Domestic silver price

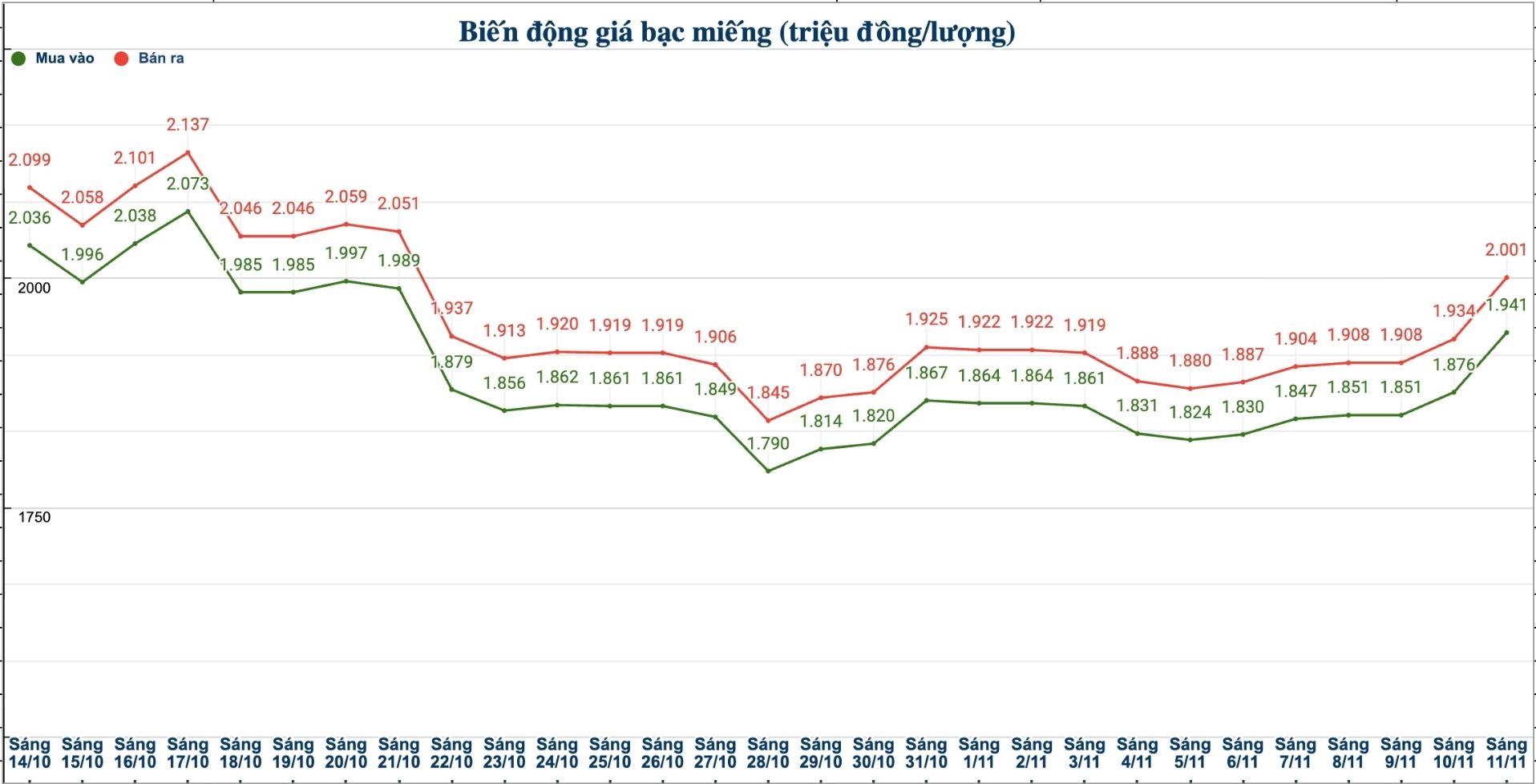

As of 10:05 on November 11, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.939 - 1.981 million VND/tael (buy - sell); an increase of 66,000 VND/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 50,966 - 52.376 million VND/kg (buy - sell); an increase of 1.72 million VND/kg for buying and an increase of 1.76 million VND/kg for selling compared to yesterday morning.

The price of 999 Phuc Loc 999 gold bars (1 tael) of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) was listed at 1.929 - 1.977 million VND/tael (buy - sell); an increase of 63,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.941 - 2.001 million VND/tael (buy - sell); an increase of 65,000 VND/tael for buying and an increase of 67,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 51.759 - 53.359 million VND/kg (buy - sell); an increase of 1.733 million VND/kg for buying and an increase of 1.796 million VND/kg for selling compared to yesterday morning.

World silver price

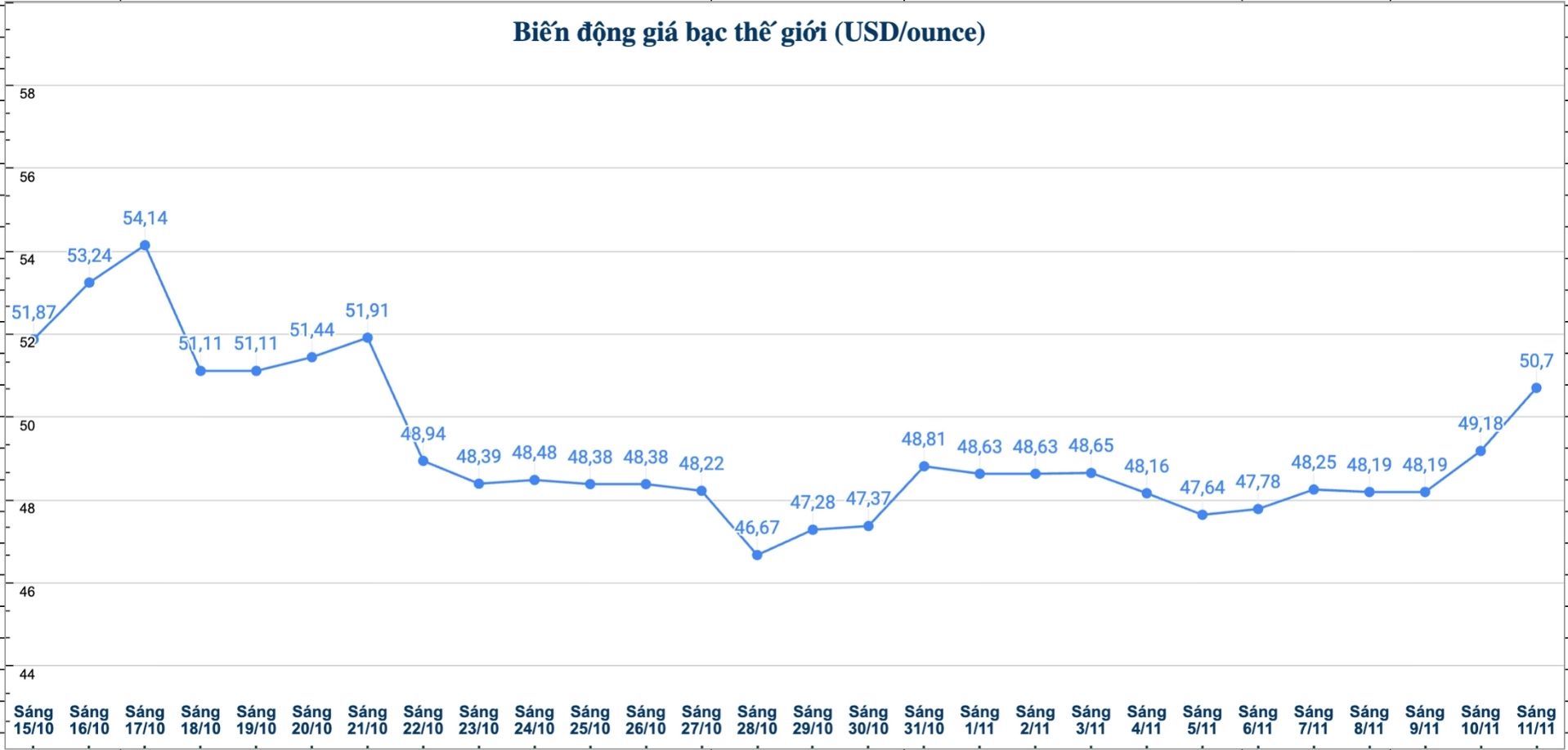

On the world market, as of 10:10 on November 11 (Vietnam time), the world silver price was listed at 50.7 USD/ounce; an increase of 1.52 USD compared to yesterday morning.

Causes and predictions

Silver prices increased sharply at the beginning of the first trading session of the week, surpassing the important threshold of 50 USD/ounce. precious metals expert Christopher Lewis at FX Empire believes that this threshold needs to be closely monitored because it could be the deciding factor on whether the market has peaked or is still on the rise.

"This is a very notable time, because this price could be a signal of an upcoming trend. If prices cannot get above this threshold, it is likely that the market has hit a peak," said Christopher Lewis.

The expert added that in recent months, silver prices have increased sharply, then adjusted slightly and remained flat. "Currently, the market is in the accumulation phase, starting to show signs of regaining momentum. The $50/ounce level is still the most important area. There are many psychological factors here and maybe even rights transactions are affected" - Christopher Lewis analyzed.

Neils Christensen - an analyst at Kitco News - commented that although silver has long been considered a precious metal and a valuable asset, more than 60% of today's demand for silver comes from industrial applications - especially electronics and solar energy. This strong demand is putting pressure on supply and leading to increasingly serious shortages.

"The USGS's list of major minerals means the metal could become a strategic commodity, affected by national trade and security policies - making the already volatile silver market more complicated," said Neils Christensen.

See more news related to silver prices HERE...