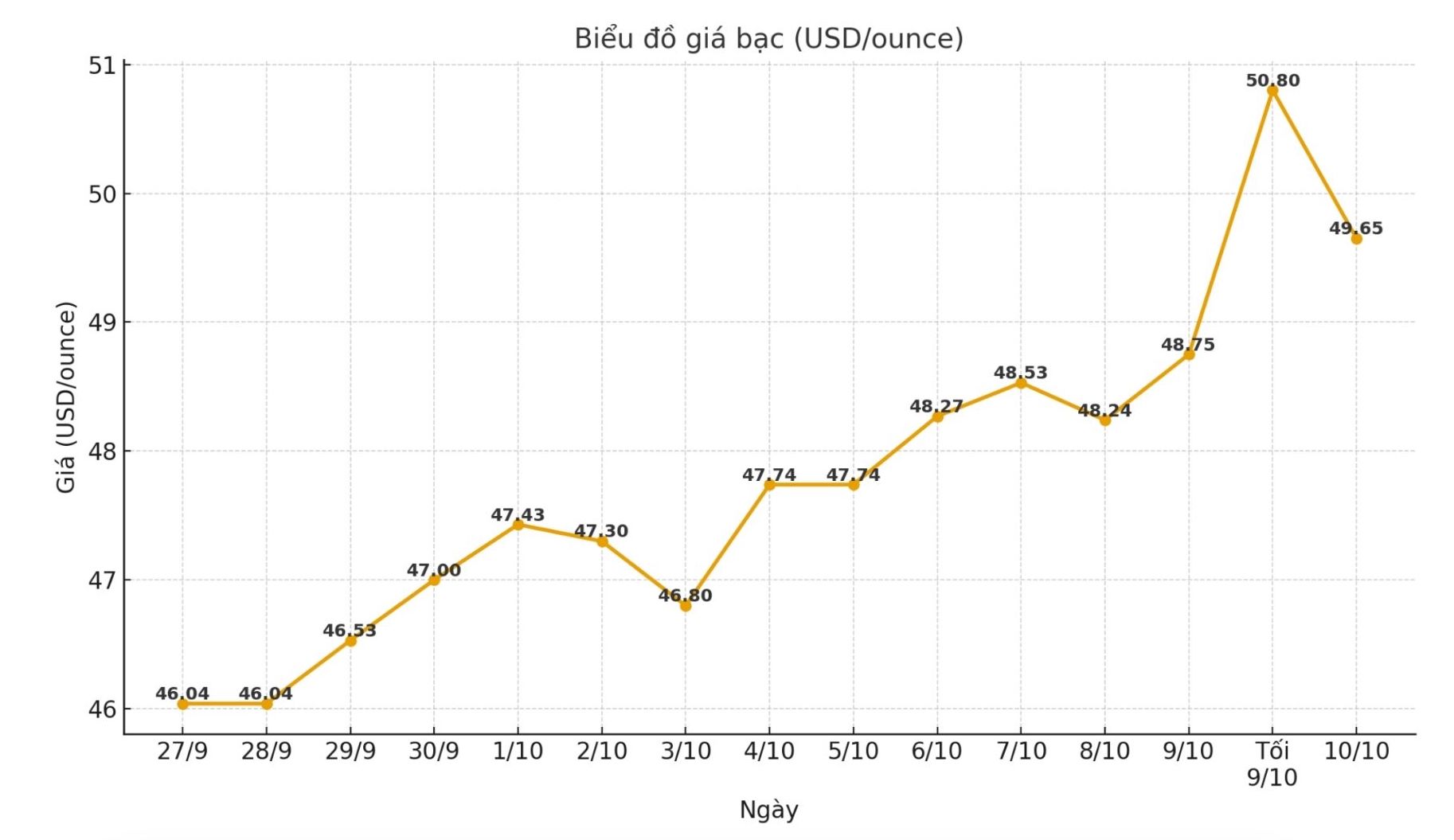

World silver prices have just officially surpassed the $50/ounce mark, marking a new historical record and arousing a wave of excitement in the precious metals market. As of 8:00 p.m. on October 9 (Vietnam time), the world silver price was listed at 50.8 USD/ounce - a record high in history.

Neils Christensen - an analyst at Kitco News - commented that this is considered the result of an unprecedented price increase, when silver continuously hit new peaks thanks to soaring industrial demand and strong return of investment capital.

Since the beginning of the year, silver prices have increased by about 70%, outperforming the increase of more than 50% for gold. The gold/ silwer ratio is currently fluctuating around 81 points - the lowest in a year, at one point falling to 78.68 points.

Many experts also believe that silver reaching the $50/ounce mark is just a matter of time, because the market is operating at the highest capacity in many years. Notably, gold's strong rally - when it surpassed $4,000/ounce - also contributed to the increase in silver prices, as investors seek profit opportunities in the precious metal group with greater potential.

Ole Hansen - Head of Commodity Strategy at Saxo Bank - said: "The $50/ounce level has been acting as a magnet for many months, especially in the context of gold continuously breaking records. Silver can be considered a "high-speed" version of gold - often reacting in the same direction but being stronger, like gold in a state of double acceleration".

Ole Hansen believes that silver's strong increase is helping to rebalance the value of the precious metal group. The gold/ silwer ratio has returned to a 10-year average of about 81 points, showing that silver is no longer "cheap" compared to gold. "The question of whether silver will hold above $50/ounce or be held back as before depends on whether gold stays above $4,000/ounce or not," Hansen said.

According to Mr. Paul Williams - CEO of Solomon Global gold and silver company, the core reason for this strong price increase is not speculative factors like in previous cycles, but comes from the reality of supply and demand in the market.

"Crystal's increase since the beginning of the year is no longer due to speculation like in 1980, but comes from practical factors. The supply-demand balance is seriously imbalanced, as industrial demand reaches a record 680.5 million ounces in 2024. Strong investment in green technology and renewable energy has also tightened silver supply, pushing prices up" - Paul Williams assessed.

Williams added that silver is playing a "double-in-one" role - both as an industrial metal and a store of value - so it should continue to attract investors to seek stability and growth potential. "Gold prices could well reach $100 an ounce by the end of 2026 if the current trend continues," Williams predicted.

As of 8:55 a.m. on October 10, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND1.907 - 1.945 million/tael (buy - sell); an increase of VND40,000/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) of silver bars at Ancarat Petrochemical Company was listed at 49,836 - 51,286 million VND/kg (buy - sell); an increase of 966,000 VND/kg and an increase of 1,066 million VND/kg in the afternoon compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.907 - 1.966 million VND/tael (buy - sell); an increase of 42,000 VND/tael for buying and an increase of 43,000 VND/tael for selling compared to yesterday morning.

The price of 999 gold bars (1kg) at Phu Quy Jewelry Group was listed at 50.853 - 52.426 million VND/kg (buy - sell); an increase of 1.120 million VND/kg for buying and an increase of 1.147 million VND/kg for selling compared to yesterday morning.

See more news related to silver prices HERE...