The application of An Binh Commercial Joint Stock Bank (ABBANK) helps customers easily manage their finances and make effective spending decisions, meeting the financial needs of individuals, business households and families.

In the context of the constant development of digital technology, users' demand for financial services is changing. Customers want more quick and convenient digital experiences.

Banking applications are no longer just a simple transaction tool for daily spending but also need to become a truly smart assistant to accompany each customer in financial decisions.

Understanding the needs of customers, ABBANK officially launched the new generation of super-fast ABBANK digital banking application, aiming for a quick, optimal experience for a variety of customers: Individual - Business Household - Modern Family.

The ABBANK application is a breakthrough in ABBANK's digital transformation journey with many outstanding highlights:

Super-fast money transfer for individuals

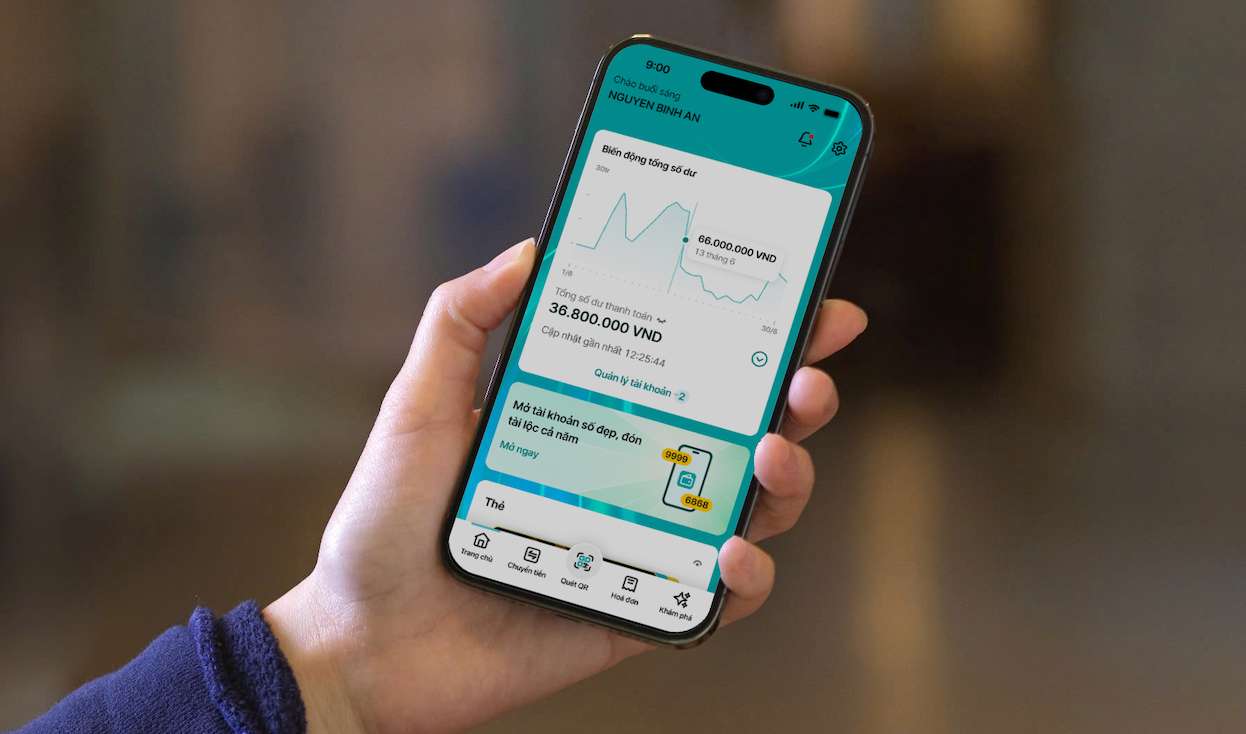

The busyness of modern life makes everyone appreciate the value of time and the simplicity of all operations. The ABBANK application brings a fast money transfer transaction experience thanks to modern technology, a simple but optimally designed interface to shorten time, without the need for many complicated operations.

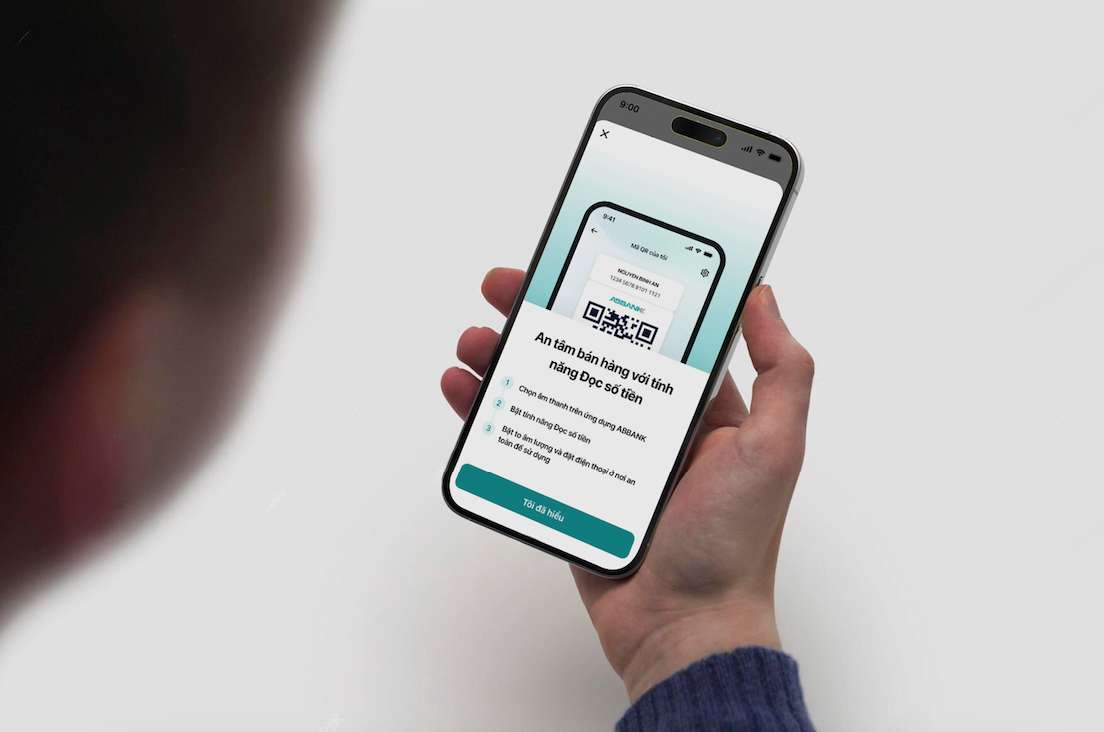

A feature of transferring payment money, although small, but "difficult to find" on many market applications available on the ABBANK application is the Payment feature with QR code. Users only need to copy the paid QR photo from the "national" Zalo or Messenger application and then "attach" it directly to the QR code scanning section without having to save the photo to the phone - avoiding creating a "burden" on the device's capacity, helping to shorten the time and operations for customers.

Super-fast growth for business households

ABBANK is a super-fast digital banking application suitable for every business household, helping store owners to always be proactive in all transactions. All balance changes are reported by voice, there is no need to open an app, helping you control your revenue and expenditure immediately, even when busy processing orders.

Transferring money or receiving payment also happens extremely quickly, ensuring that no business opportunity is missed, helping growth quickly. In particular, with a beautiful digital account on the ABBANK app, you can not only easily transact but also create a professional personal brand mark in the eyes of partners and customers.

In addition, shop owners can also unlock additional features specially designed by ABBANK to help improve family business performance: the Loa Lo balance speakers, multi-purpose QR sets, etc. at transaction counters.

Super-fast connection for modern family

For modern families, ABBANK is the solution to connect family finances, when parents and children can build a reasonable and safe spending habit early. ABBY Family solution on the ABBANK application helps parents to quickly open an account for their children 100% online, children can manage their spending via the app themselves, and parents can easily control on their application.

In addition, with ABBY Family, parents can easily guide their children to form accumulated savings habits through the feature of their children proactively depositing and managing their savings, increasing cohesion through small daily transactions.

At the heart of trading with the most modern security technology

In addition to the convenient features to meet a variety of customers, the ABBANK digital banking application is also equipped with advanced FIDO (Fast IDentity Online) security technology - 2-layer security and biometrics.

Security technology through FIDO encryption meets the most strict standards in the world today on security, helping all customer information and transactions to take place securely, bringing absolute peace of mind. The ABBANK application is used on mobile devices with iOS 15 or Android 9 or later.

Sharing about the launch of the new generation digital banking platform ABBANK for individual customers, Mr. Pham Duy Hieu - General Director of ABBANK said:

The launch of the new generation digital banking platform ABBANK continues to mark an important step forward in ABBANK's digital transformation strategy, improving user experience and aiming for sustainable development.

That is not only the success of the Bank in mastering technology, self-developing apps with full features to serve customers' needs and meeting the highest standards of safety and security.

The ABBANK platform is a testament to our commitment to continuous innovation, bringing increasingly smart, safe and convenient financial solutions to customers and the community.

In addition to convenient features, many financial solutions to effectively support ABBANK app users are also being deployed by the Bank to encourage customers to experience and use the new digital platform:

Refund up to VND 90,000 when opening an ABBY Family account and making a transaction (applicable until September 10, 2025); Refund up to VND 450,000 when opening an ABBANK payment account and registering to use Loa Loc Vang from now until July 31, 2025 (with the condition of at least 50 transactions receiving money/month through QR of the speaker, the refund incentive applies until November 30, 2025).