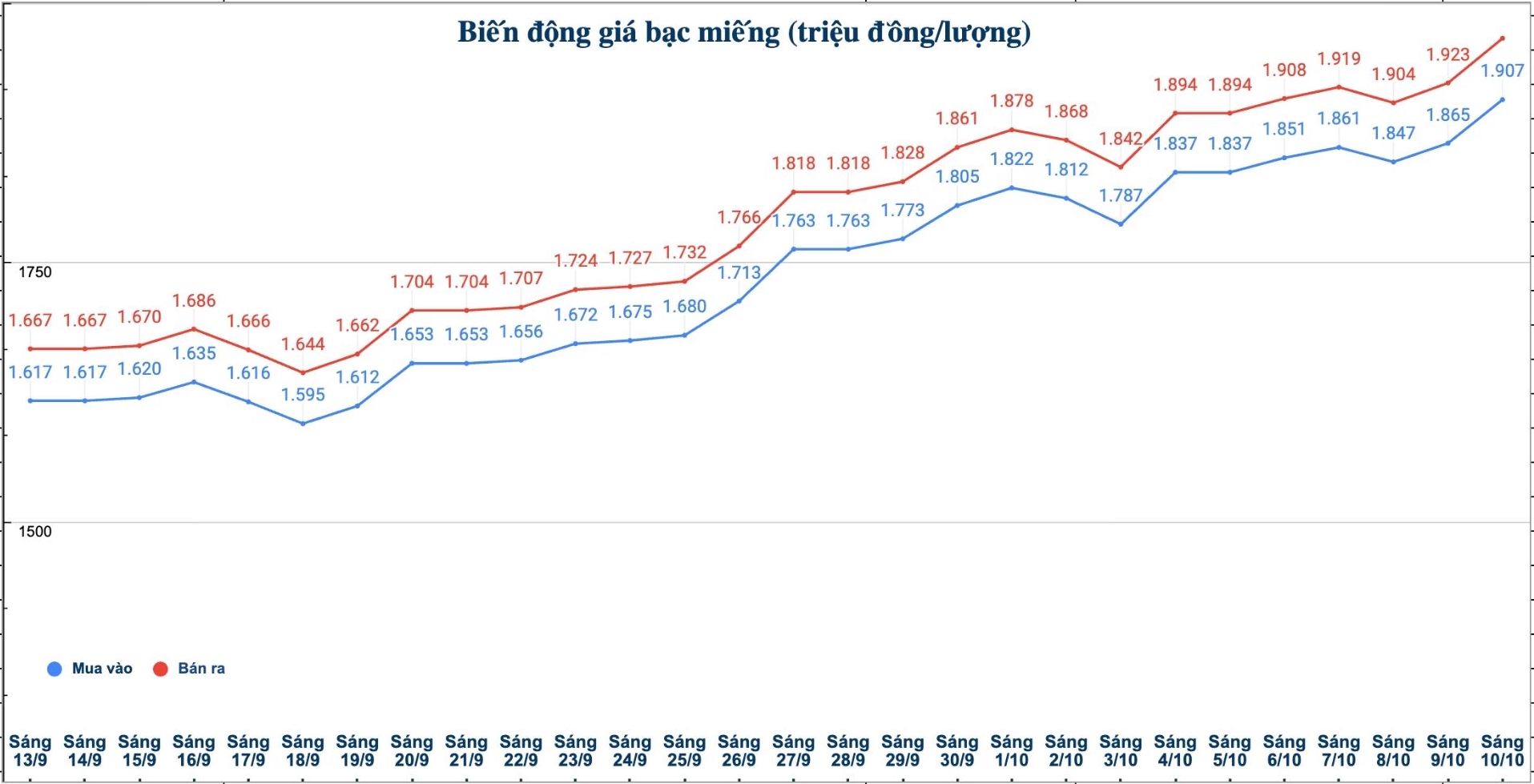

Domestic silver price

As of 9:50 a.m. on October 10, the price of 999 taels of Golden Rooster 999 taels (1 tael) of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) was listed at 1.914 - 1.959 million VND/tael (buy - sell); an increase of 36,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.907 - 1.966 million VND/tael (buy - sell); an increase of 42,000 VND/tael for buying and an increase of 43,000 VND/tael for selling compared to yesterday morning.

The price of 999 gold bars (1kg) at Phu Quy Jewelry Group was listed at 50.853 - 52.426 million VND/kg (buy - sell); an increase of 1.120 million VND/kg for buying and an increase of 1.147 million VND/kg for selling compared to yesterday morning.

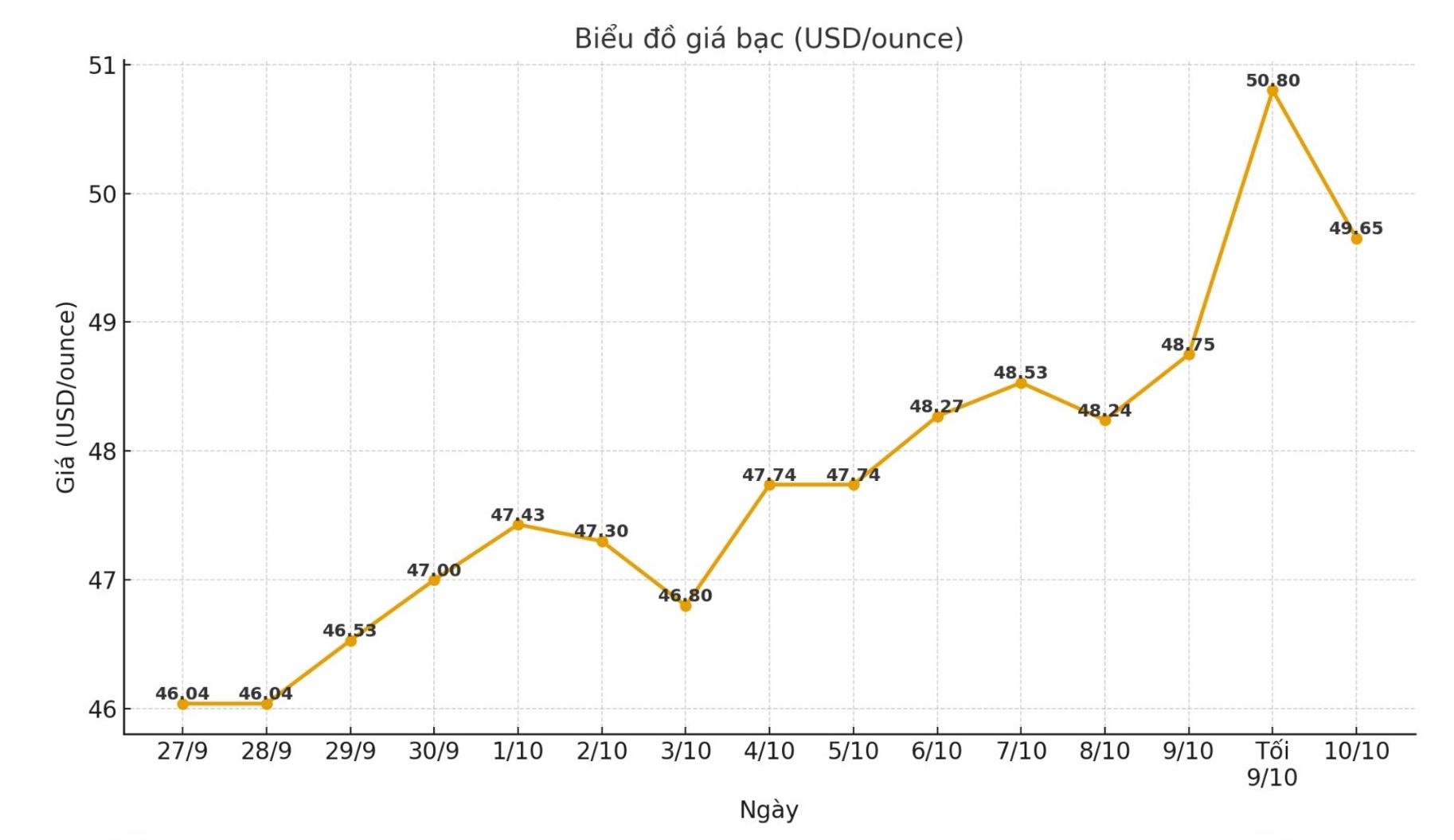

World silver price

On the world market, as of 9:50 a.m. on October 10 (Vietnam time), the world silver price was listed at 49.65 USD/ounce; up 0.9 USD compared to yesterday morning.

Causes and predictions

The silver market is witnessing scarce supply, contributing to consolidating the current strong price increase. Since the beginning of the year, silver prices have increased by more than 70%, mainly due to fundamental factors, not speculation.

According to expert James Hyerczyk, the shortage of spot supply along with strong capital flows into ETFs and physical assets are the main drivers of gold prices rising.

" Meanwhile, gold remains above $4,000/ounce thanks to geopolitical tensions, central bank buying and expectations of a Fed rate cut soon. However, gold's rally is showing signs of slowing, causing some investors to worry that silver prices could be under pressure if risk sentiment improves.

Although the stronger US dollar continues to be a factor that suppresses the increase of precious metals, instability in the Middle East and Europe still helps silver maintain its safe haven role in the market" - James Hyerczyk expressed his opinion.

Meanwhile, David Morrison - senior analyst at Trade Nation - is cautious about the strong increase of silver. He said that silver prices have now entered the "overbuy" zone, like gold, but the excitement of the market has caused many investors to pay attention to this risk.

Morrison said that this is a sensitive price zone, which could create resistance to slow silver prices down. "However, if we look back at silver easily surpassing the $40 and $45/ounce mark in September, it can be seen that buying power is still dominating and the overall uptrend is still maintained," added David Morrison.

See more news related to silver prices HERE...