The Government has just issued Decree No. 157/2025/ND-CP dated June 25, detailing and implementing measures for a number of articles of the Law on Social Insurance (SI) on compulsory social insurance for soldiers, the People's Public Security, the standing militia and people working in secret services receiving salaries as for soldiers.

Decree No. 157/2025 clearly stipulates a number of compulsory social insurance regimes for soldiers, people's police, standing militia and people working in secret service who receive salaries such as for soldiers, including: Sickness regime; retirement regime; death regime.

Regarding pension regimes, the Decree clearly stipulates the subjects and conditions for pension:

First, employees specified in Point d, Point d, Clause 1, Article 2 of the Law on Social Insurance;

Second, employees specified in Point e, Clause 1, Article 2 of the Law on Social Insurance;

Third, employees specified in Point d, Point d, Clause 1, Article 2 of the Law on Social Insurance, during their time studying, practicing, working, researching, or being cared for abroad, but still receiving salary or military rank allowance or living allowance in the country and paying social insurance according to regulations) upon retirement, having paid compulsory social insurance for 15 years or more are entitled to pension if they fall into one of the following cases:

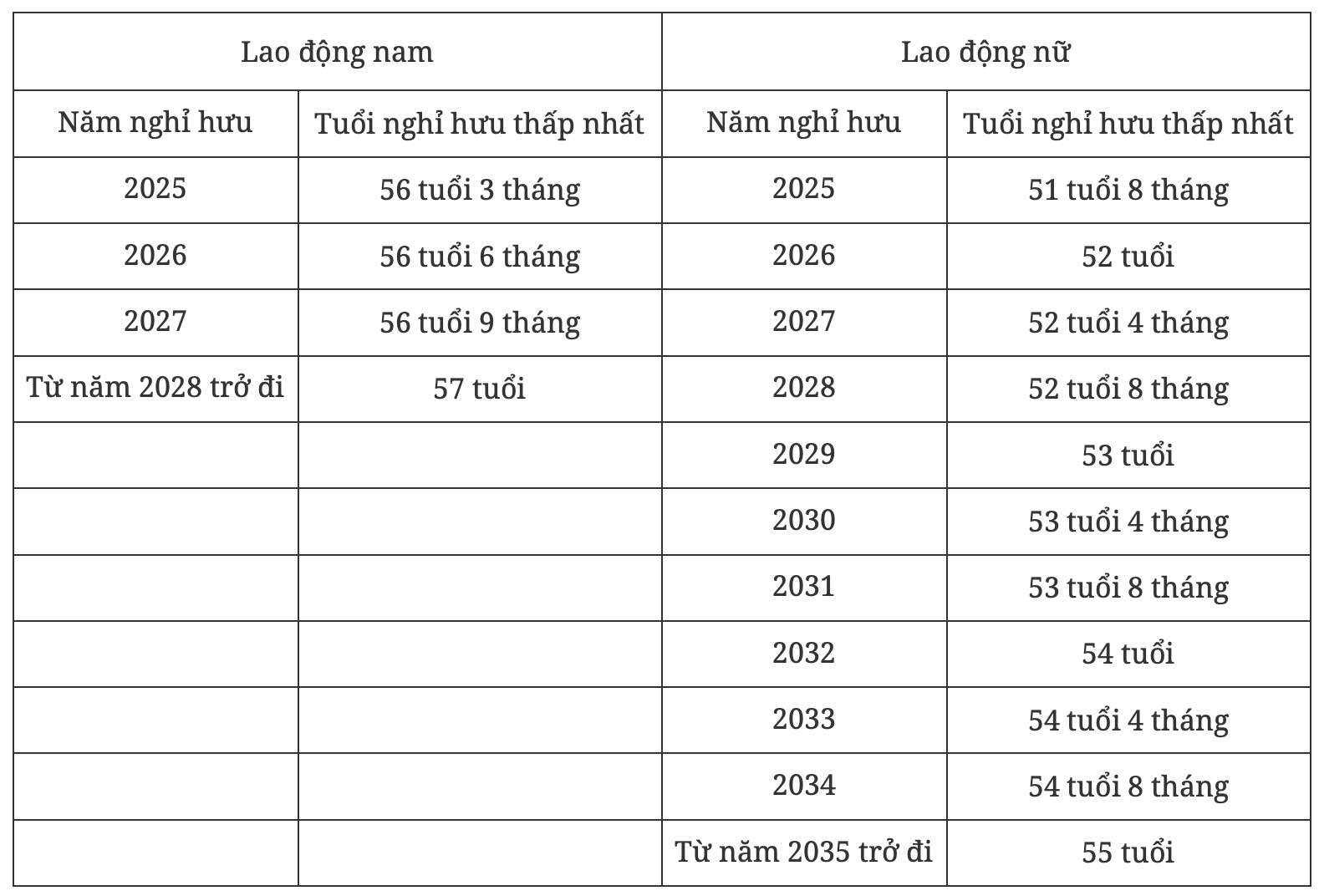

First, have an age of at most 5 years lower than the age specified in Clause 2, Article 169 of the Labor Code, implemented according to the following roadmap:

Second, have a maximum age of 5 years lower than the retirement age according to the roadmap specified in a and have a total of 15 years or more working in a heavy, toxic, dangerous or especially heavy, toxic, dangerous job on the list of heavy, toxic, dangerous or especially heavy, toxic, dangerous jobs issued by competent authorities or working in areas with particularly difficult socio-economic conditions, including working time in areas with regional allowance coefficient of 0.7 or higher before January 1, 2021.

When determining working time in a place with a regional allowance coefficient of 0.7 or higher for working time before January 1, 1995 as a basis for considering pension conditions, it shall be based on the provisions of the law on regional allowances at the time of settlement.

For areas where the law on regional allowances at the time of settlement does not stipulate or stipulate a regional allowance coefficient lower than 0.7 but in reality, workers who have worked in places with a regional allowance coefficient of 0.7 or higher as prescribed in previous regional allowance regulations, based on the provisions of those documents to determine working time in places with a regional allowance coefficient of 0.7 or higher as a basis for considering pension eligibility.

In case the employee has worked at battlefields B and C from April 30, 1975 onwards and at battlefields K from August 31, 1989 onwards is counted as the period of social insurance payment, this period of time is counted as working time in a place with a regional allowance coefficient of 0.7 to serve as a basis for considering pension conditions.

Third, it is not dependent on the age when the employee is infected with HIV/AIDS due to occupational accidents while performing assigned tasks.

This Decree takes effect from July 1, 2025.