 315.50 cents/lb.

Despite the sharp increase in coffee prices, the coffee market is still affected by objective factors such as weather, epidemics and international trade policies. These factors can make speculators cautious and reluctant to "spend money" to buy goods for storage due to concerns about the possibility of future price fluctuations.

While growers are happy with the high coffee prices, exporters are struggling to balance the purchase price with the selling price to international partners. They must renegotiate contracts or accept losses. Exporters also face fierce competition from other major coffee-producing countries, such as Brazil and Colombia, along with fluctuations in the global market.

Maintaining product quality when prices are high also makes it difficult for businesses to exploit the full potential of the coffee industry. Another important factor that challenges Vietnamese coffee exporters and processors is the pressure to maintain roasting and processing plants to maintain stable production and compete with other countries. Therefore, the shift of traditional customers from choosing Vietnamese coffee to alternative sources such as Brazil and India is creating great pressure on Vietnamese coffee exporters and processors.