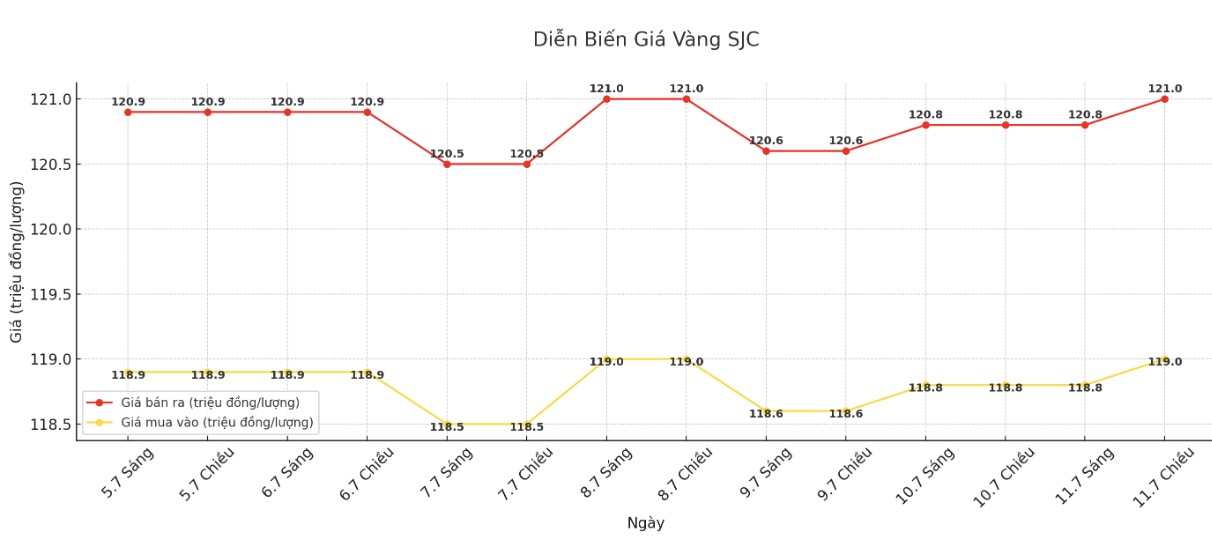

SJC gold bar price

As of 6:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND119-121 million/tael (buy in - sell out); increased by VND200,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 119-121 million VND/tael (buy - sell); increased by 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119-121 million VND/tael (buy - sell); increased by 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.3-121 million VND/tael (buy in - sell out); increased by 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

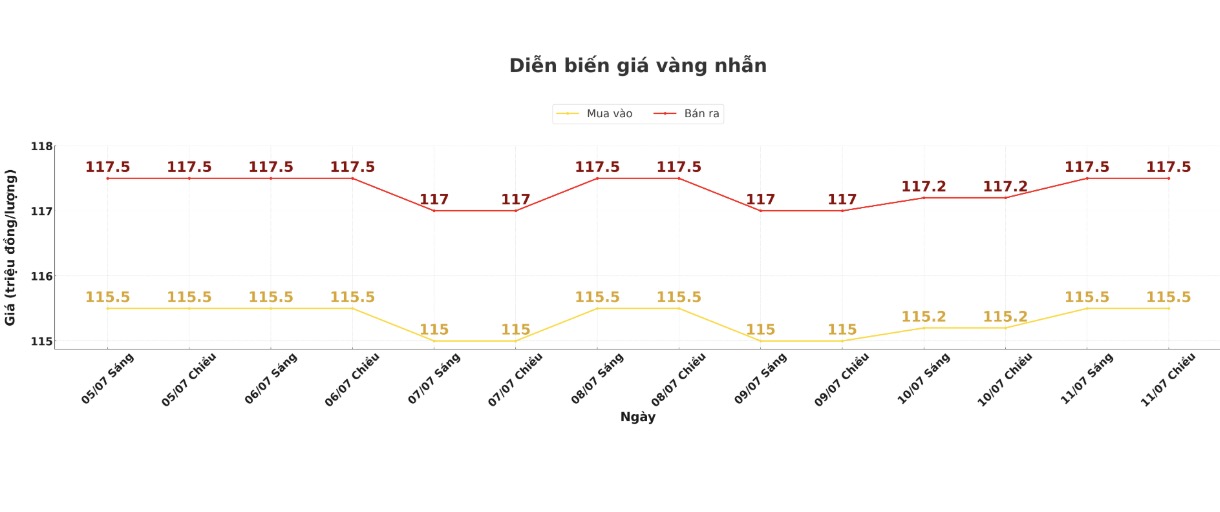

9999 gold ring price

As of 6:00 p.m., DOJI Group listed the price of gold rings at 115.5-118.5 million VND/tael (buy - sell), an increase of 300,000 VND/tael for buying and an increase of 1.3 million VND/tael for selling. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.7-118.7 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.7-117.7 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

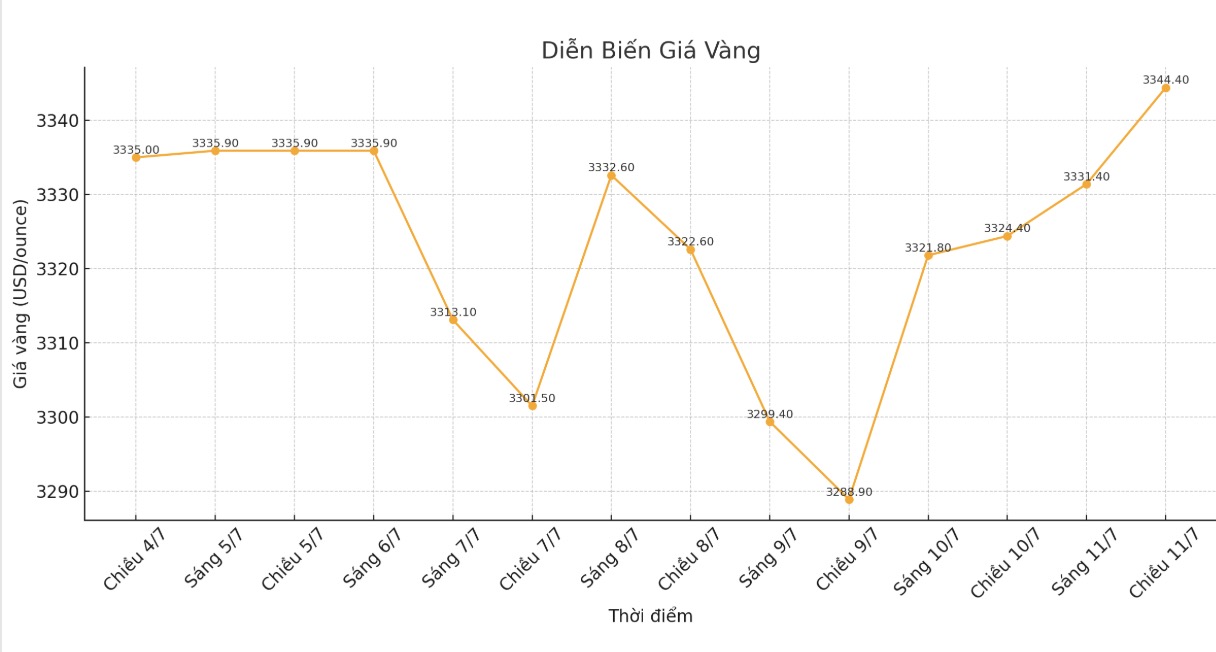

World gold price

The world gold price was listed at 6:00 p.m. at 3,344.4 USD/ounce, up 20 USD/ounce compared to 1 day ago.

Gold price forecast

Gold and silver prices both increased despite the stronger USD and positive US employment data. Investors are shifting to safe-haven assets.

This rally is especially noteworthy as gold could rise even as the US dollar strengthens a relationship that often moves in the opposite direction. This break in traditional correlation shows that gold is increasingly popular as a hedge against policy risks, rather than a pure reaction to currency fluctuations.

The unconventional approach to trade policy of the Donald Trump administration has become a key factor driving the increase of precious metals.

The recent announcement of a 50% tax on copper imports, effective from August 1, along with similar tax rates on goods from Brazil, has created a wave of uncertainty in the market.

Policy uncertainty is strong enough to overwhelm inherently unfavorable factors for precious metals, such as a strong US dollar or positive employment data, which shows the risk-off sentiment currently dominating the market.

Meanwhile, physical demand for gold in major Asian markets remains weak this week, as fluctuations in gold prices make market sentiment cautious. Meanwhile, the plus in China remains stable, while the discount in India is narrowing.

According to Hugo Pascal - a precious metals trader at In Proved, information about the new US trade policy is not enough to stimulate demand for gold in China this week.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...