The Policy Department (General Department of Politics, Ministry of National Defense) is organizing a consultation on the draft Circular of the Minister of National Defense guiding the implementation of policies and regimes for officers, professional soldiers, defense workers and civil servants, and those working in secret service who receive salaries as for soldiers (commonly known as subjects in the army) in implementing the arrangement and streamlining of the organizational apparatus in the Army according to Decree No. 178/2024/ND-CP dated December 31, 2024 of the Government on policies and regimes when implementing the arrangement of the apparatus of the political system.

According to this draft, in cases where they are eligible for early retirement, military personnel are entitled to the policies and regimes prescribed in Article 7 of Decree No. 178/2024/ND-CP.

Including specific instructions on the implementation of the one-time pension allowance regime for the number of months of early retirement; allowance for the number of years of early retirement and allowance according to the working period with compulsory social insurance (SI).

According to this guidance, in cases with an age of 2 years to 5 years to the highest age limit as instructed in Clause 5, Article 4 of this Circular, the following 3 allowances will be enjoyed:

1. One-time pension for the number of months of early retirement

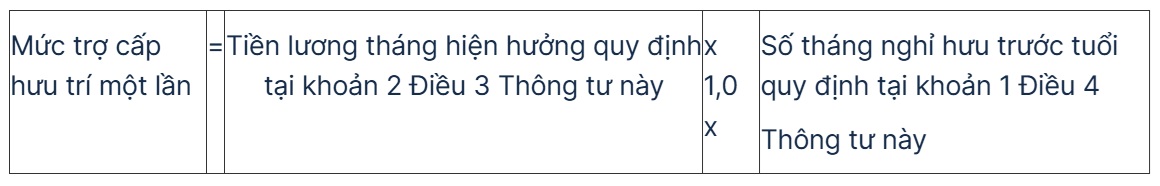

Retirement for the first 12 months from the effective date of the Merger Decision of the competent authority is entitled to pension benefits according to the formula:

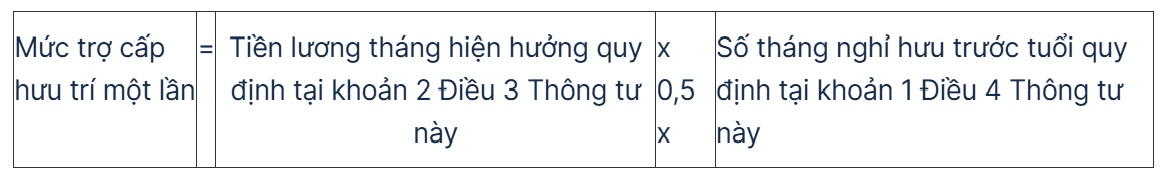

Retiring from the 13th month onwards from the effective date of the merger decision of the competent authority, will receive a one-time pension allowance according to the formula:

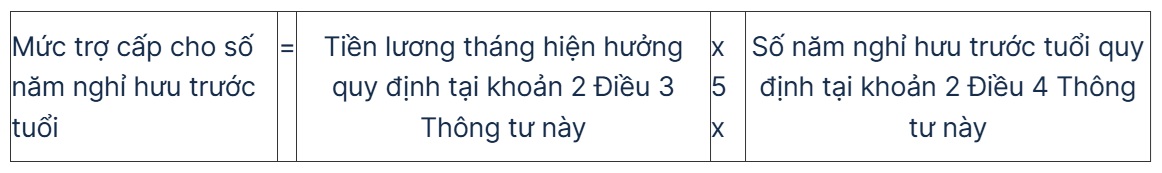

2. How to calculate allowances for the number of years of early retirement:

For each year of early retirement (12 months), they are entitled to 5 months of current salary. The subsidy level for the number of years of early retirement is calculated according to the following formula:

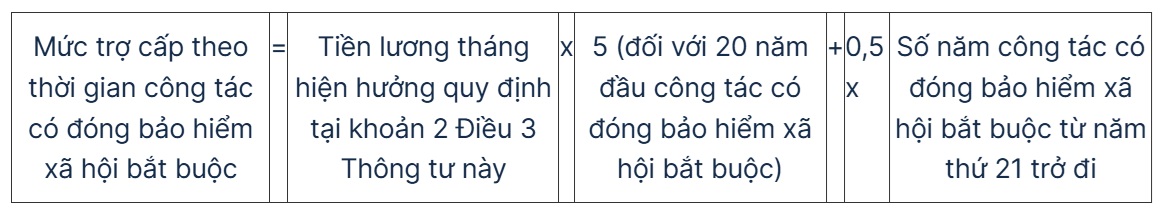

3. How to calculate allowances based on working time with compulsory social insurance contributions

Receive a subsidy of 5 months of current salary for the first 20 years of work with compulsory social insurance contributions. From the 21st year onwards, for each year of work with compulsory social insurance contributions, a subsidy of 0.5 months of current salary will be granted. The calculation formula is as follows:

The Government's electronic information portal gives an example, with this formula, a military colonel born in May 1971 (enlisted in February 1990, position of work assistant at Department A, General Staff Agency) will be 58 years old by the end of May 2029, the highest age limit according to the rank of colonel.

In case in March 2025, the unit conducts the merger and is allowed to retire early from June 1, 2025 and receive an immediate pension, 54 years old (no retirement), this officer is eligible for retirement within the first 12 months from the effective date of the merger decision of the competent authority; the retirement period before the age limit is 4 years (48 months) and has 35 years and 4 months of service in the Army with compulsory social insurance contributions.

Suppose the current monthly salary before retirement is 30,000,000 VND; in addition to receiving pension benefits according to the provisions of the law on social insurance, this military officer is entitled to the following benefits:

The one-time pension for the number of months of early retirement is: VND 30,000,000 x 1.0 month x 48 months of early retirement = VND 1,440,000,000.

The one-time allowance for the number of years of early retirement is: 30,000,000 VND x 5 months x 4 years of early retirement = 600,000,000 VND.

The one-time allowance for the number of years of work with compulsory social insurance contributions is: VND 30,000,000 x {05 months + (0.5 x 15.5 years)} = VND 382,500,000.

The total amount of benefits received when retiring early will be 2,422,500,000 VND.