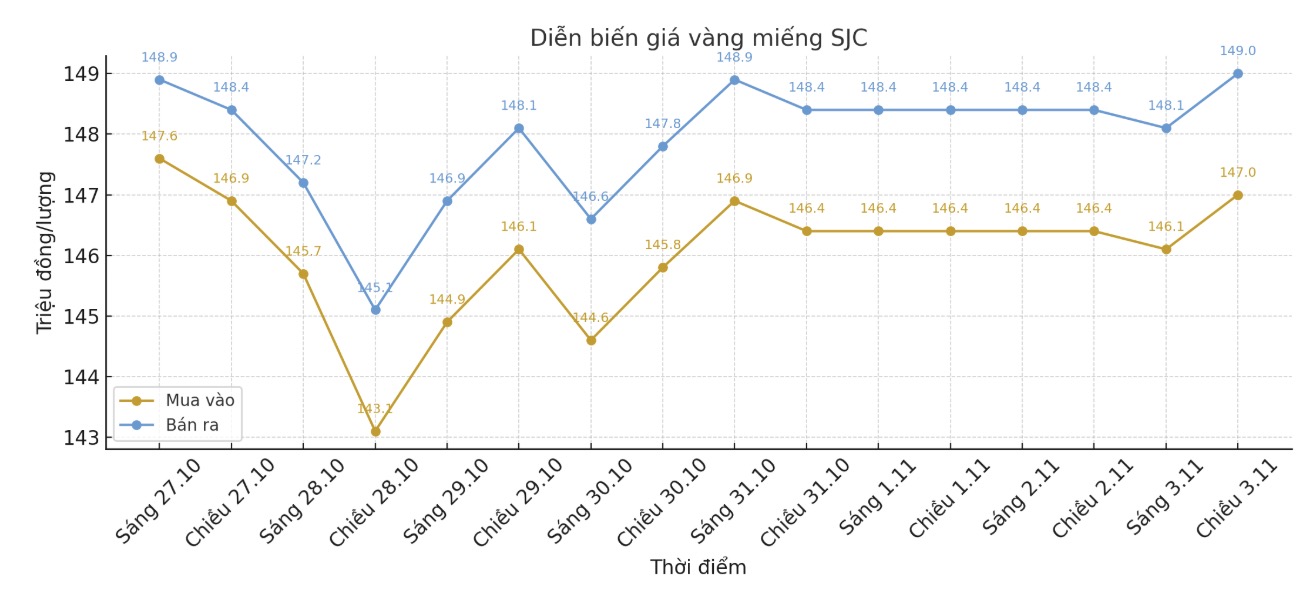

SJC gold bar price

As of 6:00 p.m., DOJI Group listed the price of SJC gold bars at 147-149 million VND/tael (buy in - sell out), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 147.5-149 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 146.5-149 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

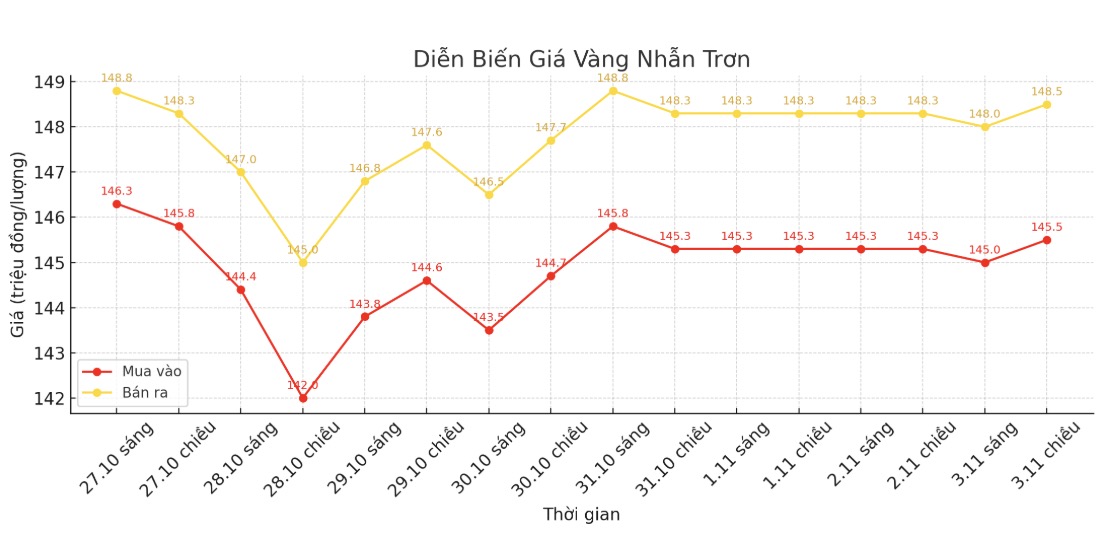

9999 gold ring price

As of 6:00 p.m., DOJI Group listed the price of gold rings at 145.5-148.5 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 146.5-149.5 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 146-149 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

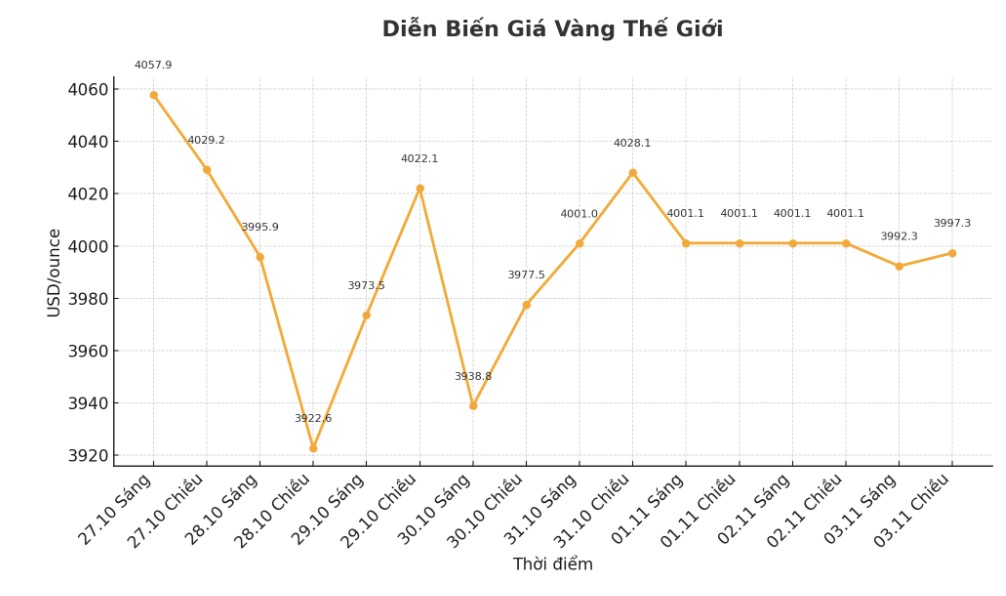

World gold price

The world gold price was listed at 6:00 p.m. at 3,997.3 USD/ounce, down 3.8 USD compared to a day ago.

Gold price forecast

Gold prices held steady around $4,000/ounce in the first trading session of the week. The precious metal is under pressure from a strong US dollar as investors reduce expectations of the US Federal Reserve (FED) continuing to cut interest rates in the short term, while the US-China trade tensions are also cooling down demand for gold.

Golds upward momentum is lacking due to a number of technical factors, while the US dollar remains quite strong, which has a negative impact on gold, said Kelvin Wong, senior market analyst at OANDA.

The Fed cut interest rates by another 25 basis points on October 29, the second time this year. However, Fed Chairman Jerome Powell's "Havy" statement later made investors skeptical about the possibility of the Fed continuing to ease policy in 2025.

Traders now see onlyund1% chance of a Fed rate cut in December, down from more than 90% before Powell's speech, according to CME FedWatch tool.

Gold - un interest-bearing assets often benefit from a low interest rate environment and when the economy is unstable.

Currently, golds safe haven role has been somewhat reduced due to the cooling of US-China trade tensions. The market may be shifting towards a more risk-off sentiment, especially in stocks, Mr. Wong added.

US President Donald Trump said last week that he had agreed to partially reduce tariffs on China in exchange for Beijing controlling the smuggling of fentanyl, buying more US soybeans, and increasing rare earth exports.

Rich Checkan - Chairman and COO of Asset Strategies International - commented that gold prices will fall this week: "Although I believe that the long-term trend of gold will continue to increase, in the short term, gold seems to lack the motivation to break out to new peaks.

Some believe this stems from tensions with cooling down China. Others said that the tougher stance of the Federal Reserve Chairman Jerome Powell has made the market skeptical about the possibility of a rate cut in December.

Some also believe that this is a profit-taking activity, or even a deliberate effort from speculators to pull gold prices down".

"Whatever the cause, this is only temporary... but I think the adjustment is not over yet. Prepare for the possibility of gold re-testering the below $4,000/ounce zone, Checkan warned.

Schedule of releasing important economic data for the week

Monday: Manufacturing ISM index.

Wednesday: ADP Employment Report, ISM survey for the service sector.

Thursday: Bank of England (BoE) monetary policy meeting.

Friday: Preliminary survey of consumer confidence - University of Michigan.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...