The gold market rebounded strongly ahead of the weekend. However, even as the precious metal continues to be supported as a safe haven asset to geopolitical and economic uncertainty, experts warn that gold's rally could be limited as the focus gradually shiftes to other commodities.

Gold ended the week in the green, trading above $3,300/ounce, after US President Donald Trump surprised investors with a new tax blow in the ongoing global trade war.

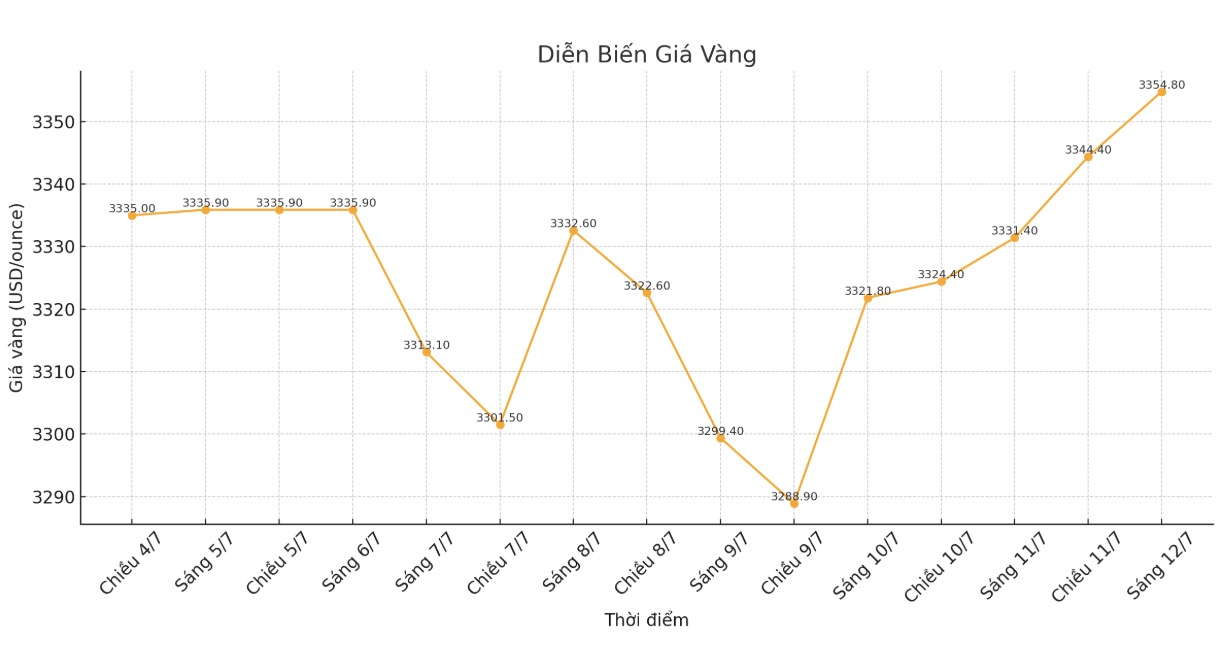

Spot gold prices were recorded at $3,354.8/ounce, up about 1% for the day and 0.5% for the whole week.

Despite initial concerns, investors have responded calmly ahead of Trump's self-made trade deadline of July 9. The return of risk-off sentiment has helped the S&P 500 reach a new peak, reducing the attractiveness of gold as a safe asset.

Although the deadline has been postponed to August 1, the global trade war has shown no signs of cooling down. Gold has maintained its upward momentum after Mr. Trump caused a stir in the commodity market when announcing a 50% tax rate on imports.

On Tuesday, Comex gold futures recorded the strongest increase in history, jumping to 13% after the above announcement. US warehouses are currently flooded with copper as companies rush to stock up ahead of August 1.

The common futures contract is currently trading at a record price difference on the London Metals Exchange (LME). This price difference has created a lack of liquidity, pushing prices higher.

However, experts also believe that the sharp increase in copper prices will increase inflationary pressures, thereby increasing economic instability and reigniting concerns about recession and stagnant inflation. This environment is still favorable for gold.

Robert Minter - ETF Strategy Director at abrdn commented: "Gold is like big banks in a financial crisis - "too big to fail". Gold is the foundation of the monetary system, so it cannot be taxed. Gold is not, and so is silver.

It is not ruled out that silver will be the next metal to fall under the president's tariff watch. In addition, industrial metals such as copper and silver are taking the wind from the growth cycle, so it is inevitable to attract attention, said the expert.

However, analysts still note that although gold has built a solid support zone, the strong increase of copper and silver will somewhat curb gold's short-term breakthrough.

Callum Thomas - Head of Research at Topdown Charts commented: "Some risk factors that have driven gold demand are fading away, such as concerns that economic growth may be overwhelmed by positive signals, boring tariff risks, or temporarily quiet geopolitical situations. The key point is, after being left behind, now is the time for other commodities to take on the leading role from gold.

Meanwhile, Philip Streible - Chief Strategist at Blue Line Futures believes that the shift of cash flow to other commodities will be the main factor holding back gold.

He said he bought gold when prices fell to $3,244 an ounce two weeks ago and had closed some of his position in Friday's rally.

In addition to copper, gold is also under competitive pressure from silver, the metal has surpassed the threshold of 38 USD/ounce. Spot silver prices are currently at 38.38 USD/ounce, up 3.88% for the day and 4% for the week.

Experts say silver is becoming an attractive choice in the precious metal group as it begins to catch up with the increase of gold and platinum.

In addition to competition in the commodity market, more and more experts are taking a neutral view on gold as economic data is expected to support the US Federal Reserve's neutral stance. An important indicator that the market is monitoring is the June Consumer Price Index (CPI). The Fed has clearly stated that it is in no rush to raise interest rates as the risk of inflation remains high.

Aaron Hill of FP Markets wrote in the note: CPI data is the only factor preventing Donald Trump from putting more pressure on the Fed Chairman. We believe the data will produce a better result than expected, which means the USD index may not decrease, and gold prices will tend to move sideways.