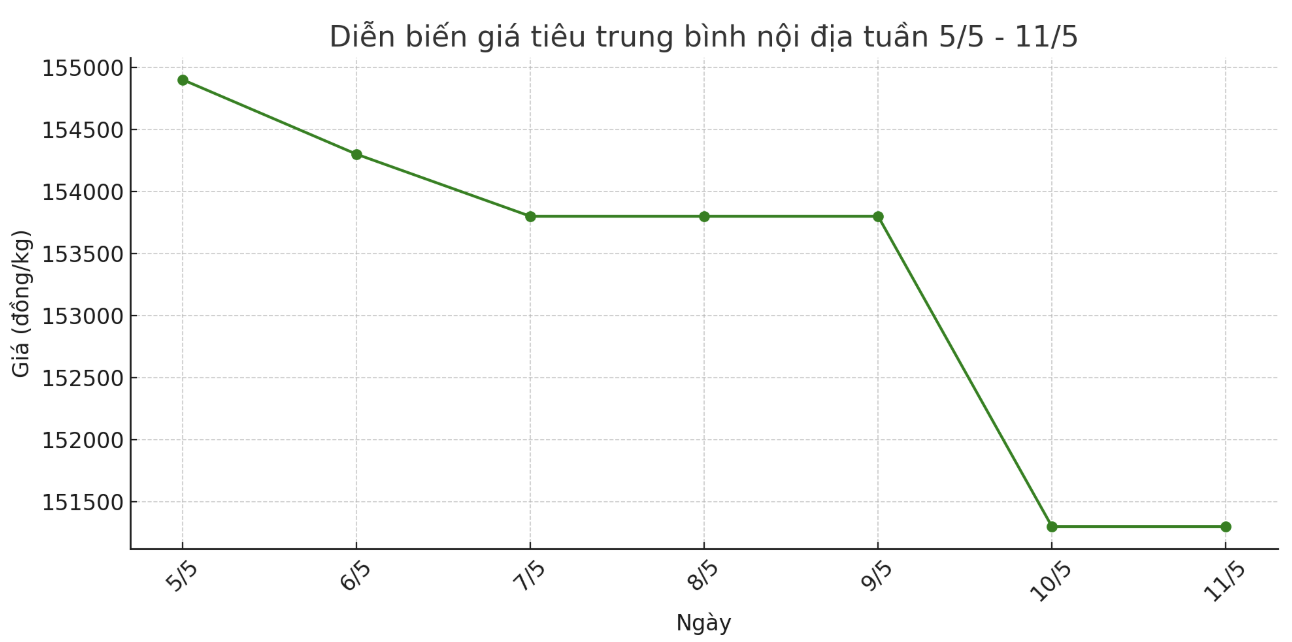

Domestic pepper prices: Continuously decreasing

As of 11:30 today (11.), domestic pepper prices are still trading in the range of 151,000 - 152,000 VND/kg, down 3,000 - 4,000 VND/kg compared to the closing price of the previous week.

To summarize last week, domestic pepper prices have continuously plummeted, pepper prices in Dak Lak and Dak Nong provinces are being purchased by dealers at 151,000 VND/kg, down 5,000 VND/kg compared to last week. Gia Lai recorded a slight decrease of more than VND 3,000/kg, down to VND 151,000/kg.

In the Southeast region, pepper prices in Binh Phuoc decreased by VND 3,500/kg last week, down to VND 151,500/kg. Meanwhile, in Ba Ria - Vung Tau and Dong Nai, pepper prices decreased by VND3,000/kg, down to VND152,000/kg.

World pepper prices: Developments in the same direction

According to data from the International Pepper Company (IPC), last week, black pepper prices in Indonesia and Malaysia decreased by 0.23% and 1.08% respectively compared to last week, down to 7,323 USD/ton and 9,200 USD/ton.

Meanwhile, the price of Brazilian ASTA 570 black pepper remains stable at 6,800 USD/ton. Vietnamese black pepper prices continue to fluctuate between 6,700 - 6,800 USD/ton for the 500 g/l and 550 g/l types.

Notably, Indonesia's white pepper prices decreased slightly by 0.23% compared to last week, down to 9,918 USD/ton.

Vietnamese white pepper and Malaysian ASTA white pepper prices have been moving sideways throughout the past week at 9,700 USD/ton and 11,900 USD/ton.

In the Indian market, pepper prices continued to remain unchanged in most pepper prices. Garbled pepper costs 67,200 rupees/kg, (equivalent to 211,862 VND/kg), Ungarbled is listed at 65.200 rupees/kg, while gram/liter has the lowest price of 64,200 rupees/kg (exchanged at 202,404 VND/kg).

Assessment and forecast

Pressure from competition for pepper products with major manufacturing markets such as Brazil and Indonesia has caused domestic pepper prices to drop sharply. At this time, many Vietnamese enterprises have shifted their exports to other potential markets to adapt more flexibly in the context of fluctuating global trade.

However, turnover value still increased thanks to high selling prices, always over 150,000 VND/kg, and imports increased sharply in the first 4 months of the year. It is forecasted that in the short term, the bearish trend on trading floors is still likely to continue.