Domestic silver price

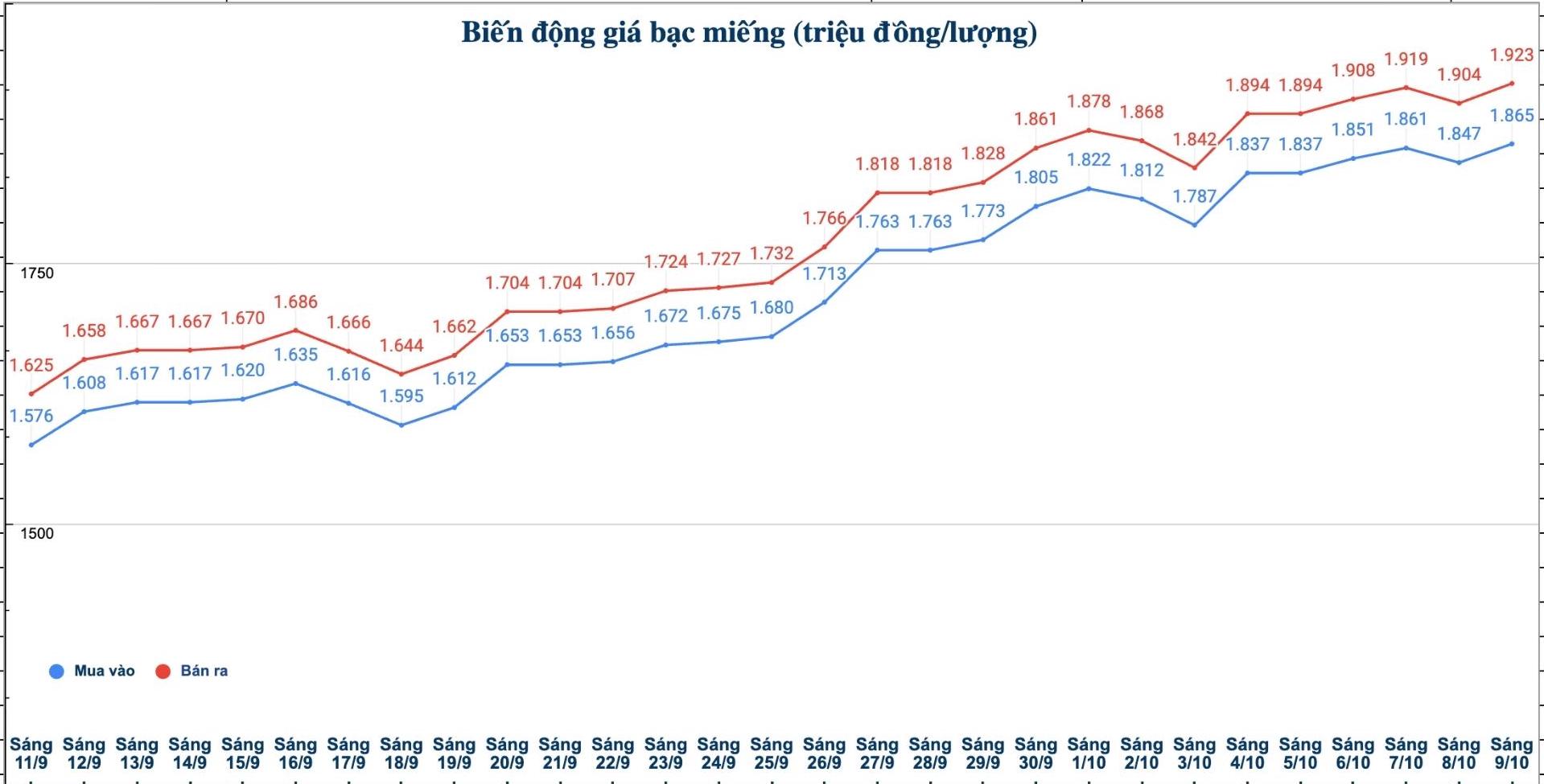

As of 9:40 a.m. on October 9, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.867 - 1.905 million VND/tael (buy - sell); an increase of 14,000 VND/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) of silver bars at Ancarat Petrochemical Company was listed at 48.870 - 50.220 million VND/kg (buy - sell); an increase of 274,000 VND/kg and an increase of 374,000 VND/kg in the afternoon compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) was listed at 1.878 - 1.923 million VND/tael (buy - sell); an increase of 12,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.865 - 1.923 million VND/tael (buy - sell); an increase of 18,000 VND/tael for buying and an increase of 19,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 49.733 - 51.279 million VND/kg (buy - sell); an increase of 480,000 VND/kg for buying and an increase of 506,000 VND/kg for selling compared to yesterday morning.

World silver price

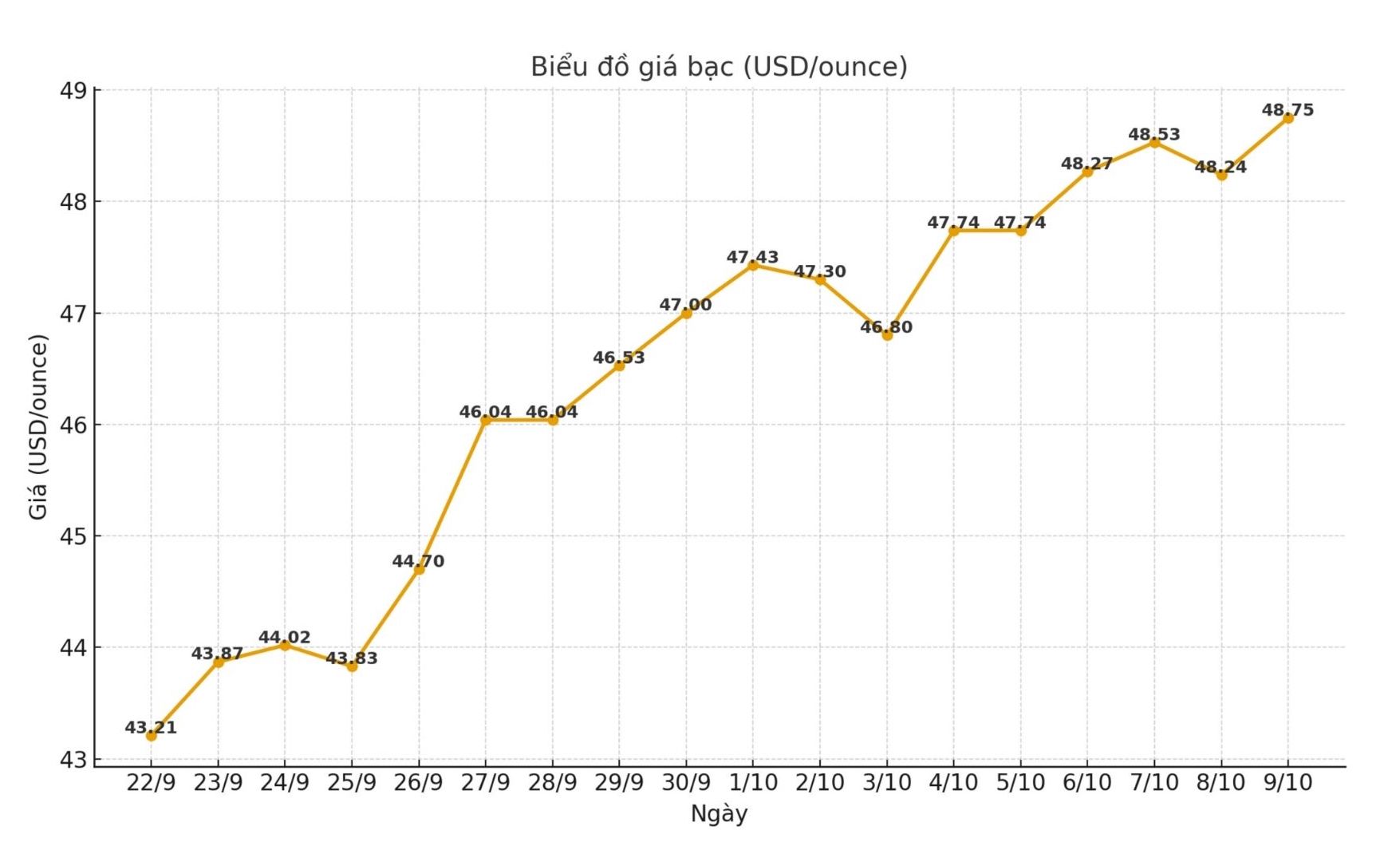

On the world market, as of 9:40 a.m. on October 9 (Vietnam time), the world silver price was listed at 48.75 USD/ounce; up 0.51 USD compared to yesterday morning.

Causes and predictions

Silver prices increased sharply as the market tried to create momentum to reach the threshold of 50 USD/ounce - an important milestone of historical significance.

According to precious metals analyst Christopher Lewis, this is a price zone that has repeatedly become a "peak" of the market in the past, appearing at least three times in the strong increase cycles of silver.

The $50/ounce mark is not only technically valuable but also has a great psychological value for investors, because it is considered a "giant brick wall" that silver prices have not been able to completely break down since 1979.

"At the moment, the silver market is still seeing strong fluctuations, as investors are looking to accumulate more momentum to break through this historic resistance zone.

The $50/ounce threshold is like the final test for the long-term uptrend. If prices can close steadily on this mark, it will be an extremely optimistic signal, which could open a new up cycle for the precious metal," he said.

However, Christopher Lewis believes that, before that, short-term corrections were inevitable. Every time the market increases too quickly, investors often tend to take profits, causing prices to temporarily retreat to technical support zones.

The $46-$45/ounce area is considered the closest support area if silver retreats in the short term. Returning to this price zone could even be positive, helping the market " cool down" and creating a more solid foundation for the next increase.

"In general, this is still a potential market but with many risks. Investing in silver at this time requires patience and careful risk control. Investors should wait for prices to adjust to a reasonable range to buy, instead of chasing the upward momentum, because silver is always the most volatile metal in the commodity market" - Christopher Lewis expressed his opinion.

See more news related to silver prices HERE...