Unexpected accident, hospital fees exceed 100 million VND

Nguyen Minh Long (born in 2003, from Hung Yen), a student studying in Ho Chi Minh City, is one of the cases who have had an accident but do not have health insurance. Long's story, told by Ms. Nguyen Thi Ha (Gia Dinh Ward, Ho Chi Minh City) - Long's sister, was based on the incident that the family had just experienced.

One evening last October, after working overtime at a coffee shop, Minh Long drove back to his rented room and had a serious traffic accident. The strong fall caused his head to hit the road, Long was taken straight to the hospital in critical condition. Hearing the bad news, Long's parents, who worked as farmers in Hung Yen, hurriedly took a bus to Ho Chi Minh City that night.

When they saw their children lying motionless in the recovery room, the family was almost devastated. But the biggest shock was when the hospital asked about health insurance, and the family learned that Long did not participate in health insurance. Previously, the school announced the collection of student health insurance money, but Long "forgot to pay" because he subjectively thought that he was young, healthy, and not needed it.

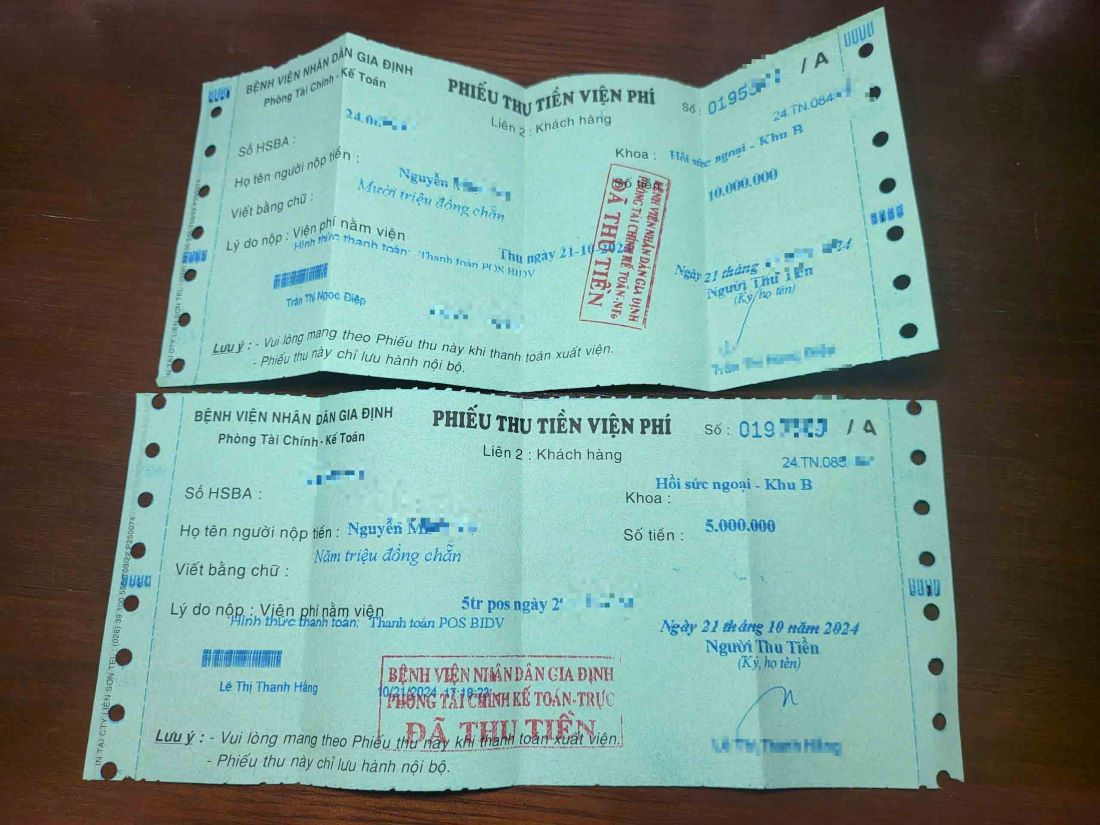

Without health insurance, all costs for surgery, resuscitation, medicine, medical supplies, chupage... must be paid for themselves. In less than two weeks of treatment, the total cost has exceeded 100 million VND. The continuous increase in hospital bills has stunned the whole family.

According to Ms. Ha, her parents live mainly on rice, their income is just enough to cover their living expenses. The huge amount of hospital fees has forced the family to struggle every day, even considering selling the land left by the grandparents.

"Just because of simple thinking, thinking young is fine, only when an accident hits them will they fall into debt," Ms. Ha shared.

After a critical period, Minh Long gradually recovered, but his family continued to bear the additional costs of medicine and periodic check-ups. Each time, a few hundred thousand dong, accumulated over many months into a large number. Not to mention, parents have to leave the harvest season in their hometown to go to Ho Chi Minh City to take care of their children, causing their income to almost be gone. Up to now, Long's health has stabilized and he has returned to school, but the burning desire for not buying health insurance still haunts the whole family.

Not only accidents, but seemingly "light" health risks can also confuse students when they do not have health insurance. Ms. Le Ngoc Anh (Go Vap ward), who just graduated from university in 2024, said that in November 2025, she suffered from food poisoning and had to be hospitalized for 3 days of treatment at a cost of more than 2.5 million VND.

"When I was admitted to the hospital, the doctor asked if I had health insurance, but I was shocked and realized that I didn't have it. During my student years, the school informed me that I was fully involved, but after graduating, no one mentioned me but I forgot," said Ms. Anh.

Immediately after being discharged from the hospital, Ms. Anh proactively registered to buy health insurance. "Fortunately, this time the cost is not large. If the amount of money was higher, I really didn't know how to manage it," she shared.

Health insurance - a "shield" for students away from home

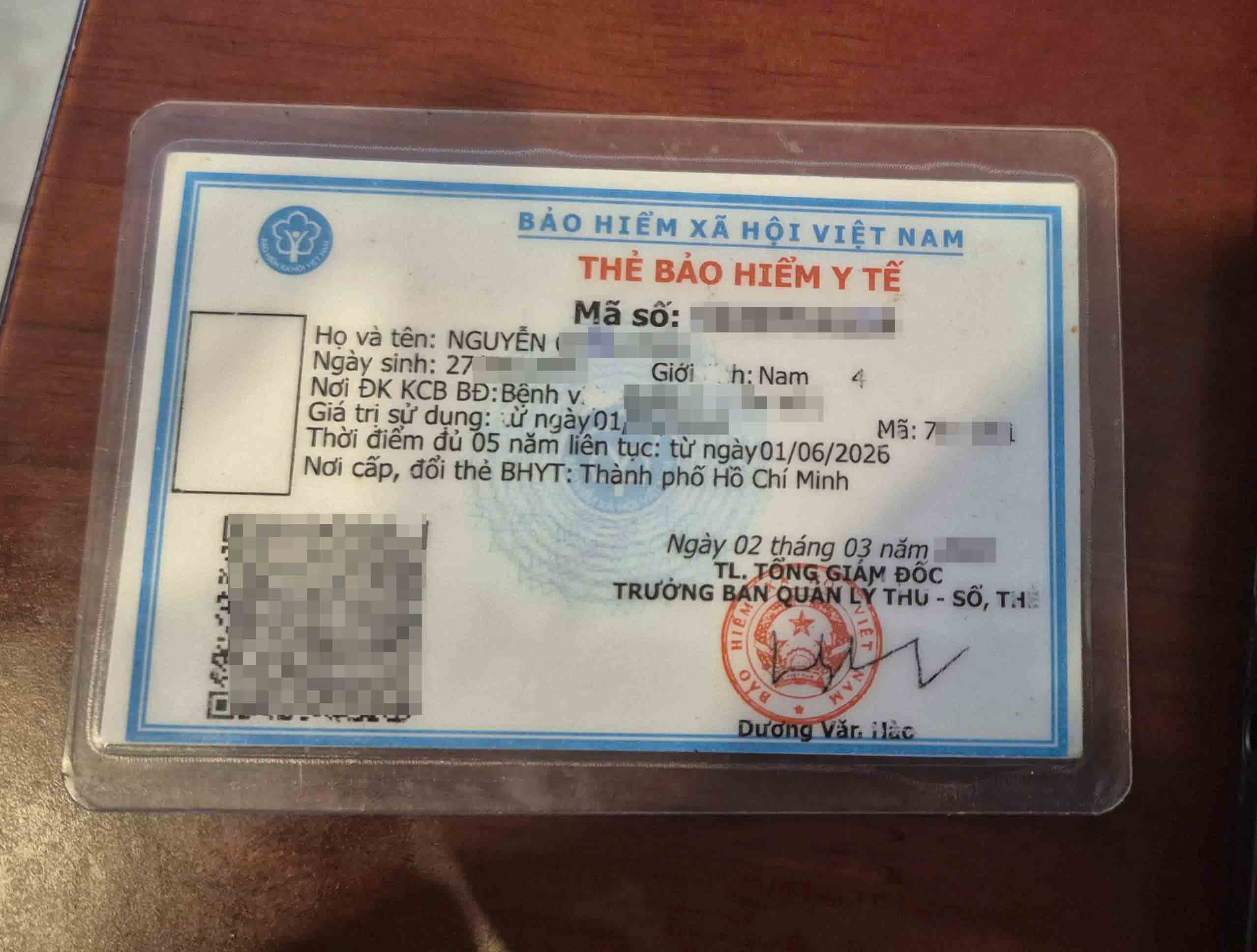

According to experts, if Minh Long participates in student health insurance, most of the medical examination and treatment costs at the right level can be covered by the health insurance fund up to 80%. At that time, the amount of money the family has to pay for itself will be significantly reduced, enough to avoid falling into a situation of borrowing and prolonged debt.

In reality, many students only realize the value of health insurance when it is too late. The mentality of "young, few diseases" makes many people take the health insurance card lightly - until unexpected risks occur.

In contrast to the above cases, Tran Thi Thu Ha, a second-year student in Ho Chi Minh City, said that health insurance has significantly reduced the family's burden when Ha had to be hospitalized for treatment of acute excess intestinal inflammation in early 2025. "I was in the hospital for more than a week but my family only had to pay more than 3 million VND. Without health insurance, the amount would definitely be much larger," Ha said.

For students studying away from home, health insurance becomes even more necessary. Nguyen Thi Kim Ngan - a 3rd year student from Quang Ngai - said that thanks to health insurance, every time she goes to the doctor, the cost is only over 100,000 VND. "Living alone, when I'm sick, I'm tired, if I have to worry about hospital fees, it's very stressful. Having health insurance helps me feel much more secure," Kim Ngan shared.

According to Ho Chi Minh City Social Insurance, student health insurance not only helps reduce medical examination and treatment costs but also ensures long-term and continuous health care benefits for learners, while contributing to the implementation of social security policies. In the context of increasing medical costs, not participating in health insurance means putting yourself at great financial risk.

From real stories, it can be seen that health insurance is not a formal procedure, but a practical "shield" for students and their families. When risks occur, health insurance cards not only help reduce the burden of money, but also bring peace of mind, which is extremely important for young people studying and starting a business away from home.

Recently, Ho Chi Minh City Social Insurance has publicized a list of more than 60 colleges and universities with a student participation rate in health insurance of less than 98% as of October 31, 2025, of which many schools are at 50-60%.