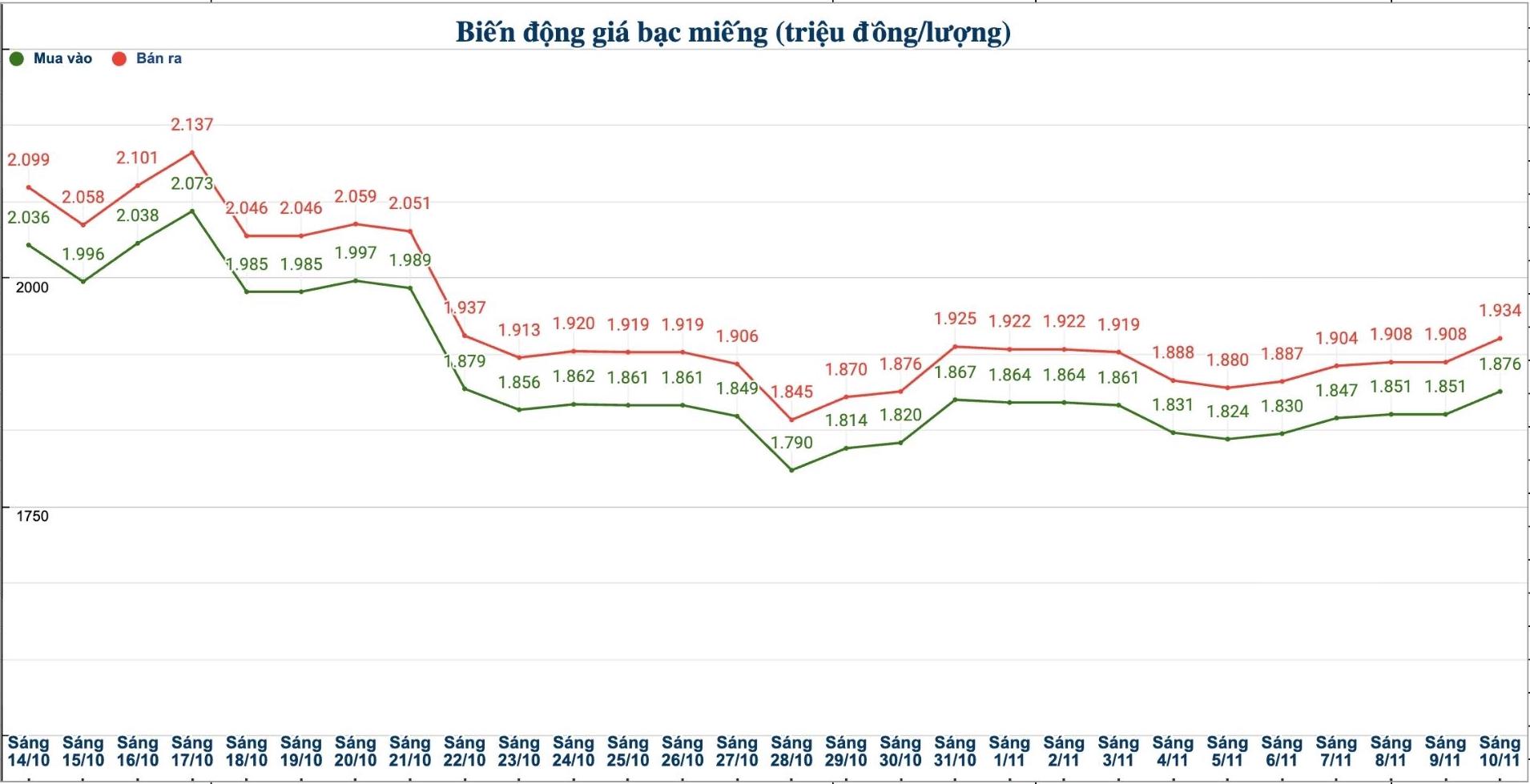

Domestic silver price

As of 10:30 a.m. on November 10, the price of 999 Phuc Loc 999 gold bars (1 tael) of Saigon Thuong Tin Bank Gold and Gemstone Co., Ltd. (Sacombank-SBJ) was listed at 1.866 - 1.914 million VND/tael (buy - sell); an increase of 45,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.876 - 1.934 million VND/tael (buy - sell); an increase of 25,000 VND/tael for buying and an increase of 26,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 50,026 - 51,573 million VND/kg (buy - sell); an increase of 667,000 VND/kg for buying and an increase of 694,000 VND/kg for selling compared to yesterday morning.

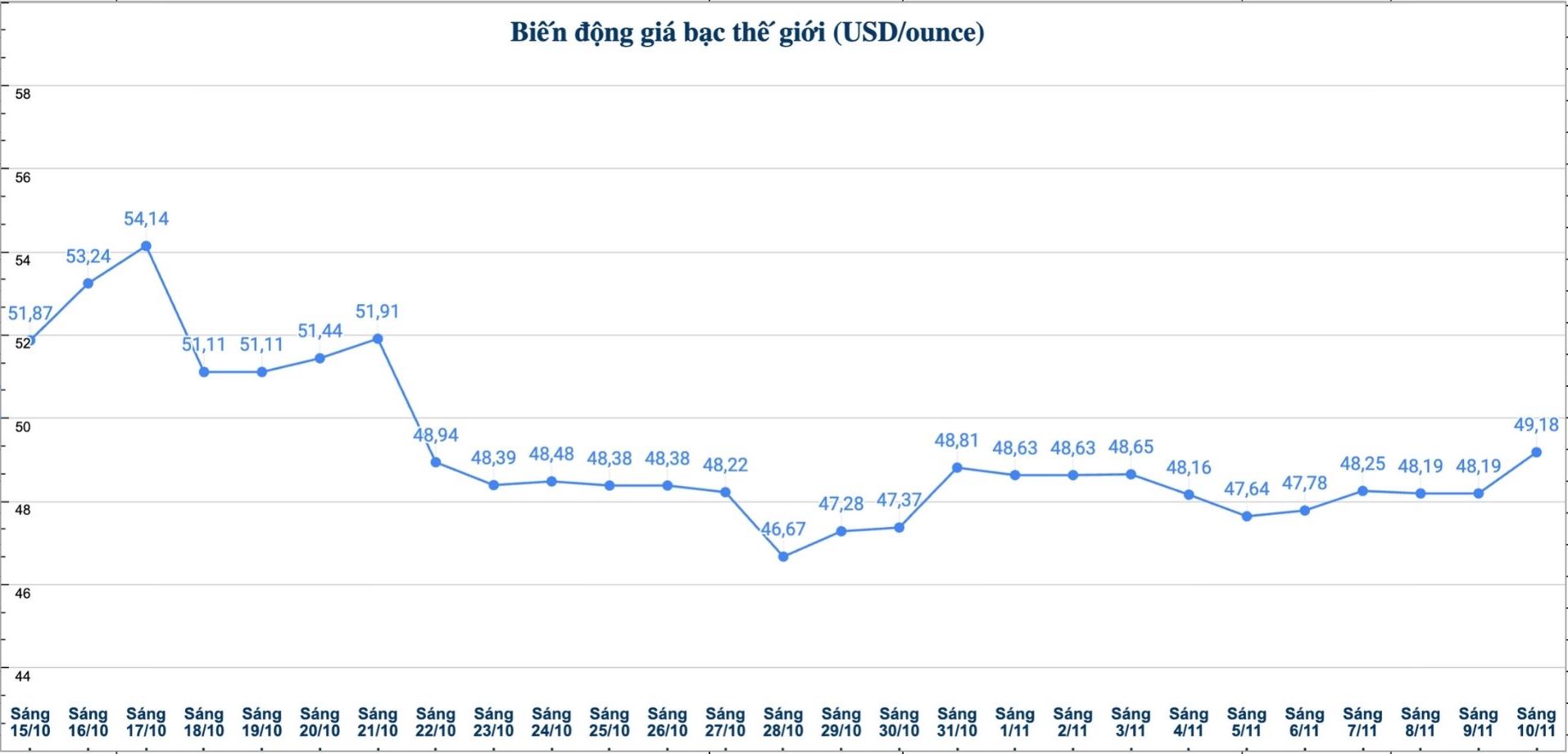

World silver price

On the world market, as of 10:30 a.m. on November 10 (Vietnam time), the world silver price was listed at 49.18 USD/ounce; up 0.99 USD compared to yesterday morning.

Causes and predictions

Last week, the United States Geological Survey (USGS) officially added silver to the List of Important Minerals in 2025. This decision puts silver on par with copper, uranium and rare earth elements, and paves the way for a series of future support policies such as tax reductions, simplification of licensing procedures and trade protection.

"For investors, this is not only a policy change, but also an affirmation of the increasingly important role of silver in the industrial supply chain, especially in the fields of solar energy, electric vehicles, semiconductors and electrification technology" - precious metals analyst James Hyerczyk commented at FX Empire.

He said that currently, more than 60% of global silver demand comes from these industries, while supply is still facing many difficulties. The amount of physical inventories is declining, London treasures continue to sell, metal rental prices have increased sharply. In contrast, US reserves remain high due to concerns about tariffs and national reserve strategies.

According to James Hyerczyk, in the context of the US government continuing to partially close, many important economic reports such as the non-farm payrolls (NFP) and the consumer price index (CPI) were delayed, causing the market to rely on the private sector employment report (ADP). The better-than-expected data has reduced expectations that the US Federal Reserve (FED) will soon cut interest rates, keeping the 10-year Treasury yield stable around 4.09%.

"While gold benefits from safe-haven demand amid political risks and a weakening stock market, silver - which is more sensitive to production - has performed poorly," said James Hyerczyk.

The expert added that despite being affected by macro factors in the short term, the long-term outlook for silver is still positive, reinforced by its role in the global energy transition and its new position on the strategic mineral map of the US.

"However, for the market to break through the $50 threshold, investors still need more clear economic data and more specific signals from the Fed" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...