Domestic pepper prices: Soaring

As of 11:30 am today (January 27), domestic pepper prices increased sharply after many days of slight adjustments, averaging at 150,800 VND/kg. Currently, key areas are trading in the range of 149,000 - 152,000 VND/kg.

Areas simultaneously increased from 500-3,000 VND/kg. Currently, the pepper price list of specific areas is as follows:

Recording the lowest increase is Dong Nai with 500 VND/kg, making this area the province with the lowest price at the threshold of 149,000 VND/kg.

Ho Chi Minh City increased by 1,000 VND/kg, while Dak Lak and Gia Lai increased prices by another 2,000 VND/kg, respectively bringing to the market in the price range of 150,000-152,000 VND/kg.

Lam Dong province alone increased by up to 3,000 VND/kg, maintaining the purchasing area with the highest price when anchored at the threshold of 152,000 VND/kg.

World pepper price: Sideways trend

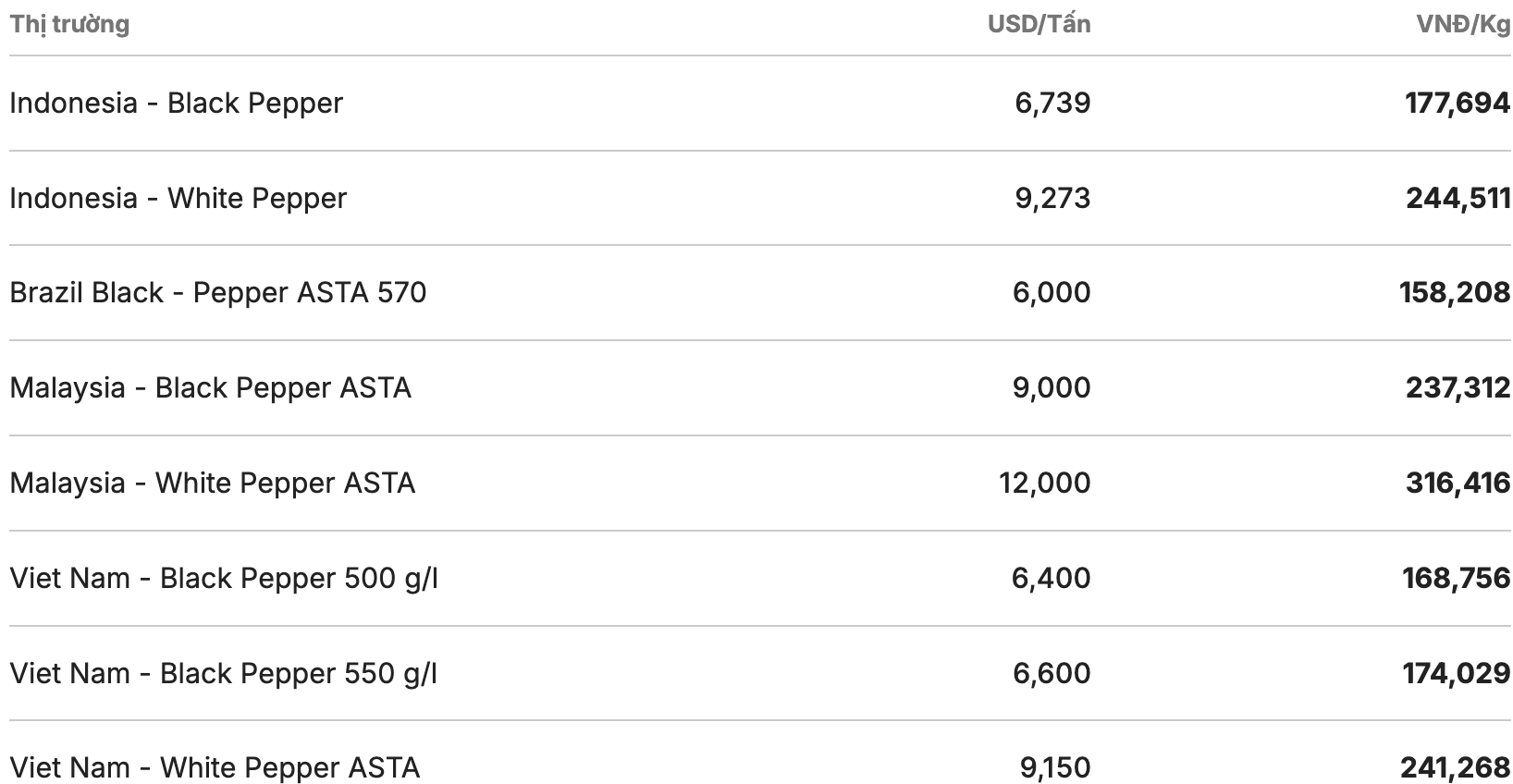

In the world market, pepper prices remain unchanged in most countries. The Indonesian exchange - one of the most vibrant markets is no exception. These two items are traded in the range of 6,739 - 9,273 USD/ton (equivalent to 177,694 VND/kg - 244,511 VND/kg), increasing by 92 USD/ton and 132 USD/ton respectively.

Meanwhile, the Brazilian market extended its unchanged days, trading at 6,000 USD/ton (about 158,208 VND/kg). In the same direction, black and white pepper continued to remain unchanged, trading at 12,000 USD/ton and 9,000 USD/ton.

Notably, in Vietnam's pepper export market, the price of black pepper of 500 g/l and 550 g/l is kept at the threshold of 6,400 - 6,600 USD/ton. ASTA white pepper continues to be offered for sale at a price of 9,150 USD/ton (equivalent to 241,268 VND/kg).

Perspectives and forecasts

The domestic pepper market has officially ended a series of days of sideways movement with a strong increase. This unexpected increase stems from a serious supply and demand imbalance on a global scale.

Statistics from specialized organizations show that adverse weather developments in the past year have affected the output of pepper powerhouses such as India and Sri Lanka with a decrease of 20% - 32%.

Experts believe that 2026 will be a time of supply constraints when global inventories hit rock bottom, and world total production is expected to continue to decline by about 15-20%.