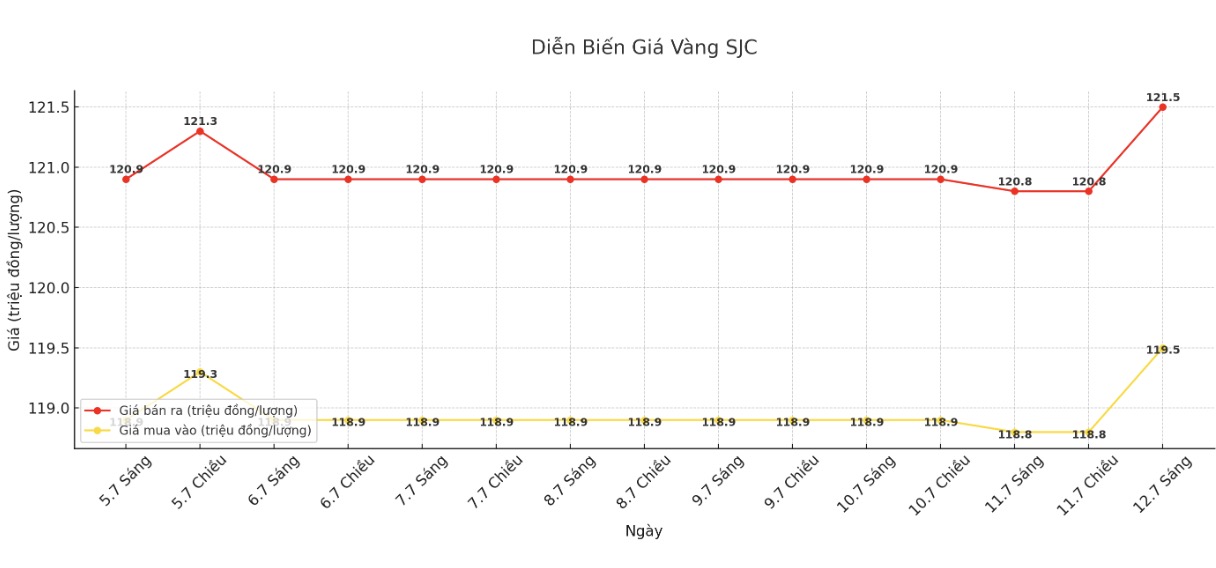

Updated SJC gold price

As of 9:10 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.5-121.5 million/tael (buy in - sell out), an increase of VND 700,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed the price of SJC gold bars at VND 119.5-121.5 million/tael (buy in - sell out), an increase of VND 700,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND 119.5-121.5 million/tael (buy in - sell out), an increase of VND 700,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.8-121.5 million VND/tael (buy - sell), an increase of 700,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

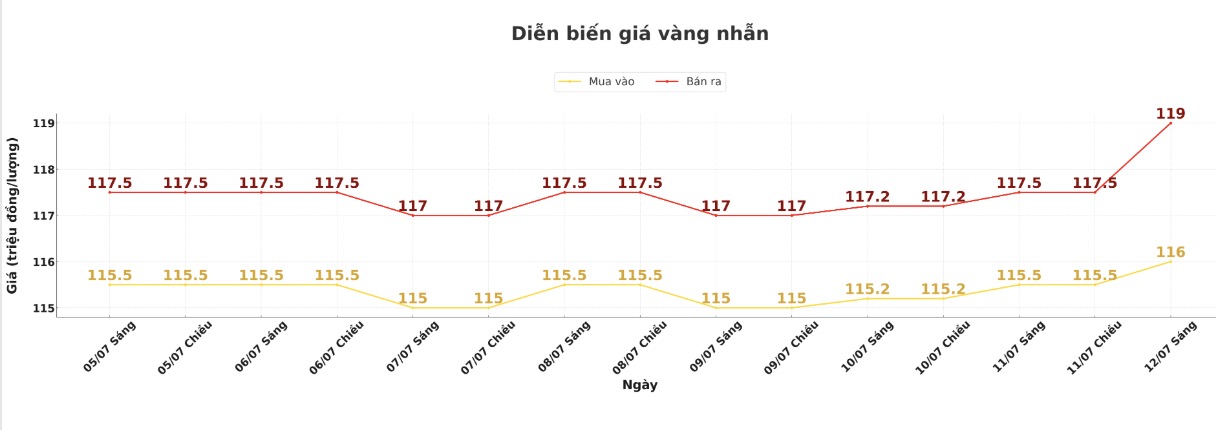

9999 round gold ring price

As of 9:10 a.m., DOJI Group listed the price of gold rings at 116-119 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.2-119.2 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Jewelry Group listed the price of gold rings at 115.2-118.2 million VND/tael (buy in - sell out), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

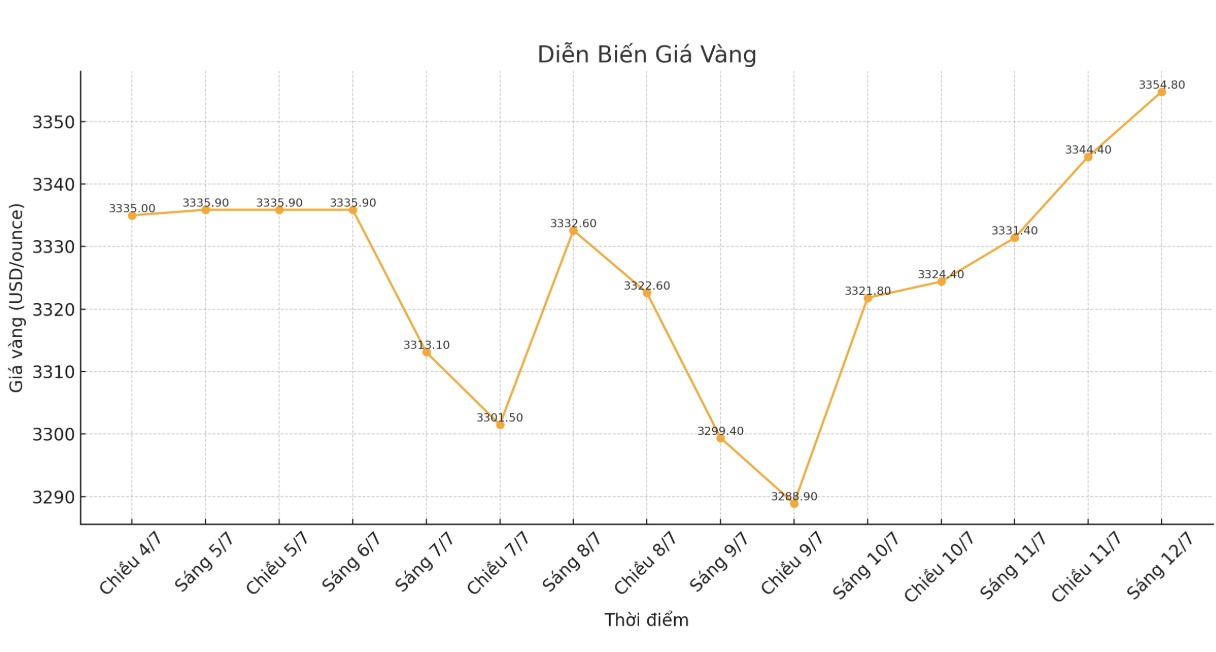

World gold price

At 9:10 a.m., the world gold price was listed around 3,354.8 USD/ounce, up 23.4 USD/ounce compared to 1 day ago.

Gold price forecast

World gold prices increased sharply as the risk-off sentiment increased at the end of the week, supporting safe-haven metals. August gold futures are currently up 33.6 USD, up to 3,359.3 USD/ounce. September silver futures are currently up $1.03, up to $38.335 an ounce.

Risk fears will increase this weekend as the US steps up threats of tariffs on other countries, tensions between the US and Russia escalate, and the Middle East situation could become more unstable.

stocks in Asia and Europe fluctuated in opposite directions in the overnight trading session. US stock indexes are expected to open lower than today in New York.

Aakash doshi - Director of Gold Strategy at State Street Global Advisors said: "We are in an uncertain environment. Investors have therefore sought gold as a safe haven". He forecasts that in the third quarter, the precious metal will fluctuate in the price range of 3,100 - 3,500 USD/ounce.

"Gold prices have been very strong in the first half of the year. Therefore, I think the current price will adjust a little" - doshi said.

Sharing the same view, Carlo Alberto De Casa - independent analyst at Swissquote, commented: "We are seeing increased demand for gold shelter. There are investors looking for safe assets despite the stock market peaking. Any current decline in gold is considered a buying opportunity.

Increased trade tensions have boosted demand for safe-haven assets such as gold, amid concerns about the risk of economic recession. The more dovish policy of the US Federal Reserve (FED) is also supporting investor sentiment, ANZ analysts said.

The combination of strong trade policies and safe-haven demand is creating an attractive environment for continued growth of the precious metal. While traditional economic indicators show the Fed will take a tighter stance, it is clear that the market is now focusing on policy uncertainty and its potential economic impacts.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...