Gold prices continue to fluctuate around $3,300/ounce, supported by general investor optimism and the US postponing import tariffs for another month.

In the latest report, commodity analysts at Metals Focus said that the room for gold prices to decrease in the second half of the year is very limited, as continued economic uncertainties will boost investment demand.

Although the global economy appears to have avoided a full-scale trade war, US tariffs are expected to remain high for a long time.

More notably, although the US economy has remained stable to date, the inflationary impact from tariffs may take several months to have a clear impact on consumers. The risk of stagnation may therefore continue, the report said.

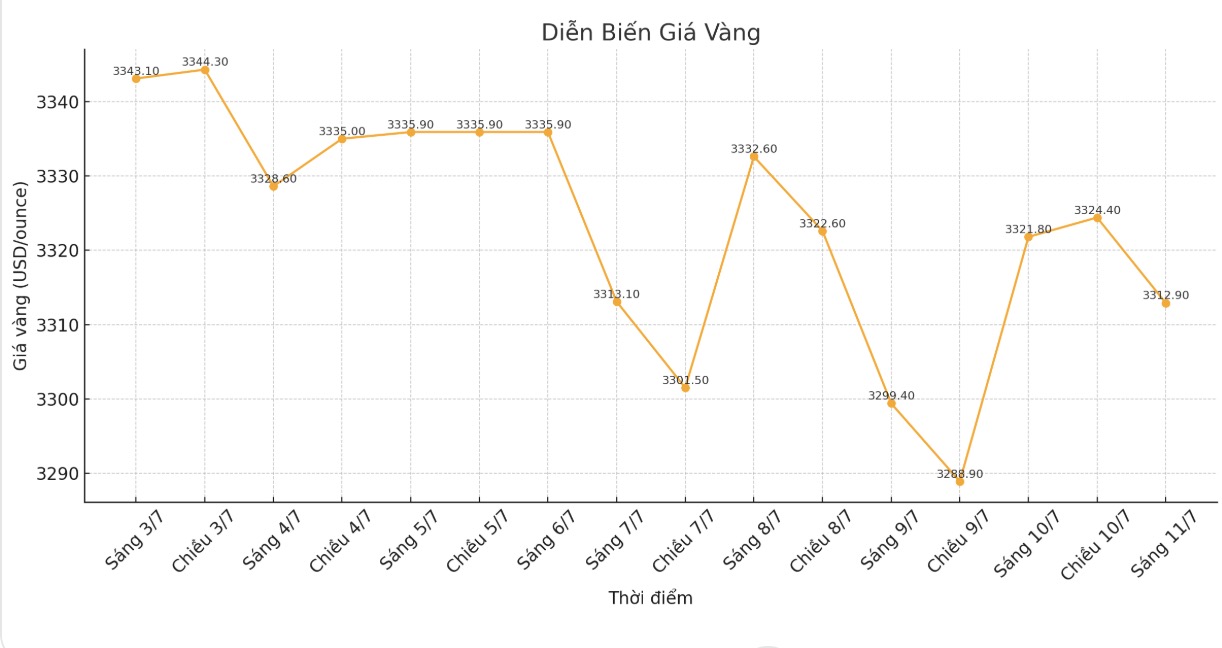

Spot gold prices recorded at 0:00 on July 11 (Vietnam time) were at 3,312.9 USD/ounce, with a slight downward trend.

The UK-based precious metals research firm added that concerns about the global debt burden are also a factor supporting the long-term uptrend of gold. In particular, investors are monitoring the US public debt situation, which has now surpassed the 37,000 billion USD mark.

At the same time, the new budget law is expected to increase the budget deficit by nearly 4,000 billion USD in the next 10 years. Concerns about the size of the US government's debt are keeping long-term bond yields high and the USD at its lowest level in many years.

President Donald Trumps tax and spending laws are expected to exacerbate the budget deficit, further raising concerns about bond supply.

Investors' confidence in the independence of the US Central Bank will also be an important issue. Although the role of the US dollar as a major reserve currency has not been immediately threatened, long-term concerns about its stability are still supporting gold, the report said.

Some experts note that gold could struggle in the second half of the year as bullish positions become overwhelming. However, Metals Focus said its speculative position had calmed in July.

In early July, the net buying position of speculative funds on the CME exchange returned to the level in April, although it was still significantly lower than the peak of the year.

Similarly, after a slight withdrawal in May, gold ETP funds attracted new cash flow in June, bringing total global holdings at the end of June to their highest level since August 2022. In USD, the asset value of gold ETP funds reached a new record high of $383 billion at the end of the month, said analysts.