UBS (one of the world's largest financial groups, headquartered in Switzerland) said that the current adjustment of the gold market is only temporary. The group said that gold prices are still on track to reach $4,200/ounce, with a higher increase scenario of up to $4,700/ounce if geopolitical or financial risks escalate.

The long-awaited correction has been suspended, UBS said in its research report released on Monday. Other than technical factors, we do not see any fundamental reasons for this sell-off."

The Swiss bank noted that the price decline has led to a second decline in open-end futures, but stressed that core demand remains strong.

UBS cited the World Gold Council's third quarter gold demand trend report, showing that "buy activities are very strong and accelerating," from both central banks and individual investors.

According to UBS, central banks have purchased 634 tons of gold this year, slower than last year but accelerating in the fourth quarter, in line with the forecast for the whole year of 900-950 tons in 2025.

ETF inflows reached 222 tons, along with demand for gold bars and coins exceeding 300 tons for the fourth consecutive quarter, showing continued investment appetite. The demand for jewelry is not as weak as it was concerned, UBS said.

We recommend buying when prices are adjusted, because we believe investors are still holding a low proportion of gold, UBS said, recommending an average allocation of about 5% of a portfolio to gold.

UBS Global Wealth Management strategist Sagar Khandelwal said on October 20 that real interest rates falling, a weak US dollar, rising public debt and geopolitical tensions could push gold prices to $4,700/ounce in the first quarter of 2026, and gold mining stocks could increase even more strongly.

While the rapid increase in gold may cause increased volatility, we still consider gold a valuable component of a sustainable investment strategy, he said.

Khandelwal warned that real US interest rates could return to negative levels as the Federal Reserve cut interest rates amid rising inflation.

This will reduce the attractiveness of the US dollar and boost capital flows into gold, he said. In fact, global gold ETFs recorded a record $17 billion in capital flows in September, bringing their total in the past three months to $26 billion, the strongest quarter in history.

UBS believes that investment demand may continue to increase and that with central bank gold purchases at a high level, total global demand for gold this year could reach about 4,850 tons - the highest level since 2011.

If private investors start diversifying from US Treasury bonds to gold, following the trend of central banks, spot gold prices could increase further, said Khandelwal.

In the context of continued economic, political and policy uncertainty, we expect capital flows to continue flowing into gold, supporting the scenario of increasing to 4,700 USD/ounce. Due to the low correlation with stocks and bonds, especially during the period of market stress, we recommend keeping the gold ratio at an average level in a diversified portfolio, he added.

Investors can also consider buying stocks of gold mining companies, as their cash flow could increase faster than gold prices in the next six months, Khandelwal suggested.

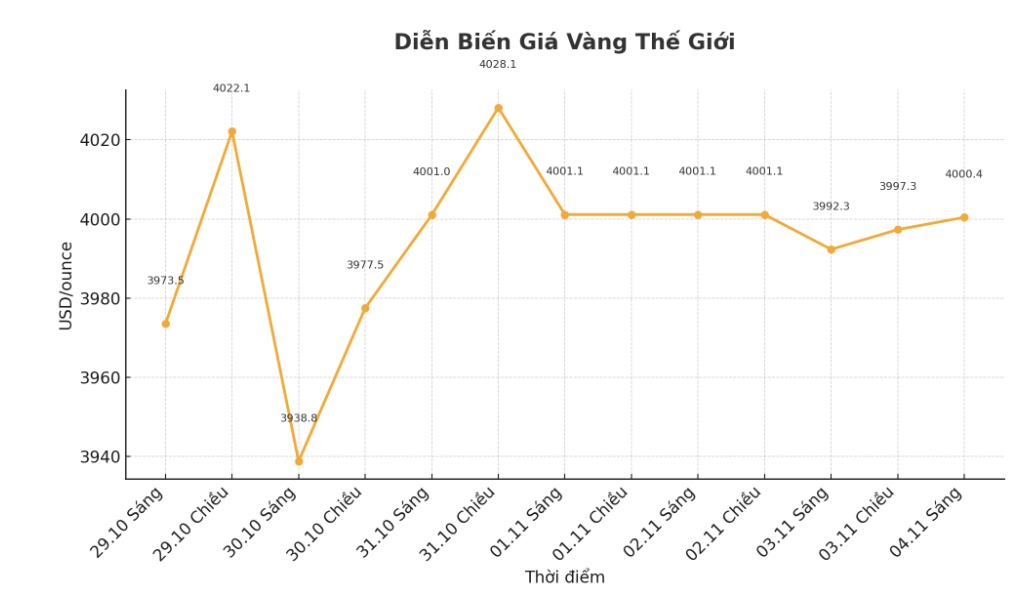

Currently, spot gold prices are fluctuating around $4,000/ounce, after reaching a two-session peak of $4,030, most recently at around 10:00 a.m. New York time (ie 10:00 p.m. on November 3 - Vietnam time).

See more news related to gold prices HERE...